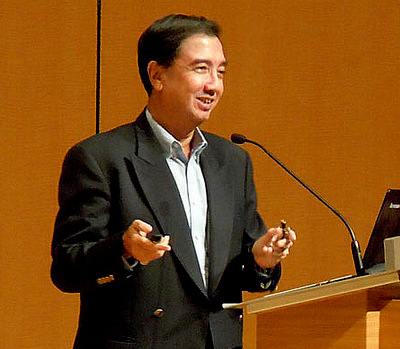

Kevin Scully, executive chairman, NRA Capital. Photo: CompanyWITH THE threat of an imminent Russian invasion of the Ukraine, financial markets dived yesterday both in Asia as well as the European markets.

Kevin Scully, executive chairman, NRA Capital. Photo: CompanyWITH THE threat of an imminent Russian invasion of the Ukraine, financial markets dived yesterday both in Asia as well as the European markets. I believe this is a knee jerk herd reaction.

I remember speaking to fund managers in the past who have told me that during such periods of market irrationality, it's best to sell first and raise cash levels as out of this uncertainty will rise good investment opportunities.

I tend to agree with this view, hence I thought I would pen here some of my thoughts on the actual fundamentals.

Let's first look at Ukraine. It's a tiny country with a population of about 45-46mn.

Its GDP in 2012 was US$175bn. 10% of the economy is agriculture, 33% industrial and the balance, services.

Its main industrial base is in coal, metals, machinery and transport equipment.

In terms of GDP, Ukraine is a small country with its 2012 GDP about 63% that of the Singapore economy according to the World Bank.

So even if Russian annexes the Ukraine as it did Poland in the 1960s, I doubt there will be any significant negative global effect.

Of course, there is fear and uncertainty that a new cold war will emerge but is Ukraine with its tiny GDP worth fighting for (I am refering here to whether the US, Nato and even China will intervene militarily)?

My guess is there will be a lot of rhetoric but no escalation of military tension.

Stock markets will be nervous but as there is likely to be little economic effect, this will provide a buying opportunity.

How did the Vix or volatility index do overnight ?

The Vix index did rise but only by 2 points to 16 which means most investors don't think much of the Ukraine crisis in its current state.

Recent story: "MIDAS, One Of My Stock Picks, Has Delivered A Good Set Of FY2013 Results"