Excerpts from analysts' reports

Maybank Kim Eng says Venture to recover from 4 years of earnings decline

Analyst: Gregory Yap

Underappreciated signposts

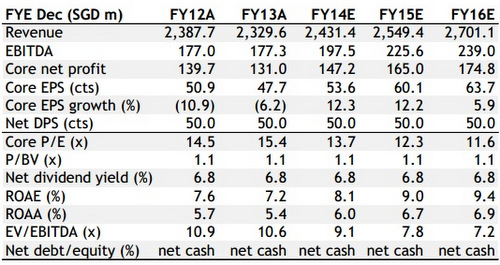

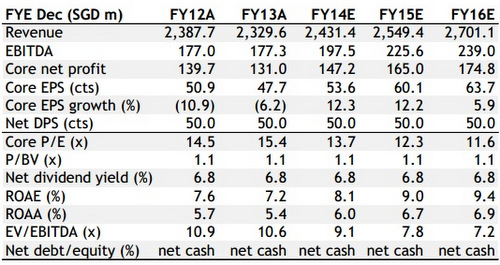

Firmly on track for an earnings recovery; reiterate BUY with TP of SGD8.64 based on 16x FY14E P/E.

Key catalysts: New customers ramping up contributions and existing customers continuing to improve.

M&A among its customers a risk but history tells us that most acquirers return to Venture.

Photo: annual reportEarnings recovery underway

Photo: annual reportEarnings recovery underway

1Q14 results showed the best signs yet of a return to growth with YoY revenue growth at its best since FY07 while PATMI registered its third consecutive quarter of YoY improvement.

This reinforces our view that Venture is on track for a 12% pa EPS growth in FY14E after four years of earnings decline. Trading at 13.7x FY14E P/E, we think the stock is undervalued and the earnings recovery story

remains underappreciated. Reiterate BUY with TP of SGD8.64, based on 16x FY14E P/E.

Growth potential improving

Already, Venture has delivered five consecutive quarters of YoY revenue growth, accompanied by three quarters of YoY PATMI growth. We expect the momentum to strengthen beyond FY14E.

We are also encouraged by the fact that its customers are seeing improved business visibility. We see additional earnings kicker from new customers, particularly in the life sciences arena. Even at this early stage, the prognosis is good: Four of its 12 new customers acquired in 2012 accounted for an encouraging 7-8% of 1Q14 sales, and their momentum could take it to 12% for FY14E.

Venture is also gaining traction with existing customers which have enjoyed earnings upgrades YTD. M&A among its customer base is a risk. However, we expect a milder impact compared to 2011-2012 when there were as many as four M&A events affecting Venture at the same time.

History has also shown that most acquirers return to Venture.

|

OCBC maintains 'buy' and 61-c target for Midas Holdings

Analyst: Andy Wong

Midas manufactures large-section and high-precision aluminium alloy extruded products which are used in the body frames of high-speed passenger trains and metro trains. Photo: CompanyJV NPRT clinches CNY3.5b metro contracts Midas Holdings (Midas) announced that its 32.5%-owned JV Nanjing SR Puzhen Rail Transport (NPRT) has clinched three metro train contracts with an aggregate value of CNY3.5b. Midas manufactures large-section and high-precision aluminium alloy extruded products which are used in the body frames of high-speed passenger trains and metro trains. Photo: CompanyJV NPRT clinches CNY3.5b metro contracts Midas Holdings (Midas) announced that its 32.5%-owned JV Nanjing SR Puzhen Rail Transport (NPRT) has clinched three metro train contracts with an aggregate value of CNY3.5b.

This bumps up NPRT’s YTD contract wins to CNY4.6b. The first order is worth ~CNY1.5b for the Suzhou Rail Transit Line 4 and Branch Procurement Contract, with delivery slated between 2015 and 2017.

The second contract is worth ~CNY0.9b for the Hefei Rail Transit Line 1 Phases 1 and 2, with delivery scheduled from 2015 to 2016.

The last contract is for the Hangzhou Metro Line 4 Phase 1 Stock Procurement contract and is worth ~CNY1.1b, with delivery slated from 2014 to 2017.

As Midas is also a key supplier of aluminium extrusion profiles for NPRT, we believe this may also lead to future contract wins for Midas.

Maintain BUYon Midas, with an unchanged fair value estimate of S$0.61, pegged to 1.2x FY14F P/B.

|

Photo: annual reportEarnings recovery underway

Photo: annual reportEarnings recovery underway