Time & date: 10 am, 26 Oct 2015.

Time & date: 10 am, 26 Oct 2015.

Venue: Rendezvous Grand Hotel Singapore,

9, Bras Basah Road.

|

In August, core banking software provider Silverlake Axis was cut by a razor-sharp short-seller report that caused the company’s share price to decline by half and wipe out a billion dollars’ worth of value practically overnight. |

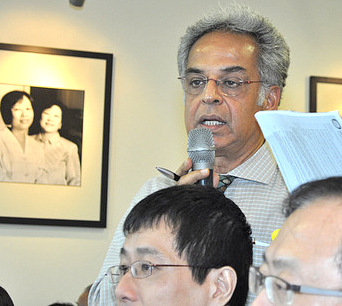

Mano Sabnani. NextInsight file photo.“The question relating to what happened during the year — the short-seller report…”

Mano Sabnani. NextInsight file photo.“The question relating to what happened during the year — the short-seller report…”

Mano Sabnani, a former newspaper editor and now fulltime investor, started his questioning but was interrupted by the company secretary before he could finish.

“Yes, as I mentioned, we will be addressing this after the meeting.”

At the start of the meeting, the company secretary had reminded shareholders to keep their questions within the items on the agenda.

Mano quickly rebutted: “No, I think you can do it now. This is corporate governance. You have a corporate governance statement in your annual report. In the statement, it says that the company will engage shareholders actively and it will address all concerns during the AGM. You can’t restrict us from asking this issue (referring to the short-seller report) which also covers the accounts. It’s a wrong road to go and I can tell you Noble Group (which was also attacked by a short-seller) has tried it and they failed.”

As Mano brought up his concerns, the company secretary, who was bounded by his strict agenda, tried to intervene several times.

Finally Mano got frustrated and raised his voice: “Chairman, I do not understand this. Is company secretary running the show or are you running the show? You are the chairman and I think I want to hear from you.”

Silverlake CEO Raymond Kwong and Chairman Goh Peng Ooi. Photo: CompanyThe chairman finally broke his silence: “My opinion is I told the board that we are responsible to all shareholders and we should explain (run a presentation on how we run this company). But this could go on and on until the afternoon. I think in the interest of everyone, some people would want to finish the AGM then ask questions so they have liberty to control their time. I have no problem to stay until tonight.”

Silverlake CEO Raymond Kwong and Chairman Goh Peng Ooi. Photo: CompanyThe chairman finally broke his silence: “My opinion is I told the board that we are responsible to all shareholders and we should explain (run a presentation on how we run this company). But this could go on and on until the afternoon. I think in the interest of everyone, some people would want to finish the AGM then ask questions so they have liberty to control their time. I have no problem to stay until tonight.”

Mano interrupted: “Sorry, I’m not getting any answers. This is the first meeting after the short-seller report and we can’t pass the accounts blindfolded. We need to clarify the issue before we go to normal routine business. But you are putting it the other way round – the cart before the horse.”

When Mano finished his reasoning, the room quickly filled with applause from the minority shareholders who supported his stand.

After a wild goose chase, Mano finally got his question answered — Deloitte is making a full independent review on the allegations which takes time to complete. Goh and independent director, Ong Kian Min, said they hope every shareholder stays patient while the report is readied.

At some point through the meeting, Goh sidetracked and flitted from Newton’s laws of motion to category theory to Maxwell’s equation to quantum physics which disrupted and revolutionized the world we live in today. He went on about the history of computing and how IBM dominates the world of computers.

He even covered the theory of everything, the E8 mathematical model (above image and which has been shown on the cover of every Silverlake Axis annual report since 2007) and its 248 dimensions and compared to our world of 16 dimensions. He also explained how the Chinese word Tao Te Ching came about. After his long and deep soliloquy, I thought I was attending a lecture conducted by an old professor rambling about his favorite themes oblivious to the puzzled looks in his class.

