Excerpts from analysts' reports

OSK-DMG initiates coverage of Sinarmas Land with $1.01 target

Analyst: Goh Han Peng (right)

Sinarmas Land (SML) has one of the largest and most diversified landbanks in Indonesia and offers steady and resilient growth.

OSK-DMG initiates coverage of Sinarmas Land with $1.01 target

|

|

Sinarmas Land (SML) has one of the largest and most diversified landbanks in Indonesia and offers steady and resilient growth.

Armed with a solid balance sheet and healthy cash flows, SML is embarking on an international expansion to broaden the group’s revenue base.

We initiate coverage on the stock with a BUY and a TP of SGD1.01, based on sum-of-parts valuation.

We initiate coverage on the stock with a BUY and a TP of SGD1.01, based on sum-of-parts valuation.

One of the largest landowners in Indonesia. SML has one of the largest landbanks in Indonesia with more than 6000ha of land for future development.

Its 51.5%-owned subsidiary, Bumi Serpong Damai Tbk (BSDE), is the largest property company in Indonesia by sales and market capitalization.

BSDE pioneered the development of BSD City in Serpong, an integrated township with total development rights of 6000ha, almost half the size of the city of Paris. SML also owns 2000ha of industrial real estate and has an overseas property portfolio worth some SGD800m.

Its 51.5%-owned subsidiary, Bumi Serpong Damai Tbk (BSDE), is the largest property company in Indonesia by sales and market capitalization.

BSDE pioneered the development of BSD City in Serpong, an integrated township with total development rights of 6000ha, almost half the size of the city of Paris. SML also owns 2000ha of industrial real estate and has an overseas property portfolio worth some SGD800m.

Strong balance sheet; gearing up for international expansion. SML is in net cash position and generates more than SGD300m in operating cash flows per annum.

Management intends to leverage on its strong balance sheet to embark on an international expansion, adding to its portfolio of prime commercial properties in gateway cities.

Management intends to leverage on its strong balance sheet to embark on an international expansion, adding to its portfolio of prime commercial properties in gateway cities.

Unlocking of value from legacy overseas assets. With the exception of its office property in West End London acquired last year, the rest of SML’s overseas properties in Singapore, Malaysia and China are legacy assets that are still carried at nominal cost in the balance sheet.

We estimate the group could unlock as much as SGD600m from these properties.

We estimate the group could unlock as much as SGD600m from these properties.

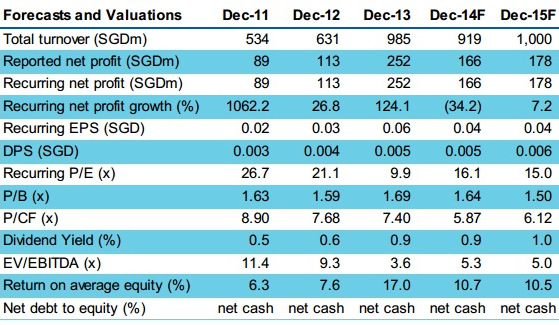

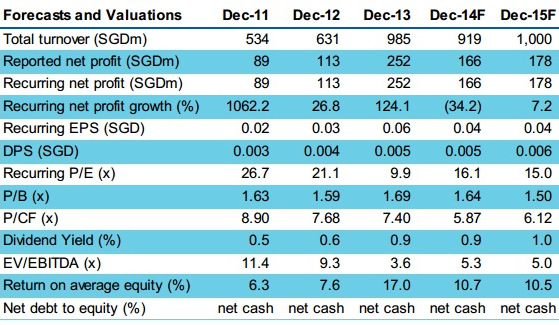

Trading at steep discount to SOTP valuation; initiate with BUY and TP of SGD1.01. We value SML using a sum-of-parts valuation with a TP of SGD1.01.

The bulk of SML’s value is driven by its 51.5% stake in BSDE, which accounts for 55% of our SOTP valuation.

We believe the stock is mis-understood due to under-coverage and offers scope for re-rating as investors get acquainted with its deep value. BUY.

Full report here.

Recent story: SINARMAS LAND: Key takeaways from meeting with executive directors

The bulk of SML’s value is driven by its 51.5% stake in BSDE, which accounts for 55% of our SOTP valuation.

We believe the stock is mis-understood due to under-coverage and offers scope for re-rating as investors get acquainted with its deep value. BUY.

Full report here.

Recent story: SINARMAS LAND: Key takeaways from meeting with executive directors

It seems that just one major project can already create enough NAV to cover its current market cap.

a. 450 hotel rooms x $1mil per key = $450 mil (Valuation)

b. Commercial retail space = 90,000sqf x $5233 (source: property guru)PSF x 80% (efficiency ratio) = $377mil (REVENUE)

c. Total cost of investment = $320mil (land, construction, etc)

(land cost = $189mil. The construction contract was awarded to Keong Hong for $101mil).

[$350mil might have been "overstated" at company's website]

Shareholder value from this single project alone ~ $507mil , which is close to its current market cap (yet to be recognized in its books), based on very conservative assumptions!

Has Cash & equivalent of S$851m as at 31.03.14.

Completion of Intl Convention Centre & many other real estate projects expected to add to revenue pretty soon. Has about the largest land bank in Indonesia.

Also, overseas assets worth more than $800m.

Indonesian economy is growing by leaps & bounds,

It is a young nation ( with half of the population below age 30) - will definitely create a gigantic demand for housing, industrial, commercial, infrastructure, etcetera which can be satisfied & provided by Sinarmas Land!

Sinarmas is thus heavily undervalued & definitely worth much more & is a great buy!!!