Excerpts from UOB Kay Hian's 47-page report

We have a year-end target of 3,400 for the FSSTI, which implies an upside of 6% for the broader market. Our year-end target of 3,400 is based on a 10% discount each to the long-term P/B and PE valuation mean for the FSSTI.

We think a 10% discount is warranted as the projected market ROE for 2014 of 9.9% is expected to be below the long-term ROE target of 11.4%.

We have a year-end target of 3,400 for the FSSTI, which implies an upside of 6% for the broader market. Our year-end target of 3,400 is based on a 10% discount each to the long-term P/B and PE valuation mean for the FSSTI.

We think a 10% discount is warranted as the projected market ROE for 2014 of 9.9% is expected to be below the long-term ROE target of 11.4%.

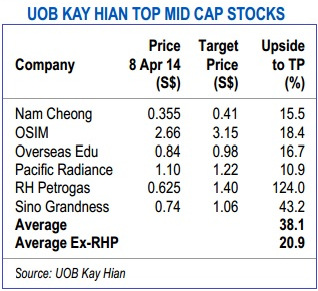

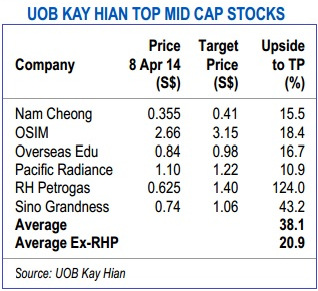

Comparatively, our preferred basket of selected mid caps offers a higher average upside of 21%.

This excludes the expected returns from RH Petrogas, which is an outlier with an expected return of 124%. If we were to include RH Petrogas, the average returns from our mid cap picks would be higher at 38%, but we have excluded RH Petrogas as we think its risk return profile would primarily suit investors with aggressive risk appetite.

This excludes the expected returns from RH Petrogas, which is an outlier with an expected return of 124%. If we were to include RH Petrogas, the average returns from our mid cap picks would be higher at 38%, but we have excluded RH Petrogas as we think its risk return profile would primarily suit investors with aggressive risk appetite.

Our key picks in the mid cap list include:

Loquat juice is the No.1 offering by Garden Fresh, the beverage subsidiary of Sino Grandness which is headed for an IPO in HK. Photo: Company1) Sino Grandness (BUY/Target: S$1.06). Clear catalyst from the proposed listing of its juice subsidiary. We see potential upside to our target price should the group secure a higher valuation for the listing of Garden Fresh vs our estimate of 16x FY13 PE. Loquat juice is the No.1 offering by Garden Fresh, the beverage subsidiary of Sino Grandness which is headed for an IPO in HK. Photo: Company1) Sino Grandness (BUY/Target: S$1.06). Clear catalyst from the proposed listing of its juice subsidiary. We see potential upside to our target price should the group secure a higher valuation for the listing of Garden Fresh vs our estimate of 16x FY13 PE. 2) OSIM (BUY/Target: S$3.15). Compelling consumer proxy with strong cash flows. The group is embarking on a three-pronged approach; growing sales of its massage chair, nutritional product and luxury tea business segments to drive its revenue and net profit. Our estimates are 4-7% ahead of consensus expectations. 3) Pacific Radiance (BUY/Target: S$1.22). Visible growth outlook and strong management track record in building shareholder value.

We have a target price of S$1.22 but we see upside from: a) further sector re-rating, b) higher PE valuation for superior management and a virtuous-cycle OSV business model, and c) POSH’s premium valuations when it commences trading. 4) Overseas Education (BUY/Target: S$0.98). Resilient earnings outlook and longer-term growth underpinned by an at least 22% rise in capacity from its new campus. We have a target price of S$0.98/share, based on a 3-stage DCF valuation model. 5) RH Petrogas (BUY/Target: S$1.40). Trading at a deep discount to NPV of assets.

We see potential catalysts from newsflow such as the Overall Development Plan (ODP) approval for Fuyu 1 in China in 1H14. Management remains open to M&A opportunities and the acquisition of new production assets would remove our concerns on its cash flows if the Indonesian government does not renew its concessions for the Basin and Island PSCs (both are expiring in 2020). 6) Nam Cheong (BUY/Target: S$0.41). Record high orderbook of RM1.4b (S$573m) provides good earnings visibility.

For 2015, Nam Cheong has unveiled a larger US$700m shipbuilding programme (2014: US$600m) comprising 35 vessels. We forecast a net profit CAGR of 11% over the next three years. |

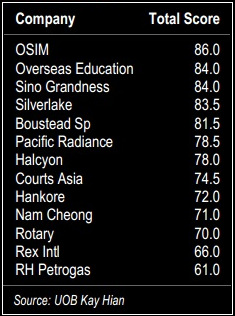

Assessing Mid Caps Using UOB KAY HIAN Mid Cap Due Diligence

Assessing Mid Caps Using UOB KAY HIAN Mid Cap Due Diligence Using our proprietary UOB Kay Hian Mid Cap Due Diligence analysis, which considers valuation, business model and a host of parameters including financials and barriers to entry etc, our key picks (in order of preference) are:

1) OSIM

2) Overseas Education

3) Sino Grandness

4) Silverlake

5) Boustead

6) Pacific Radiance

Our ranking system builds in weightings for the various parameters but we have attributed the highest weighting (measured by points) for key issues such as management track record, corporate governance and areas such as valuation and trading liquidity.

Recent story: DBS Vickers: Stock picks for a global recovery

Recent story: DBS Vickers: Stock picks for a global recovery