Excerpts from analysts' reportsPhillips Securities initiates coverge of Sinarmas Land with 97-c target priceAnalyst: Lucas Tan

Investment Merits

Sinarmas Land (65 c) has a market cap of S$1.98 billion. Chart: www.FT.comHigh potential returns from enormous land development bank

Sinarmas Land (65 c) has a market cap of S$1.98 billion. Chart: www.FT.comHigh potential returns from enormous land development bank

SML, including those of its subsidiaries, have a total land bank of c.710 mil sq ft for development. Based on the strategic location of the sites and development-sales record, we believe that current levels of revenue and profit from these sites will show significant growth.

Since the restructuring of the company, management has shown a high level of resolve towards realising the value of their land bank. Management has demonstrated great understanding of the market and came up with the right product for the market. Therefore, SML was able to maintain a healthy profit margin in their development segment. We continue to see healthy demand for the real estate assets and reckon that SML will continually monetize their land bank.

Prudent financial management with huge war chest

Taking into account borrowings, loans and obligations to financial leases, SML boasts of a net cash position. In 2013, SML (through its subsidiaries) has taken on more debts (bond issuance program). Having factored the extent of issuing the full amount under the program, the company should continue to hold a net cash position by end FY2014. The cash holdings and potential to take on more debt has gifted the management a war chest, to further invest in overseas ventures and to carry out development projects aggressively.

Undervaluation

SML is trading at a steep discount to our SOTP valuation. There are a number of reasons that the market has overlooked this company: economic situation of Indonesia, presidential campaign that recently concluded, and many others. However, this is a heavily undervalued company backed by tangible assets. As the management continually demonstrates healthy margins in its development segment, we believe the market will soon realise its full value.

Investment Action

We value the Indonesian assets at SG$3.6B and the overseas assets at SG$600M. Including the net cash situation and the potential effects of conversion of warrants, we arrive at an equity value of S$4.45B. Based on a maximum number of shares of 3,194M shares, we initiate coverage on SML with a BUY call and a target price of S$0.97.

Ful 24-page report here.Recent story: OSK-DMG: Deep value in SINARMAS LAND, target price $1.01

CIMB expects "significantly stronger 2H" from QT VascularAnalyst: Gary Ng

|

▊ While 1H14 headline losses (US$16.8m vs. our estimate of US13.1m) appear alarming higher than our expectation, we track QTV’s performance via its sales units, which came in above expectation. We revise our FY14 estimate due to accounting treatment of some non-recurring items but our blended valuation-based target price is intact. We reiterate our Add rating as we see QTV’s value proposition translating into a better 2H14 and rosier 2015.

Product penetration is 6x higher now

1H14 revenue is higher than that of FY13, with the Cordis distribution contract kicking in (Apr 14); QTV sold 8,321 units in 2Q14 (+368% yoy) and 13,043 units in 1H14 (+345% yoy). Importantly, 2Q14 sales were based on an agreed price under its US distribution agreement with Cordis (50% discount to previous ASP). This implies that 2Q14 revenue (US$3.2m) reflects a sixfold increase in market penetration from a year ago, when QTV employed a direct sales model.

Conspicuous costs and expense items include various non-recurring items (US$4m interest on convertibles, US$3m IPO expenses) in 2Q14 and non-cash adjustments (US$2.7m) in 1H14. Stripping these out, QTV’s net losses for 2Q14 and 1H14 were c.US4m and c.US$12m, respectively.

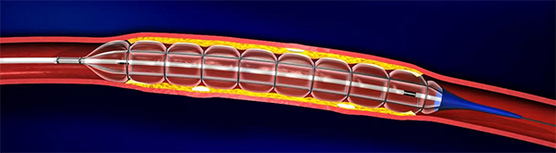

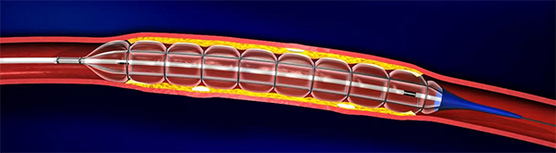

Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage. Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage.

Significantly stronger 2H14

Roll-out of the coronary Chocolate product in the US and EU in late-3Q14 (earlier than expected), larger orders in Asia and production cost-savings from technologies transfer from the US to Singapore will complement the increase in economies of scale. Note that R&D expenses will still be at around 45% of sales as the group embarks on its next wave of new product development. However, we expect the net R&D/sales ratio to come down to 35-40% on the back of more capitalisation of development costs, similar to 1H14 (US$1.6m).

Exciting time in 2015

The distribution agreements were instrumental in helping QTV lower its opex, in our view, possibly turning around its bottomline. Its new product, Silk PTA, is currently at the design feasibility stage and CE Mark submission is targeted for 1Q15. Management also said that regulatory approval in Japan for Chocolate products is expected early next year.

|

Sinarmas Land (65 c) has a market cap of S$1.98 billion. Chart: www.FT.comHigh potential returns from enormous land development bank

Sinarmas Land (65 c) has a market cap of S$1.98 billion. Chart: www.FT.comHigh potential returns from enormous land development bank