Analysts sought the views of Teo Hong Lim, Roxy-Pacific's executive chairman and CEO, on the market situation and Roxy-Pacific's plans.

Teo Hong Lim, executive chairman & CEO of Roxy-Pacific Holdings, bought 300,000 Roxy shares on Monday, 17 Feb @ an average price of 59.3 cents. NextInsight file photo.Q: How do you see the property market going forward?

Teo Hong Lim, executive chairman & CEO of Roxy-Pacific Holdings, bought 300,000 Roxy shares on Monday, 17 Feb @ an average price of 59.3 cents. NextInsight file photo.Q: How do you see the property market going forward?A: The TDSR (total debt servicing ratio) is the biggest challenge for residential property developers now. It's not that the market is gone.

There are pockets of demand in various parts of Singapore -- where you can buy a plot and there is not much competition and you will still be able to sell.

We have to do our sums right, and maintain a margin discipline. We have to design the product meticulously, so there won't be extra costs. It's something we have been doing for years.

We need to keep innovating and come up with some unique features. We have some ideas.

We have been going for freehold land, and our psf price is higher because the land cost was higher. We will do our usual compact units which means if you went to another developer, for the same floor area you get a 3-bedder but at Roxy, you get a 4-bedder.

When you sell this in future, you should get better value for your 4-bedder.

Despite the TDSR, our projects launched last year are largely sold. The remaining units are mainly the penthouses. Most of the 2-bedders, 3-bedders, 4-bedders have been sold.

Q: Regarding your two landbank in Singapore -- in Tampines and Telok Kurau -- when will the projects be launched?

A: Likely in the next two months.

Q: What about the KL project?

A: Likely year-end -- or early next year. We target RM1000 psf but likely we can do more. Construction cost is likely to be in the range of RM400 psf.

Q: Will you be adding to your landbank in Singapore?

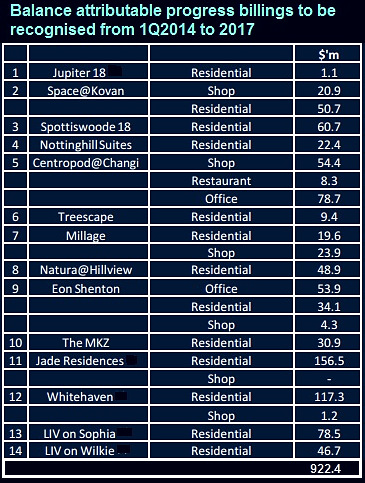

Roxy-Pacific has S$922 million of revenue to recognise. A: We can't discount the Singapore market but let's clear our existing stock first.

Roxy-Pacific has S$922 million of revenue to recognise. A: We can't discount the Singapore market but let's clear our existing stock first. Land prices have not come off. In fact, they have gone up higher. In recent tenders, there were more competitors. Most developers are relying on state land now because there's hardly any freehold site available after many years of en-bloc sales.

Q: Will you get higher margins from overseas projects?

A: Sometimes when we do simulations, the margins look reasonable but not fantastic. Most of the time, it's 20% of the gross development value. We take the view that there could be a rise in selling price.

We target strong markets where we can sell 70-80% in 2-3 months -- just like what happened in Singapore in the last few years.

The challenge in Singapore today for some recently-launched projects --- not ours -- is, if you count the number of units sold versus the total units available, the figure could be as low as 15%. It's quite scary. When the market slows down, it's difficult to sell big projects.

The reason could be the asking price -- you have only 1 chance and if you don't sell well at your asking price, everybody will know about it, the media will write about it. Then even those who want to buy will decide to wait.

Another reason - the units could be oversized. The luxury market is not there. The higher the price, the harder the TDSR will hit.

Q: Construction costs are rising -- by how much?

CFO Koh Seng Geok bought 60,000 Roxy shares on Monday, 17 Feb @ 58.5 cents on average. NextInsight file photoA: About 10%. Sometimes, the situation is the contractors' quotes are far apart. What we have done in some projects is to ask main contractors to enter into JVs with us with them taking 5-10% stakes. Just before we bought a site, we have locked in the construction costs.

CFO Koh Seng Geok bought 60,000 Roxy shares on Monday, 17 Feb @ 58.5 cents on average. NextInsight file photoA: About 10%. Sometimes, the situation is the contractors' quotes are far apart. What we have done in some projects is to ask main contractors to enter into JVs with us with them taking 5-10% stakes. Just before we bought a site, we have locked in the construction costs.Q: If property prices drop by 15-20%, what steps would Roxy take?

A: The key would be, do we have substantial stock left? If you talk about a 15-20% drop, that would wipe out nearly all the margins of developers.

Then you could hold the property for the longer-term and try to rent it. For listco developers, we can sweep the units into a special purpose vehicle and rent them out. But it's a costly move because we would have to pay 10% ABSD (additional buyers' stamp duty).

The clear-cut strategy is to price right and be focused in selling.

Roxy-Pacific stock has turned out to be a 5-bagger over the past 5 years. Chart: FT.com

Roxy-Pacific stock has turned out to be a 5-bagger over the past 5 years. Chart: FT.comQ: The increase in hotel room stock last year was around 3,000 rooms, a 5-6% increase which was in line with tourist arrivals growth. Yet it seems that the hotel industry had issues absorbing the new supply. Why is this so?  Chris Teo, MD, Roxy-Pacific (right): Generally, there is new supply and we are feeling pressure from corporates -- it's a demand-supply situation and new players tend to be more aggressive in their rates. Chris Teo, MD, Roxy-Pacific (right): Generally, there is new supply and we are feeling pressure from corporates -- it's a demand-supply situation and new players tend to be more aggressive in their rates.One of our biggest challenge is to maintain cost levels, getting manpower at the right cost levels. We are actively engaging our operator, Accor, to see what we can do as a group as Accor operates a number of hotels in Singapore. The government realises that there is an oversupply and has taken a few hotel sites off the market. We have certain advantages being out of the mainstream areas like Orchard. We maintain our niche market in the east quite well. The new airport developments and all that will keep us competitive for years to come. That's why we last year we decided to upgrade our rooms substantially. Another reason: Last year was a slower year for the MICE (Meetings, Incentive Travels, Conferences and Exhibitions) business compared to this year. Demand will be very strong this year. |

See Roxy-Pacific's PowerPoint presentation which has been uploaded to the SGX website.