StanChart: ‘Outperform’ Call on XIAO NAN GUO

Xiao Nan Guo is one of the largest, mid-to-high-end, full-service Chinese restaurant chains in China, with its head office based in Shanghai. Photo: Xiao Nan GuoStandard Chartered Research has an “Outperform” recommendation on Xiao Nan Guo Restaurants Holdings (HK: 3666), expecting it to report a turnaround in earnings this year.

Xiao Nan Guo is one of the largest, mid-to-high-end, full-service Chinese restaurant chains in China, with its head office based in Shanghai. Photo: Xiao Nan GuoStandard Chartered Research has an “Outperform” recommendation on Xiao Nan Guo Restaurants Holdings (HK: 3666), expecting it to report a turnaround in earnings this year.

The research house has hiked its target price to 1.80 hkd from 1.60 previously (recent share price 1.44).

Xiao Nan Guo was heavily impacted by China government’s anti-corruption initiatives in 2013, and the restaurant chain issued a profit warning on January 24 for its full-year 2013 results.

Xiao Nan Guo announced in its 2013 interim results that net profit fell 43.3% year-on-year to 31.8 million yuan

Standard Chartered said that while customer traffic has been gradually picking up since 2H13, ASP remains under pressure.

“However, we believe the magnitude of store closures is narrowing in 2014.

“Xiao Nan Guo is also speeding up the opening of its sub-brand restaurant, The Dining Room, in capturing more consumer spending in the casual dining segment,” the research house said.

Standard Chartered has also cut its 2014E/15E earnings estimates on Xiao Nan Guo by 67%/51%, respectively.

“We believe the downside is limited and expect a potential turnaround in earnings in 2014.” The company opened four restaurants in 2013, taking the total to six, and targets 12 new stores per annum during 2014-2015. Photo: Company

The company opened four restaurants in 2013, taking the total to six, and targets 12 new stores per annum during 2014-2015. Photo: Company

Difficult Year

Xiao Nan Guo had a tough 2013 led by China government’s anti-corruption initiatives, with the dining chain having only one net store opening of its main restaurant chain Shanghai Min -- it opened three and closed two -- in 1H13.

It closed five restaurants in 2H13, mostly in Shanghai and Beijing, thus incurring additional one-off expenses.

“In our view, the government’s anti-corruption campaign is likely to persist in 2014, hence continuing to affect Xiao Nan Guo’s business.

“Xiao Nan Guo’s core brand, Shanghai Min, relies heavily on corporate spending, which accounted for more than 90% of its 1H13 sales,” Standard Chartered said.

The research house added that via exploring the potential of new brands, Xiao Nan Guo’s sub-brand -- The Dining Room -- has been well received by consumers.

The company opened four restaurants in 2013, taking the total to six, and targets 12 new stores per annum during 2014-2015.

“We believe The Dining Room’s lower price point offers the potential to grow in the casual-dining segment,” the research note added.

The brand accounted for only 3.3% of total sales in 1H13 and had a gross profit margin of 70%.

In addition, Xiao Nan Guo is also trying to introduce a new brand named Xiao Xiao Nan Guo (小小南国) with a lower average spending of 130 yuan/person versus Shanghai Min’s 200 yuan.

“This aims at capturing more family/casual spending, and management said the first restaurant under this brand will be rolled out in 1Q14.

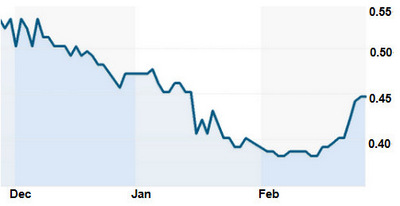

“We understand from management that SSSG (same store sales growth) turned positive over the Chinese New Year, mostly driven by volumes, and we expect a potential turnaround in earnings in 2014.” Xiao Nan Guo's Hong Kong shares (HKD1.47) have had a choppy performance. They currently trade at a trailing PE of 12.6X and have a market cap of HKD2.2 billion. Chart: Reuters

