Excerpts from analysts' reports

Maybank Kim Eng says Overseas Education Ltd is transforming "from tortoise to hare"

Analysts: Gregory Yap & Truong Thanh Hang

Maybank Kim Eng says Overseas Education Ltd is transforming "from tortoise to hare"

Analysts: Gregory Yap & Truong Thanh Hang

|

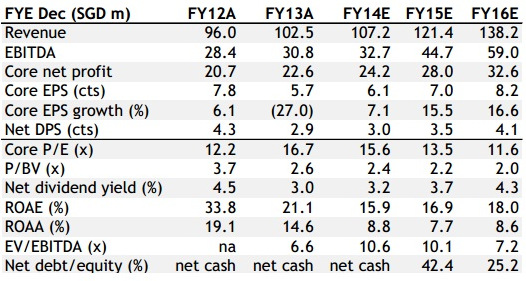

§ Growth constraints a thing of the past with the new campus coming on-stream next August. EPS growth to accelerate to 15%/17% in FY15E/16E from 7% in FY14E. § Catalysts: Higher-than-expected hikes in tuition fee and regional expansion. Risks: Competition and rising staff costs. |

Entering into a strong growth trajectory

The successful raising of the final SGD150m cash to build its new SGD271m campus has eliminated the overhang on the stock which once faced severe growth constraints.

With this issue now behind them, Overseas Education Ltd (OEL) – an international school operator - will embark on a stronger earnings growth trajectory of 16.1% over FY14E-16E (+13.6% CAGR in FY09-13).

With this issue now behind them, Overseas Education Ltd (OEL) – an international school operator - will embark on a stronger earnings growth trajectory of 16.1% over FY14E-16E (+13.6% CAGR in FY09-13). At 16x FY14E P/E, OEL is attractively priced vs sector peers’ 27.5x. Our DCF-based TP of SGD1.40 (5.5% WACC, 1% Tg) provides a strong 47% upside.

Why we like OEL

Deep-pocketed clientele. By targeting the children of high-income foreign professionals in Singapore, OEL commands strong pricing power at a time when demand still outstrips supply. Tighter immigration policies should not have any impact on its business

.

.

Demand outpaces supply = pricing power. As the new campus commences next August, we expect OEL to close the 15% gap between its tuition fees and competitors’.

The competitive dynamics are expected to stay favourable: 8% pa demand growth for school places vs less than 4% pa supply growth until 2015/16.

The competitive dynamics are expected to stay favourable: 8% pa demand growth for school places vs less than 4% pa supply growth until 2015/16.

No more growth constraints. While growth in recent years was decent, it was hampered by space constraints at its old campus.

This is set to change as the new campus increases its capacity by 22% and allows OEL to hike its tuition fees by 5.5% pa in FY15E-16E and 3-4% pa thereafter, based on our estimates

This is set to change as the new campus increases its capacity by 22% and allows OEL to hike its tuition fees by 5.5% pa in FY15E-16E and 3-4% pa thereafter, based on our estimates