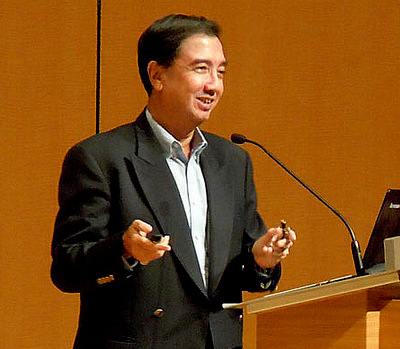

Kevin Scully, executive chairman of NRA Capital. Photo: CompanyI HAD ONE of my regular Channel News Asia interviews on Prime Time Morning today at about 8.10am.

Kevin Scully, executive chairman of NRA Capital. Photo: CompanyI HAD ONE of my regular Channel News Asia interviews on Prime Time Morning today at about 8.10am. I was asked about 9 questions and thought I would share these with those who missed the interview and maybe elaborate a little more given that I am not constrained by time.

Question 1: US stocks battle back overnight, do you see room for further falls?

The US markets had a good run in 2013 with gains of about 30%. A 10% correction is not unreasonable and would allow the market a base to consolidate.

Question 2: Is Wall Street at risk of big correction this year?

Wall Street was down about 5% before last night’s rebound – so a 10% correction that I indicated in question 1 would point to possible fall to the 14800 level.

Question 3: Are US stocks overvalued?

US stocks based on analysts forecasts are not expensive with prospective PER of 14 times for FY2014 on earnings growth of about 5%. If the current reporting season delivers these expectations and guides for a better 2014, this will underpin the market.

Question 4: Do you expect today’s release of US job numbers for January to be as bad as December?

I am looking at a doubling of non farm payroll increases to about 180,000 – much higher than the 74,000 in December which will lower the US unemployment rate to 6.7%. This will in my opinion support the Fed decision to continue “Tapering” and hopefully bring QE3 to an end by August September 2014. The continuance of “Tapering” will result in further US$ strength and sustain the fund flows from emerging markets to the US and to a lesser extent the EU. I believe the US Bull market has another two years to go.

Question 5: Japanese stocks are in correction territory, after a 13% pull back this year. Is the bear market of a threshold of a 20% drop not far off?

I don’t think Japan is in a bear market and after last year’s 50% rise, a correction of 20% will be healthy. I see good support for the Nikkei 225 at the 13380 level.

Question 6: Singapore’s benchmark STI is trading below the 3000 mark – could prices go cheaper?

Much would depend on what happens to the property sector in Singapore. Price declines of 20% or more could trigger a rise in NPLs and provisions for the Singapore banks which are about 30% of the STI Index. This could create a downward bias for the STI. I see critical support at the 2900 level.

Question 7: Singapore Airlines reported a sharp decline in its fiscal third-quarter net profit. Do you see intense competition ahead from Gulf carriers and budget airlines?

SIA’s Q3 net profit decline was due mainly to exceptional items. The airline industry as a whole has been facing severe competition since 2011. SIA’s earnings multiples are not cheap and the outlook in the near terms remains difficult. The shares are a HOLD / AVOID for now.

Question 8: Marina Bay Sands saw a 17% year on year contraction on VIP volume in the fourth quarter of 2013. Are you downbeat on Genting Singapore’s earnings outlook?

I am looking at 10% earnings growth for Genting in the current FY. The shares are trading on PER terms inline with their peer group and are not expensive but probably fully valued for now.

Question 9: Starhub posted a 5% drop in fourth quarter net profit. What’s your call on the Telco and the industry itself?

The Singapore market is very mature given the current penetration rates. The sector has been a defensive yield play with dividend yields ranging from 4-5%. Of the three that are listed, Singapore Telecom looks the most attractive now at S$3.50 – the other two I would prefer to accumulate when their share prices are 5-10% lower.