Ausgroup provided scaffolding services (and marine transportation through Teras Australia) for Bechtel International Curtis' LNG project in Gladstone, eastern Australia, where coal seam gas is commercially converted to LNG for the first time in the world. Photo from Bechtel

Ausgroup provided scaffolding services (and marine transportation through Teras Australia) for Bechtel International Curtis' LNG project in Gladstone, eastern Australia, where coal seam gas is commercially converted to LNG for the first time in the world. Photo from Bechtel

OIL PRICES may have fallen below a key level for LNG production, but this has yet to affect SGX-listed Ausgroup, even though most of its existing portfolio, projects under tender as well as target projects are for LNG jobs.

Ausgroup CEO Stuart Kenny. NextInsight file photoThe reason for this, according to Ausgroup CEO Stuart Kenny in a recent telephone interview with NextInsight, is because LNG offtake in Australia is contracted at long term fixed prices, shielding LNG producers from price volatility on the spot market.

Ausgroup CEO Stuart Kenny. NextInsight file photoThe reason for this, according to Ausgroup CEO Stuart Kenny in a recent telephone interview with NextInsight, is because LNG offtake in Australia is contracted at long term fixed prices, shielding LNG producers from price volatility on the spot market.

Most of Australia’s domestic natural gas market is traded under long-term bilateral contracts between sell side producers and the buy side (power generators, large industrial users and distribution companies).

Unlike in the US where natural gas prices are based on the spot market or mid-term sales of up to 5 years, Australian natural gas prices are mainly determined through buy and sell side negotiations for contract tenures of 10 to 20 years.

The long term nature of these contracts provide Ausgroup with earnings visibility, as LNG plants will need maintenance through the long tenures.

The long term offtake contracts characteristic of the Australian natural gas market is due to its relatively young and inefficient market structure.

Australia’s gas market is divided into 3 geographic regions (eastern, northern and western Australia) with inadequate regional pipeline interconnection.

In contrast, the US gas market is much larger. There is an extensive gas pipeline network in the US that is 20 times the size of Australia’s, with pipelines all the way to Canada and Mexico.

The US also has a much more diversified source of gas, ranging from shale, conventional, gas produced with oil, deep tight formation, as well as offshore and onshore oilwells.

These resources are dispersed geographically in the US. It also has a much larger drilling and well services infrastructure.

Asia loves LNG

Nonetheless, Australian natural gas remains competitive even though its offtake prices are higher than in the US, because of relatively low transportation costs to Asia.

Asia accounts for about three-quarters of global LNG demand.

Japan is currently the world’s largest LNG importer, accounting for 30% of global demand, followed by South Korea.

Not only do Asian buyers pay a handsome premium for LNG in Asia, the pie is also growing.

During the first half of this year, LNG imports by China increased 25% year-on-year as it sought to use cleaner fuels to reduce pollution.

By the end of this decade, China is expected to overtake South Korea to become the world’s second largest LNG importer, behind Japan.

In July this year, Australia overtook Qatar as China’s largest supplier with a 76% increase in volume year on year.

Australia to become world's largest LNG exporter

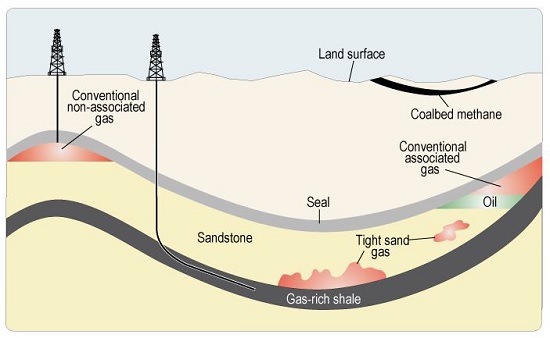

Sources of conventional and unconventional natural gas. Diagram from US Energy Information Administration and US Geological Survey (2011).

Sources of conventional and unconventional natural gas. Diagram from US Energy Information Administration and US Geological Survey (2011).The relatively shallow depth of coal seams makes gas extraction more cost effective than extraction from rock formations for conventional gas and shale.

At Gladstone in eastern Australia, consortiums led by the UK’s BG Group, Australia’s Santos, and Origin Energy are building 3 plants to commercially convert coal seam gas into LNG for the first time in the world.

As production kicks in, Australia is expected to overtake Qatar as the world’s largest exporter by the end of this decade.

Such developments are partly why Australia is experiencing an unprecedented LNG boom with projects worth over US$200 billion under construction and coming into production over the next 4 years.

The value of the Group’s work in hand was A$455.1 million as at 10 November 2014.

Recent story: @ AUSGROUP’S AGM: CEO Says Ship Has Turned Around