Which brings us to this quote about Goh Peng Ooi by Goh Peng Ooi:

“You don’t have to worry that Goh Peng Ooi won’t talk. In fact, you have to stop him from talking.” – Goh Peng Ooi

I digress. So before I launch into my own personal monologue, here are…

12 Things I Learned from Silverlake Axis’s AGM 2015

- Goh is someone who prefers to go through a lengthy thought process when faced with a problem before heading to a conclusion. That explains why he may take up to 30 minutes to answer a question! It also means he is not very good at getting straight to the point as his answers tend to be lengthy and may digress from the original question. Acting CEO Raymond Kwong, on the contrary, is very good at giving answers straight to the point. He had this to say about his chairman:

“Prior to this meeting, few people I met whom know Goh personally pre-conditioned me on one unique characteristic about Goh — when he talks about mathematics, you will lose him. It’s true because I found myself getting lost several times during a meeting whenever Goh tried to lecture us on some mathematical models related to company’s underlying business. But only later I find out that it is the abnormal way he expresses his thoughts. In fact, the word ‘continuous improvement’ is being described as ‘internal disruption’. Goodness gracious.”

- The recurring maintenance division has grown significantly to RM178 million in revenue; up 44% from the previous year. A good sign that customer retention is high and customers are doing more enhancement work. Kwong also mentioned that recurring revenues from the company’s insurance business is likely to continue to grow strongly. Sale of software and hardware, which is lumpy in nature, has declined to RM2.4 million (65% drop from the previous year). Customers make major software/hardware upgrades in cycles and the next major upgrade is not due yet.

- According to a long-time shareholder, competitors in the core banking software industry have been acquiring new customers and seeing double-digit growth.Silverlake Axis’s growth, on the other hand, remains flat and have no new customers acquired for the year. The chairman reiterated he is not excited about a business model of expansion for the sake of growth, which he feels his competitors subscribe to. “It (the model) has a heavy cost,” he said and pointed out that Silverlake Axis’s recent acquisition of SunGard Ambit, a retail banking software firm, had incurred heavy costs of $120 million expanding. He also highlighted that his competitors employ their CEOs which may lead to a short-term focus on hitting KPIs before leaving a company. In essence, he feels it is not right to follow others blindly.

- Newly appointed director Mohd Munir (ex-CEO of CIMB) made it clear to all shareholders he is not aware of any bribery involved in Silverlake Axis winning contracts during his tenure in the banking industry. Regarding the corruption allegation, Goh said if you run your business based on corruption, you are corrupted and is not sustainable at all.

- A business needs a solid foundation to be successful in the long term. What builds a solid foundation? Since no one can predict the future, Goh says he uses a mathematical foundation to run the company. Although the company has been successful for the past 27 years, Goh remains uncertain about the future but he believes the statistical chance that Silverlake Axis will continue being successful is high. That’s the reason why he still holds on to his stock today and hasn’t sold a single share of his in the open market. Despite many offers to buy out the whole company, he refuses to sell out but he has sold blocks of shares privately as many have complained about the company’s tightly-controlled shares and liquidity.

- Experts in their respective fields run the various business functions of Silverlake Axis. For example, PricewaterhouseCoopers has advised Silverlake finances and accounting since the very start. Silverlake only has a small team of accountants and outsources most of the work to these professionals. The same goes for its legal team – the company engages external lawyers when needed to save on fixed costs.

The boss' daughter: Goh Shiou Ling spent 12 years in the US and then joined Silverlake in 2014 as a non-executive director. Photo: CompanyAs a founder, Goh’s role in the company involves two things; arbitration and vision. Should anything happen to him, his daughter, Goh Shiou Ling, will take over his arbitration role and mediate between the CEOs of each respective division when they disagree with one another. His daughter was appointed as a non-executive director in 2014. She studied corporate governance while holding a full-time position in her father’s private business entities as part of her job training. Goh also pointed out his board of directors can run already the company very well without him. But the question remains — who can lead and establish a forward vision for the company when Goh decides to call it a day?

