AusGroup recently secured a contract to supply scaffolding material for the Chveron-operated Gorgon Project. Company photo

AusGroup recently secured a contract to supply scaffolding material for the Chveron-operated Gorgon Project. Company photo

IN SPITE OF its shrinking earnings, AusGroup’s stock price has been holding up after Asdew Acquisition’s Alan Wang and listco Ezion Holdings took stakes in the engineering services provider.

AusGroup, which had fallen into a loss attributable to shareholders of A$14.1 million for 9MFY2014, had been trading at less than 35 cents since last October, until Ezion Holdings acquired 39.9 million shares (6.9%) on 3 April.

At Ezion’s investment, its stock price jumped by close to 20% overnight to 41.5 cents and has stayed firmly above that level since. AusGroup's stock price surged by close to 20% overnight after Ezion took a stake on 3 April. Bloomberg data

AusGroup's stock price surged by close to 20% overnight after Ezion took a stake on 3 April. Bloomberg data

Several positive corporate developments have also followed the above smart money moves.

Scaffolding material for Gorgon Project

On 9 Jun, AusGroup announced that its subsidiary, MAS Australasia Pty Ltd, had secured a contract to supply scaffolding material to main contractor CB&I and Kentz Joint Venture (CKJV), for works on the Chevron-operated Gorgon Project.

MAS will be providing 6,100 tonnes of scaffolding material, which will be used to provide access for the completion of modules, ancillary structures and equipment for all trades services being carried out on Barrow Island.

The Gorgon Project is one of the world’s largest natural gas projects and the largest single resource development in Australia’s history.

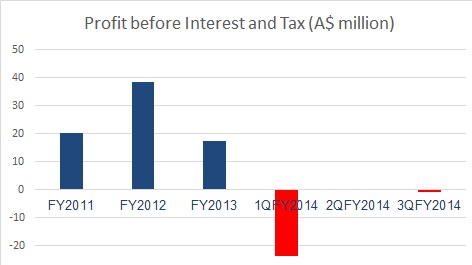

It is operated by an Australian subsidiary of Chevron and is a joint venture of the Australian subsidiaries of Chevron (47.3%), ExxonMobil (25%), Shell (25%), Osaka Gas (1.25%), Tokyo Gas (1%) and Chubu Electric Power (0.417%). AusGroup posted EBIT loss of A$23.6 million in 1QFY2014 and loss of A$600,000 in 3QFY2014. The company's financial year ends in June.

AusGroup posted EBIT loss of A$23.6 million in 1QFY2014 and loss of A$600,000 in 3QFY2014. The company's financial year ends in June.

Multi-Discipline Services Agreement for Karratha Gas Plant

On 1 May, AusGroup announced it had been awarded works under their Multi-Discipline Services Agreement (MDSA) contract with Woodside Energy as operator of the North West Shelf Project’s Karratha Gas Plant (KGP).

The MDSA was initially awarded in October 2013 for a rolling program of general and campaign maintenance activity potentially over a term of 5 years.

The scope of work awarded includes the provision of a Perth based team of Karratha Life Extension (KLE) program management resources, and a core crew of KLE site based personnel who are fully supported by Woodside Energy.

Additionally, AusGroup will provide the management, supervision and craft labor required to undertake pre outage works associated with the KLE domestic gas outage.

This includes the recruitment and on boarding of all shutdown resources.

The Karratha Gas Plant is one of the most advanced integrated gas production systems in the world, with capacity to produce 12,000 tonnes of domestic gas per day.

The plant consists of five LNG processing trains, two domestic gas trains, six condensate stabilisation units, three LPG fractionation units as well as storage and loading facilities for LNG, liquefied petroleum gas (LPG) and condensate.

The North West Shelf Project facilities account for more than 40% of Australia’s oil and gas production.

Shutdown of Yara Pilbara ammonia plant

On 11 April, AusGroup announced it won a 7-month contract worth A$20 million for provision of services to shut down the Yara Pilbara ammonia plant at the Burrup Peninsula in Western Australia.

AusGroup’s scope of work includes the provision of personnel and equipment, mechanical inspections, piping modifications and piping tie-ins across the TAN Burrup Project.

Yara Pilbara is responsible for the operation and management of one of the world’s largest ammonia production facilities.

Recent story: AUSGROUP Attracts Ezion To Be Substantial Shareholder