Excerpts from analysts' reports

Voyage Research says Roxy-Pacific's unbooked revenue has risen to S$1 billion

Analyst: Liu Jinshu (left)

Analyst: Liu Jinshu (left)

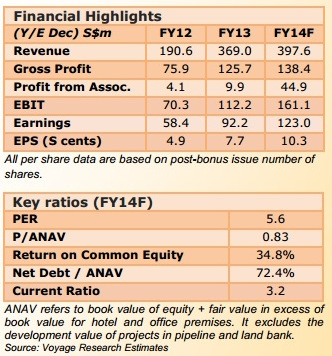

Roxy-Pacific Holdings Limited (Roxy) reported a 27% jump in net profit for 1Q FY14. We view the results as largely in line with expectations and reiterate that the company will likely benefit from the completion of Centropod and its Hong Kong project in FY14.

Quarterly results do not yet reflect contribution from these projects, which are accounted for only upon completion or handover. Moreover, 59 Goulburn Street in Sydney is also likely to elevate the company’s investment income in 2H 2014.

Voyage Research says Roxy-Pacific's unbooked revenue has risen to S$1 billion

Analyst: Liu Jinshu (left)

Analyst: Liu Jinshu (left)Roxy-Pacific Holdings Limited (Roxy) reported a 27% jump in net profit for 1Q FY14. We view the results as largely in line with expectations and reiterate that the company will likely benefit from the completion of Centropod and its Hong Kong project in FY14.

Quarterly results do not yet reflect contribution from these projects, which are accounted for only upon completion or handover. Moreover, 59 Goulburn Street in Sydney is also likely to elevate the company’s investment income in 2H 2014.

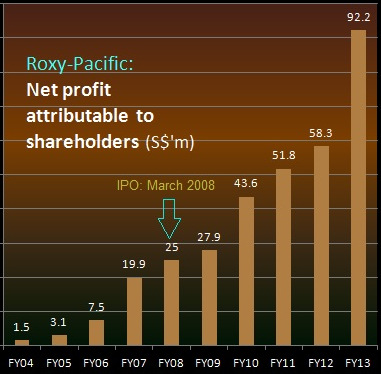

After last year's record profit (S$92.2 m), Roxy-Pacific could be headed for a record S$123 m this year, according to Voyage Research.Consistent Movement of Units: Roxy pre-sold S$19.6m of its Singapore projects during the current reported period of 7 Feb to 24 Apr 2014 (77 days) or S$255k/day, compared to S$23.5m during 30 Oct 2013 to 6 Feb 2014 (100 days) or S$235k/day.

After last year's record profit (S$92.2 m), Roxy-Pacific could be headed for a record S$123 m this year, according to Voyage Research.Consistent Movement of Units: Roxy pre-sold S$19.6m of its Singapore projects during the current reported period of 7 Feb to 24 Apr 2014 (77 days) or S$255k/day, compared to S$23.5m during 30 Oct 2013 to 6 Feb 2014 (100 days) or S$235k/day. As such, Roxy’s pre-sales in Singapore can be viewed as consistent or slightly better in 1Q FY14 compared to 4Q FY13.

We also understand that Roxy sold two more units at Jade Residences, during the weekend after it released its results, which were not reflected in the reported numbers.

Four More Floors Sold at Russell Street: Other than sales in Singapore, the company also sold four more floors at its 30% owned Hong Kong project, which raised attributable pre-sales from about S$95m in Feb 2014 to S$137.7m as of 24 Apr 2014.

As a result, progress billings to be recognized as revenue from 2Q FY14 to FY17 has risen from S$922.4m as of end FY13 to S$1.001bn as of end 1Q FY14.

As a result, progress billings to be recognized as revenue from 2Q FY14 to FY17 has risen from S$922.4m as of end FY13 to S$1.001bn as of end 1Q FY14.

As a result, progress billings to be recognized as revenue from 2Q FY14 to FY17 has risen from S$922.4m as of end FY13 to S$1.001bn as of end 1Q FY14.

As a result, progress billings to be recognized as revenue from 2Q FY14 to FY17 has risen from S$922.4m as of end FY13 to S$1.001bn as of end 1Q FY14. Hotel Ownership Segment – Improved Performance: Average occupancy rate at the hotel remained stable over 4Q FY13, at 90.2% in 1Q FY14 versus 90.3% in 4Q FY13.

Average room rate increased from S$183 in 4Q FY13 to S$190.5 in 1Q FY14, while revenue per available room rose from S$162 to S$172 over the same period.

The improved room rates led hotel ownership revenue to exceed our forecasts slightly.

Average room rate increased from S$183 in 4Q FY13 to S$190.5 in 1Q FY14, while revenue per available room rose from S$162 to S$172 over the same period.

The improved room rates led hotel ownership revenue to exceed our forecasts slightly.

We were even more surprised by the improvement in EBITDA margin, as adjusted EBITDA came in at 41% of revenue in 1Q FY14, compared to 38% in 4Q FY13. We had expected margins to remain stable on the back of higher manpower costs in Singapore.

The company explained that the outlook for room rates in 2014 has improved as one-third of planned new hotel rooms have been delayed till 2015 and that new openings are skewed towards end 2014.

Invest. Intrinsic value: 72 cents.

Recent story: @ ROXY-PACIFIC's AGM: Seeking opportunities post-property boom in S'pore

Invest. Intrinsic value: 72 cents.

Recent story: @ ROXY-PACIFIC's AGM: Seeking opportunities post-property boom in S'pore