The boss' daughter: Goh Shiou Ling spent 12 years in the US and then joined Silverlake in 2014 as a non-executive director. Photo: CompanyAs a founder, Goh’s role in the company involves two things; arbitration and vision. Should anything happen to him, his daughter, Goh Shiou Ling, will take over his arbitration role and mediate between the CEOs of each respective division when they disagree with one another. His daughter was appointed as a non-executive director in 2014. She studied corporate governance while holding a full-time position in her father’s private business entities as part of her job training. Goh also pointed out his board of directors can run already the company very well without him. But the question remains — who can lead and establish a forward vision for the company when Goh decides to call it a day?- The intellectual property of its core banking software belongs to Silverlake Axis itself. Should anyone, including Goh himself, want to use the software, they have to pay for it. The fees are charged according to the rate that Silverlake Axis charges its regular customers (i.e. banks). Goh personally owns several private entities to carry out research in his twin passions of mathematics and technology. As part of his research objectives, Goh thinks that he can apply Silverlake Axis’s core banking system in other industries (e.g. airline reservation systems) but since Goh’s private entities do not own the IP of the software, they need to pay the licensing and other related costs to Silverlake Axis for the use of the software.

- Mano then suggested to the board that Silverlake Axis buy out Goh’s private entities and merge everything under one company to prevent any potential conflict of interest and future attacks from short-sellers. Ong Kian Min pointed out that it’s not Silverlake Axis’s business model to pursue the riskier ventures Goh’s private entities participate in. For example, SunGard was acquired for only S$12 million but it had invested $120 million in R&D over twenty years. A risk that many of SunGard’s investors had to stomach over the years. Next, Silverlake Axis prefers to keep its expenses as low as possible and acquiring Goh’s private companies means increasing head count and business expenses.

- This now explains the related party transactions between Silverlake Axis and Goh’s privately-owned entities. Firstly, ‘sale of goods and rendering of services to related parties’ amounting to RM150 million was payment for the use of the core banking system owned by Silverlake Axis. Secondly, ‘service fees paid to related company’ amounting to RM46.4 million was paid for engaging the services of the professionals working under Goh’s private companies. Silverlake Axis doesn’t require them 24/7 so this arrangement works better for the company. Acting CEO Raymond Kwong then added that the model has been working very well for Silverlake Axis since the company can focus on continuous improvement in its core business while Goh’s private entities can focus on new developments. Goh did point out that should his personal research arm strike gold, Silverlake Axis has the first right of refusal for any new technological developments. Having said that, shareholders must take note that this only works if Goh decides to sell the use of any new tech developments.

- Goh thinks China is a very difficult market to penetrate and that the only way to succeed there is to fully immerse in the country and conduct business the “Chinese way”. Goh personally thinks the best strategy to get a foothold in China is to acquire companies that are synergistic with Silverlake Axis while continuing to analyze potential acquisitions, the ins and outs of China’s business landscape, and how future technological disruption will take place in China. Silverlake Axis’s acquisition of Global InfoTech Software took Goh 25 years of observation and studying market trends in China. He quipped:

“Everyone has a love/hate relationship with China. This is the country you love because you can’t ignore but it’s also a country you hate because it’s so difficult and competitive.”

- The company is trying to narrow down the author behind the short-seller report. It could be one of the Silverlake Axis competitors who lost a bidding war and tried to bribe one of their low-level employees. Who exactly is this person? We may never know.

Rusmin Ang (left) is an equity investor and the co-founder of The Fifth Person on whose site this article first appeared on 23 April 2015. He has been featured multiple times on national radio 938LIVE for his views on how to invest profitably in the stock market and his investment articles have appeared on The Business Times BTInvest and Business Insider. Rusmin is also on the speaking circuit for CIMB Securities (Malaysia) and has spoken at events in Penang, Sibu and Kuala Lumpur. Rusmin is also the co-author of Value Investing in Growth Companies which is published by Wiley, Inc. The book can be found in all major book stores worldwide and on Amazon.com, Barnes & Noble and Apple's iBooks.

Rusmin Ang (left) is an equity investor and the co-founder of The Fifth Person on whose site this article first appeared on 23 April 2015. He has been featured multiple times on national radio 938LIVE for his views on how to invest profitably in the stock market and his investment articles have appeared on The Business Times BTInvest and Business Insider. Rusmin is also on the speaking circuit for CIMB Securities (Malaysia) and has spoken at events in Penang, Sibu and Kuala Lumpur. Rusmin is also the co-author of Value Investing in Growth Companies which is published by Wiley, Inc. The book can be found in all major book stores worldwide and on Amazon.com, Barnes & Noble and Apple's iBooks.

12 Things I Learned from Silverlake Axis’s AGM 2015

http://www.nextinsight.net/…/10378-12-things-i-learned-from…