Excerpts from analyst's report

|

|

No change to our investment thesis. We continue to like Innovalues for its 1) expected revenue growth from existing and new AU projects from new and existing customers 2) Gross margin expansion from high margin automotive projects (from favorable sales mix and improved operational efficiencies) and further labour cost savings from the OA segment with its move to Malaysia from Shanghai, expected to be complete by 3Q15. 3) The turnaround in the OA segment will be an added bonus.

No need to panic until fundamentals change. The stock price of Innovalues has rebounded from a recent sell-down. During the correction, we recommended that investors add to their positions as we saw no negative fundamental reasons behind such a steep decline. In our note, we also pointed out that Innovalues had always rebounded from recent corrections. While we think such corrections may continue to occur from time to time, we believe investors should remain focused on company fundaments and steer clear from speculation.

More upside, maintain BUY with unchanged TP. Although Innovalues had triple-bagged since our initiation with a BUY rating in Sep 2014, we believe there is still considerable upside.

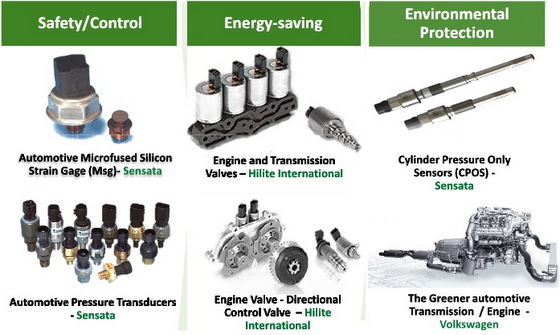

Innovalues is still far from being the finished article as its automotive products are focused on the strong industry tailwinds of safety, energy saving and environmental protection. We maintain our BUY rating on Innovalues, with a target price of S$0.985, still pegged at 14x FY15F EPS.

Key stock price catalysts include strong quarterly results and higher than expected dividend payout for FY15F (we are expecting S$0.033 DPS for FY15F or 3.8% yield).