Xiao Nan Guo's Hong Kong shares (HKD1.47) have had a choppy performance. They currently trade at a trailing PE of 12.6X and have a market cap of HKD2.2 billion. Chart: Reuters

Founded in 1987, Xiao Nan Guo Restaurants Holdings Ltd was listed on the Main Board of the Hong Kong Stock Exchange on July 4, 2012. As of June 30, 2013, the Company operated six central kitchens and five central warehouses, serving a restaurant network of 69 Shanghai Min restaurants, four Maison De L’Hui restaurants and four “the dining room” restaurants in some of the most affluent and fastest-growing cities in Greater China, including Shanghai, Beijing, Dalian, Suzhou, Nanjing, Tianjin, Ningbo, Wuxi, Shenzhen, Hong Kong, Shijiazhuang, Changzhou and Xian.

BESUNYEN Wins CSR Honor

Besunyen's Detox Tea and Slimming Tea have market shares of 21% and 33%, respectively, in their categories in China.

Besunyen's Detox Tea and Slimming Tea have market shares of 21% and 33%, respectively, in their categories in China.

Aries Consulting file photoBesunyen Holdings Company Ltd (HK: 926), a leading provider of therapeutic teas, has won the “2013 China Corporate Social Responsibility Outstanding SME” Award at the Sixth China Corporate Social Responsibility (CSR) Summit.

The award highlights outstanding contributions of SMEs in China to social welfare.

“As the only enterprise winning the award, we are grateful to everyone for approving our efforts in China’s charity affairs.

“Since our establishment 14 years ago, Besunyen has actively participated in various community charity affairs and fulfilled our corporate responsibilities,” said Besunyen Chairman and CEO Mr. Zhao Yihong.

The Hong Kong listco set up the “Besunyen Charity Fund” to fulfill its corporate social responsibilities through sponsoring and participating in large-scale charity functions.

Mr. Zhao added that Besunyen is enthusiastic about education, pointing to the firm’s building of the Hope Primary School and promoting campus-based charity concepts.

“Besunyen also helps care for vulnerable groups through donating to disabled youth and AIDS orphans, along with constructing medical facilities to protect the health of vulnerable segments of society.”

Active Role in Spring Festival Show

Besunyen's Hong Kong shares (44.5 HKD cents) rebounded in Feb, giving the company a market cap of HKD700 m. Chart: ReutersDuring the recently completed Chinese New Year Holiday, Besunyen played an active part in the “2014 China City Spring Festival Gala Evening” TV program televised live in 23 urban TV markets.

Besunyen's Hong Kong shares (44.5 HKD cents) rebounded in Feb, giving the company a market cap of HKD700 m. Chart: ReutersDuring the recently completed Chinese New Year Holiday, Besunyen played an active part in the “2014 China City Spring Festival Gala Evening” TV program televised live in 23 urban TV markets.

The evening of entertainment also showcased filial piety model citizen Mr. Fu Hongwei to tell a national audience about the classical Confucian virtue from his own experience.

Bensunyen’s Mr. Zhao donated 100,000 yuan to Mr. Fu on behalf of Besunyen to encourage his efforts and devotion in practicing the spirit of filial piety.

Mr. Zhao was recently awarded the honor of “Person of China -- JIN Entrepreneurs Rise up for 20 Years” amid stiff competition.

The criteria of the competition take into consideration all aspects of the enterprises and their leaders including status in their respective industry, innovation capabilities and corporate social responsibility.

For more info, click here for the Dec/Jan newsletter.

Besunyen is a leading provider of therapeutic tea products in China and other health food offerings. The majority of the Group’s sales turnover comes from two best-selling products, namely Besunyen Detox Tea and Besunyen Slimming Tea. In terms of sales turnover, these two products accounted for market shares of 20.8% and 32.5% in the detox and slimming categories, respectively, in retail pharmacies in China in 2012. The Group’s distribution network covers over 309 distributors across China, reaching approximately 126,000 retail outlets as of 30 June 2013.

See also:

BESUNYEN’S TV-Tea Tieup

XIAO NAN GUO’S ‘the dining room’ Gets Cooking In Shenzhen