Excerpts from analysts' reports

Maybank Kim Eng says Super's "4Q results likely to shrug off disappointing 3Q13"

Analyst: James Koh

Three main factors led to Super Group’s disappointing 3Q13 results, but we note that things are taking a turn for the better.

Three main factors led to Super Group’s disappointing 3Q13 results, but we note that things are taking a turn for the better.

Maybank Kim Eng says Super's "4Q results likely to shrug off disappointing 3Q13"

Analyst: James Koh

Three main factors led to Super Group’s disappointing 3Q13 results, but we note that things are taking a turn for the better.

Three main factors led to Super Group’s disappointing 3Q13 results, but we note that things are taking a turn for the better.(1) In Myanmar, the company’s second-biggest market, an unstable currency dealt a hard blow to sales and margins but with the situation stabilising, volumes should return in 4Q13.

(2) In the Philippines, revenue had plunged 51% YoY but our channel checks suggest that end-user demand remains healthy and some of the headline decline was partly due to de-stocking. We therefore expect QoQ improvements.

(3) Non-dairy creamer sales declined as its customers experienced lower demand but we expect management’s efforts to diversify customer base in this business to pay off over the next 1-2 quarters.

(2) In the Philippines, revenue had plunged 51% YoY but our channel checks suggest that end-user demand remains healthy and some of the headline decline was partly due to de-stocking. We therefore expect QoQ improvements.

(3) Non-dairy creamer sales declined as its customers experienced lower demand but we expect management’s efforts to diversify customer base in this business to pay off over the next 1-2 quarters.

What’s Our View: Super is due to announce its 4Q13 results in end-February.

We expect FY13E revenue of SGD561m, up 8% YoY, and recurring net profit of SGD85.5m, up 10% YoY.

Our FY13F estimates are adjusted downwards by 3%, but still above consensus. In our view, the current share price offers a good chance to accumulate the stock for its longer-term growth story even if weakness should persist for another 1-2 quarters.

Our DCF-based TP is SGD4.45, pegged to 25x FY14E P/E, which is slightly above peer average but justified by its higher EPS CAGR of 13% over FY13F-15F.

Key risks include a prolonged political standoff in Thailand, which may hurt Super’s sales in Bangkok.

We expect FY13E revenue of SGD561m, up 8% YoY, and recurring net profit of SGD85.5m, up 10% YoY.

Our FY13F estimates are adjusted downwards by 3%, but still above consensus. In our view, the current share price offers a good chance to accumulate the stock for its longer-term growth story even if weakness should persist for another 1-2 quarters.

Our DCF-based TP is SGD4.45, pegged to 25x FY14E P/E, which is slightly above peer average but justified by its higher EPS CAGR of 13% over FY13F-15F.

Key risks include a prolonged political standoff in Thailand, which may hurt Super’s sales in Bangkok.

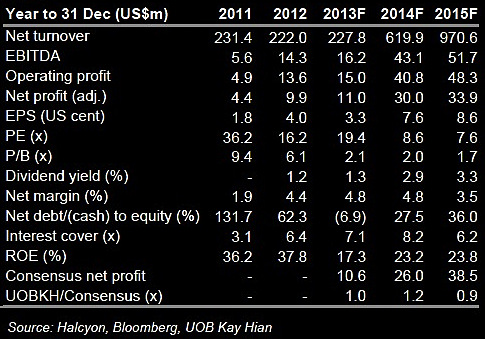

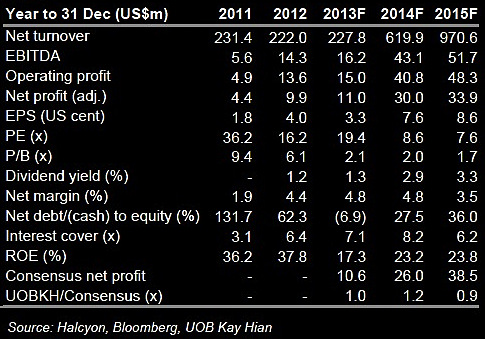

UOB Kay Hian expects Halcyon Agri to double profit in 2014.

Analyst: Andrea Isabel Co, CFA

Analyst: Andrea Isabel Co, CFA

• Maintain BUY and target price of S$0.95 based on a peer-average PE of 10x applied to our 2014F EPS estimate of 9.5 S cents.

Halycon owns and operates two natural rubber processing facilities in Palembang, South Sumatra, Indonesia, which is the largest natural rubber exporting province in Indonesia. Halycon's products are sold to a global customer base, including many of the top 20 global tyre manufacturers. Photo: Company WHAT’S NEW

Halycon owns and operates two natural rubber processing facilities in Palembang, South Sumatra, Indonesia, which is the largest natural rubber exporting province in Indonesia. Halycon's products are sold to a global customer base, including many of the top 20 global tyre manufacturers. Photo: Company WHAT’S NEW

Halycon owns and operates two natural rubber processing facilities in Palembang, South Sumatra, Indonesia, which is the largest natural rubber exporting province in Indonesia. Halycon's products are sold to a global customer base, including many of the top 20 global tyre manufacturers. Photo: Company WHAT’S NEW

Halycon owns and operates two natural rubber processing facilities in Palembang, South Sumatra, Indonesia, which is the largest natural rubber exporting province in Indonesia. Halycon's products are sold to a global customer base, including many of the top 20 global tyre manufacturers. Photo: Company WHAT’S NEW• Halcyon Agri Corp (Halcyon) announced on 16 January the completion of the acquisition of two natural rubber (NR) processing factories in Ipoh, Malaysia together with all associated buildings, plant and machinery and four plots of land on which the assets are located and operated.

• Following the acquisition, CLS Sdn Bhd and its wholly-owned subsidiary Hevea CLS Sdn Bhd have become indirect wholly-owned subsidiaries of the company.

• Proceeds of US$14.2m from the Credence Placement has been utilised to satisfy part of the consideration for the acquisition, which amounts to RM46.7m. The company will make further announcements upon satisfaction of the conditions and payment of the remaining consideration of RM10m.

STOCK IMPACT

• Target to ramp up to 50% utilisation in 2014. The CLS acquisition adds 180,000 tonnes of annual production capacity to the group. Management intends to achieve 50% utilisation by end-14, which doubles the group’s output potential to close to 200,000 tonnes this year.

Numerous grades of Standard Malaysian Rubber (SMR) will be produced in the two Ipoh factories with 100,000 tonnes to be allocated for the premium SMR2-CV.

We expect production here to commence soon as the factories are operationally ready.

• Looking to enlarge customer portfolio with the addition of Korean tyre makers such as Hankook, Kumho and Nexen. Halcyon is working to achieve qualified supplier status for these and other global brands. We think the group’s strong CSR initiatives will boost its approval applications.

• Eyes exciting 2014. For the seasonally weak 4Q13, we expect Halcyon’s gross material profit to be lower than the average US$413/tonne in 9M13 but still remain above US$350/tonne.

Management is confident it will meet its committed volume of 26,575 tonnes for the quarter. We are excited about the huge jump in midstream capacity this year and its entry into the Malaysian market, which will help mitigate seasonal effects, reduce concentration risk and diversify its revenue base. We project the group’s earnings to more than double to US$30m in 2014.

Management is confident it will meet its committed volume of 26,575 tonnes for the quarter. We are excited about the huge jump in midstream capacity this year and its entry into the Malaysian market, which will help mitigate seasonal effects, reduce concentration risk and diversify its revenue base. We project the group’s earnings to more than double to US$30m in 2014.