Steen Jakobsen (Saxo Bank’s chief economist and keynote speaker at the CFA Singapore 2014 Annual Forecast Dinner) believes that the US Federal Reserve will not be able to carry on with the tapering.

Steen Jakobsen (Saxo Bank’s chief economist and keynote speaker at the CFA Singapore 2014 Annual Forecast Dinner) believes that the US Federal Reserve will not be able to carry on with the tapering.

AT CFA SINGAPORE'S Annual Forecast Dinner in March, 4 experts -- an economist, an asset allocator, an equity portfolio manager and a fixed income portfolio manager -- tackled the following questions: How will equities do this year? Are markets overvalued? Will cyclical stocks outperform dividend yield stocks? How will the fixed income markets do as interest rates rise? What are the risks in 2014?

Their discussion was published in the recent The CFA Singapore Quarterly produced by NextInsight and is republished here with permission.

The CFA Singapore Annual Forecast Dinner took place on 25 March 2014, a week after the US Federal Open Market Committee announced the continued tapering of its monthly purchases of mortgage-backed securities and long-term Treasuries, which will be balanced by low Federal funds rates.

However, Steen Jakobsen (Saxo Bank’s chief economist), who was the keynote speaker at the Forecast Dinner, believes that the US Federal Reserve will not be able to carry on with the tapering.

He thinks there will be a severe sell-off in equities markets by the end of this year.

The following is a summary of Mr Jakobsen’s address at CFA Singapore Annual Forecast Dinner. Steen Jakobsen, Chief Economist, Saxo BankWHY STOCKS WILL UNDERPERFORM THIS YEAR

Steen Jakobsen, Chief Economist, Saxo BankWHY STOCKS WILL UNDERPERFORM THIS YEAR

“The two main conclusions I have today are: Firstly, the stock market is lagging the real economy by 3 months. More importantly, the interest rate cycle leads the real economy by 9 months. Exactly 9 months ago (during May to June 2013), all the talk was about tapering.

“The consequences of that move are being felt right now. Do not underestimate the impact of Federal Reserve policy decisions on the currency and interest rate environment down the road.

“A businessman may decide on some corporate action based on today’s interest rate. But it will be at least 6 to 9 months down the road before he would have secured financing or invested. What happened last year explains a lot about what goes on now. The price of higher rates is immediately felt in the economy.

“Out of the 25 indicators that we have in Saxo’s forecasting model, 20 indicate that the US economy will turn down in 2014 and hit a low. The interesting thing is: As we come out of 2014 into 2015, we expect higher growth and higher inflation.

“Some people think the low interest rate environment will persist. Anyone in fixed income will realize short term interest rates stopped going down a long time ago. A chart on GDP-weighted interest rates of G10 nations shows that last year, one-year interest rates of large economies moved 72 basis points down, and then back up by 58 basis points.”

Mr Jakobsen pointed out that growth in the US housing market has been slowing after the tapering began.

In the chart below, an inverse relationship between the 30-year US mortgage rate and building permits shows a very strong correlation between the lack of growth in the US housing market right now and the interest rate increase since May last year. Mortgage rates, which dropped to its lowest ever after QE3 was announced in September 2012, rose after the US Federal Reserve decreased its monthly fund injection into mortgage-backed securities. FRED data

Mortgage rates, which dropped to its lowest ever after QE3 was announced in September 2012, rose after the US Federal Reserve decreased its monthly fund injection into mortgage-backed securities. FRED data

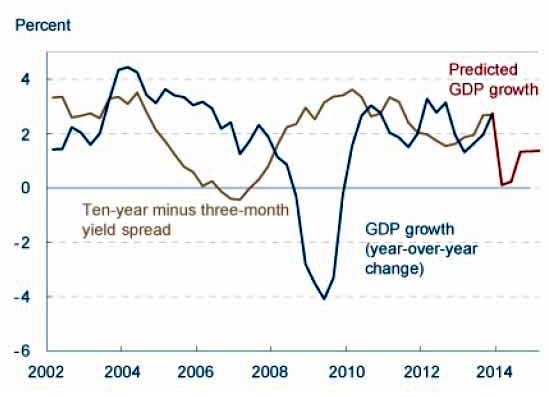

He also pointed to a chart from the San Francisco Federal Reserve website that clearly indicated that the US growth will come down dramatically this year.

