Excerpts from analyst's report

|

|

What’s New

Innovalues came under heavy selling pressure today for no reason we are aware of. Its prospects remain excellent. We expect 2Q15 results, to be released in early Aug, to meet our expectations. We forecast earnings of SGD5.6m, up 32% YoY and flat QoQ. 2Q should form 24% of our full-year forecast.

The QoQ comparison will be slightly dampened by higher overheads from the current on-going transfer of Office Automation (OA) production from China to Malaysia. We have factored in the estimated SGD0.6m pa in cost savings into our forecasts. 2H15 is expected to be stronger than 1H15.

|

However, there may be upside if traction is better than expected on the following:

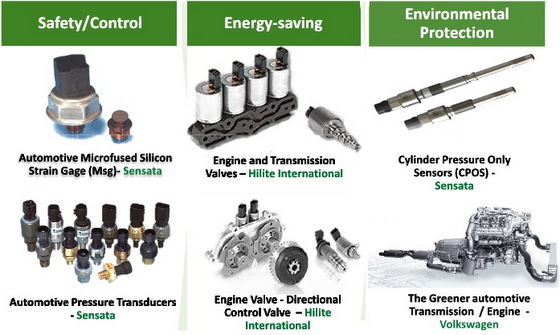

(1) Innovalues has received a number of approvals on new auto parts that will go into mass-production in 2H15, from customers such as Sensata.

(2) Margin improvement from continuing productivity measures, which will now focus more on quality control and parts inspection. Management believes there is still scope for substantial cost savings in this area. Lastly, with almost SGD30m in cash, a lightly-geared balance sheet and a high-flying share price, there could also be scope for Innovalues to make EPS-accretive acquisitions.

What’s Our View

We believe the share price correction opens up an opportunity to BUY into Innovalues at lower valuations. Our forecasts and TP are unchanged. Our TP of SGD1.00 is based on 14x FY15 P/E, in line with the average for its peers.