Time: 10 am, 30 Sept 2015.

Venue: Lian Beng Building, Harrison Road.

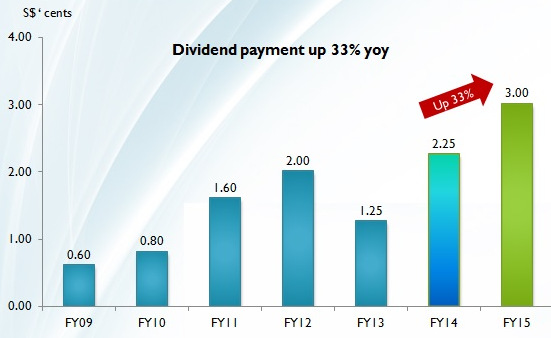

MOST OF THE shareholders who spoke up prefaced their questions with congratulatory remarks on Lian Beng Group's FY15 (ended June) performance -- record revenue ($747.0 million), record profit ($108.0 million), and record dividends (3 cents a share). Here is a summary of several of the questions and answers:

Here is a summary of several of the questions and answers:

Q: Singapore now has tighter control on the inflow of foreign workers. How is Lian Beng's dormitory business doing?

Executive director Ong Lay Koon: The Mandai dormitory is almost 100% occupied. Lian Beng is constructing another dormitory in Jalan Papan with 7,900 beds. It will be completed in mid-2016 and will target workers in the oil & gas industry on nearby Jurong Island, (home to more than 100 global energy and chemical companies. The dormitory project cost S$160 million and is developed by a 51-49% JV between Centurion Corp and Lian Beng.

Q: The original announcement said the cost would be $200 m and that the lease 23 years. And why is the lease only 23 years when normally industrial land lease is 30 years and sometimes there is an option to renew?

Executive chairman Ong Pang Aik: The construction cost has come down. The 23 years is for the land title and is given from JTC. Twenty three years can be considered good. Now new land comes with lease of only 20 years.

| Stock price | 52 cents |

| 52-week range | 47 - 70 cents |

| PE (ttm) | 2.49 |

| Market cap | S$264 million |

| Price/book | 0.57 |

| Dividend yield | 5.8% |

Q: The company has done well but the stock price is not moving. Can you do something -- some companies announce their dividend policy, and buy back their shares.

Ong Lay Koon: We don't have a dividend payout policy but normally we will increase the dividend payout if the company performs better (see graph below).

Ong Pang Aik: We have been buying back shares, and have bought back 25,270,400 shares (since Oct 2014).

Q: Construction segment margins have ranged between 6-12% in the past. The company's margins have been quite stable compared to some other construction companies. How come?

The other question is, why have Lian Beng's margins come down in recent years? I know some companies have continued to do well -- for example, because of fixed-price contracts. The price of steel came down, price of concrete came down, and the price of diesel came down, and they had better margins. Ong Lay Koon: It depends on how we tender after we take into account all factors. How much margin we tender at depends on the market condition.

Ong Lay Koon: It depends on how we tender after we take into account all factors. How much margin we tender at depends on the market condition.

Our margins have been relatively stable because we have construction-related activities -- engineering, scaffolding, and we have our own fleet of machinery -- which enable us to better control costs. Construction projects usually take 2-3 years and the margin can depend on the progress of the project and type of project.

Q: Your JV for the asphalt plant -- Where do you see the demand coming from for your asphalt?

Ong Lay Koon: There are only two other asphalt pre-mix suppliers in Singapore. We foresee new demand from, for example, the expansion of Changi Airport. And we can also make use of asphalt for road works in some of our condo construction projects and to supply to civil engineering contractors.