The San Francisco Federal Reserve should be on the same page as Janet Yellen, since she was formerly its President.

Yield Curve predicted GDP growth published on the San Francisco Federal Reserve website in March 2014. The chart clearly indicated that US growth will come down dramatically this year.

Yield Curve predicted GDP growth published on the San Francisco Federal Reserve website in March 2014. The chart clearly indicated that US growth will come down dramatically this year.

Data sources: Bureau of Economic Analysis, Board of Governors of the Federal Reserve System, authors' calculations.

“The reason US stock market valuations are rich even though we have high unemployment and low productivity is because we have a 80:20 economy. 80% of all the companies are SMEs. This 80% accounts for 100% of job growth, but are only given 20% of US credit financing. On the other hand, listed companies, which account for 20% of companies, get 80% of the credit financing.”

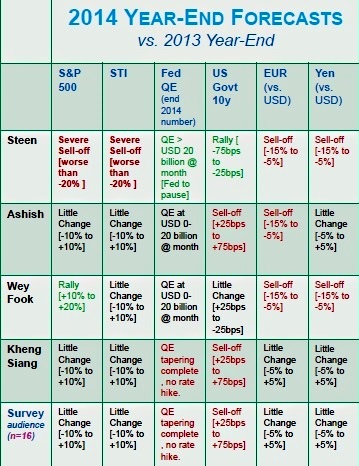

The following discussion is based on a survey of CFA Singapore members as well as panel speakers on their views for 2014 and their personal portfolio allocation strategy.

|

Mr Jakobsen is looking at a sell-off of equities in the US and in Singapore. |

CFA Singapore members generally believe tapering will be completed this year.

They are expecting a significant sell-off in US 10-year Treasuries. As much as 30% to 50% of their portfolio is allocated to cash.

|

"My central premise is the US will be the market that will do very well compared to the rest of the world. The US accounts for 55% of the world’s equities market. As it starts to recover, it sucks the excess liquidity out from every corner of the world. You are seeing the effect of that in stocks and currencies, and that has some way to go. The US economy is recovering nicely because it has become more competitive. Its wages have been stagnant for the past 10 years. Today, it is the most competitive economy in the world. The shale gas boom has also made it more competitive. The US will continue to attract a lot of cash out of the emerging markets. You can see this coming from the massive amounts of cash allocation in Singapore private banks - currently in the region of 30% to 40%. (Singapore is one of the world’s largest private banking centres.) I am extremely bullish on US equities. Valuations are not cheap, but not overly expensive. I am completely invested in US exchange traded funds." |

|

He has a balanced portfolio. "Most of the forecasts will be wrong at the end of the year, but what is important is the thinking behind them. In the last 4 to 5 years, dividend stocks have done very well - much better than they have done over the very long term. I think that will be a recurring theme. Should equities trade at 15 to 16 times earnings, which may be the market average? Or should they trade at higher valuations, given the low interest rates? |

|

He has a balanced portfolio. "I don’t think the Fed wants to rock the boat by changing their forward guidance unless they see strong evidence of data that warrants a shift from the view it has given. |

Ashish Goyal, CFA (Investment Director of Eastspring Investments (Singapore) and event panelist) is looking at the US Fed tightening as the main factor influencing the markets.

Ashish Goyal, CFA (Investment Director of Eastspring Investments (Singapore) and event panelist) is looking at the US Fed tightening as the main factor influencing the markets. Ng Kheng Siang, CFA (Asia Pacific Head of Fixed Income State Street Global Advisors and event panelist) is expecting tapering to be complete at the end of this year and a sell-off in US 10-year Treasuries.

Ng Kheng Siang, CFA (Asia Pacific Head of Fixed Income State Street Global Advisors and event panelist) is expecting tapering to be complete at the end of this year and a sell-off in US 10-year Treasuries.