Excerpts from analysts' report

Goldman Sachs analysts: Miang Chuen Koh, CFA, Wieta Anton Honoris and Arthur Khoo

| Sembcorp Marine (SCMN.SI): More concerns than for Keppel; downgrade to Sell |

We have not built in any negative impact from potential contract cancellations in Brazil, except for a delay in cash payments from Sete Brasil, which we expect to persist into 2015-16. That said, we still expect the Brazil orders to generate similar profits as we previously forecasted. Risk to this view is skewed to the downside, given recent Brazil newsflow (Reuters, April 8).

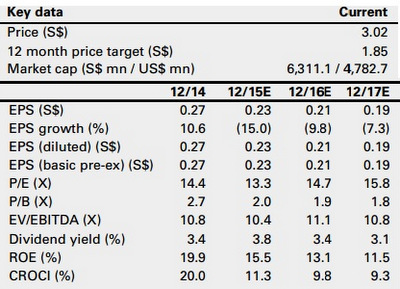

Following our global oil team’s lower oil forecasts, we cut 2015-17 orders by 29%-45% and consequently EPS by 6%-27%. We cut our 12-month target price by 29% to S$1.85, implying 39% downside potential.

Catalysts

(1) Lower rig utilization/day-rates in the next 12 months resulting in lower demand for newbuild rigs; (2) Lower jackup prices / asset values in the next 12 months as competition for limited new orders intensifies; (3) Negative earnings surprise as our 2015-17 EPS are 9-17% below Bloomberg consensus.

Valuation

SMM is trading at mid-cycle levels for two-year forward P/E and EV/EBITDA, and hence we see scope for it to derate given our expectations of lower earnings and returns ahead. We continue to use 2016E EV/GCI vs CROCI/WACC valuation methodology and a sector cash return multiple of 0.7X (unchanged; 3-year sector average) to derive our 12-month target price.

Key risks

(1) Higher-than-expected oil price/rig day-rates; (2) higher-than-expected rig price / order wins; (3) lower-thanexpected competition; (4) stronger-than-expected cost control