I HAVE A dismal record.

All my counters were bought in 2013 except Nam Lee. I used to own and sell other counters too, and trade S-chips quite heavily at one point of time.

After reading “The Intelligent Investor”, my whole investment paradigm shifted. I am also clearer with what I want - I want dividend income for cash flow, more than capital gain.

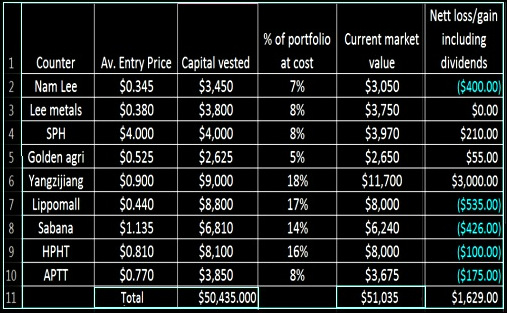

I decided to be more transparent with readers, showing how much was vested. It's OK if other thinks I am silly, and stop reading my blog. I also calculate return based on costs.

I know there are better performance indicators but I think this suits me fine. At the end of the day, I want to make money.

As you can see, for the year 2013, it is a dismal 3.3 % return.

I added Asian Pay Television Trust (APTT) and Hutchison Port Holdings Trust (HPHT) to my portfolio.

For HPHT, I bought a second tranche at $0.77. But I am not losing sleep over it. In fact, I would have bought more of APTT if it falls to 70.5 cents.

I was reading various forums and blogs and realized quite a number of people achieved returns of 30% in 2013.

I was wondering why my results are so dismal compared to them. And no, these people were not trading or speculating in pennies.

Yangzijiang's shares returned 28.6% in 2013, including a 5-cent dividend. NextInsight file photo.They bought stocks like M1, Challenger, Valuetronics, Yangzijiang, Chip Eng Seng, etc.

Yangzijiang's shares returned 28.6% in 2013, including a 5-cent dividend. NextInsight file photo.They bought stocks like M1, Challenger, Valuetronics, Yangzijiang, Chip Eng Seng, etc. Demoralized feelings aside, I reflected hard on what could be lacking in my investment process that created such a glaring difference. I have come up with several possible reasons.

1) Scope of companies on my radar screen. Companies under my research could be too small. Also, it might be time to start looking at Hong Kong companies too.

While I have heard about Challenger and Valuetronics from forums a number of times, it never piqued my interest.

Maybe, it pays to look at more companies extensively.

I used Google screening to screen for companies of interest. I think I might need to pay more attention to what bloggers, forummers suggest.

2) Size of portfolio/ circle of competence. I only have about 9-12 counters in my portfolio. It might be wise to include more companies from different sectors and industries after extensive research.

It might be good to start reading up and learning about the businesses of utilities or telecom, commodities, etc. I want to give myself the bandwidth for further research when the opportunities arises.

3) Extensiveness/ disciplined of research. I believe I have done my research diligently, but I might have been too generous in my criteria.

I believe I did what most analysts have done, looking at numbers over a number of years, comparing them with industry peers, reading about business strategies, industry outlook etc.

But I think I should be able to do better in 2 areas:

a) Tracking of competence of allocation of capital, by comparing ROA, ROE, ROIC and record of acquisitions more closely.

b) Stop looking at just consistent positive free cash flow (FCF) but also the size of it, e.g. COIC (Cashflow return On Investment Capital, which is FCF divided by vested capital. The latter is total assets - current liabilities - excess cash).

c) Stop looking at FCF as FCF=Operating Cash Flow - Property Plant Equipment, but looking also at finance costs, taxation and minority interest as well. (A learning journey/ school fees brought by my purchase of APTT and HPHT)

4) Margin of safety. I should demand a higher margin of safety with smaller companies.

5) Temperament- Overcome laziness. I usually start serious research only when I see a company whose valuation I think is getting closer to being fair.

I did not bother to do preliminary screening of numbers of companies thrown out by bloggers, perhaps due to the fact that I know, there is a lot of reading to be done, before I can quite figure out what the company is capable of.

6) Others

a) Check various sources of news. For example, sino-shipping news mentioned another free trade zone in Guangzhou-HK-Macau area is pending approval by the end of the year. I Googled the various key words only to realize that analysts felt the approval by central government could be years away.

b) Industry news is important,but it is usually already old news for insiders. What could be useful might be to see if the management is on top of the industry news.

For example, when I read about news regarding eco-ships and bigger ships, and also the demand for LNG, LNP carriers, Yangzijiang was already sourcing for customers for those and building eco and bigger ships. If a company is only acting on the opportunities when you read about them, maybe it means nothing already.

c) Don’t just track companies, track personnel with wonderful business records.

d) Read a prospectus thoroughly and repetitively. A lot of information about the business can be found in there.

A glance through the 'risks' and 'business summary' sections is a no-no.

Let's hope my 2014 record will be better. I think I will be super busy with work when the new year starts. I got 2 new bosses. Sigh…. I don’t want to sound cynical, but seriously, I don’t think I shared the same frequency in work values in the 2 weeks of contact with them. Let's hope I am wrong. Wish everyone a good 2014!

We all learned from our mistakes and successes. Source of stock picks - I will check with Nextinsight, Investor.com, business mags. Then I will go to SGX to check latest financials and the company's website. I am more of value investor than growth. Bulk of my investments is in high dividend income stocks. A part goes to growth stock and a part on deep value. Key considerations - feasible business model, strong financial position, positive profitability growth, strong operating cash flow, sustainable dividend payout policy, experienced management, reputable auditor.

Stocks with low PE, low PB and high dividend yield will interest me. I stay away from S-chips, penny stocks, and those with high leverage. Also, not keen on companies with dubious management.

From a macro perspective, will also stay away from corporates with FEX risk (revenue in rupiah, rupees etc).

Hope this general guideline helps. Lotustpsll