IN AN article on 1 Oct 2013, we presented a selection of our articles on 8 stocks that looked promising to readers who posted in our forum.

In addition, these past articles have garnered a high volume of hits. We also took into account analysts' recommendations on these stocks.

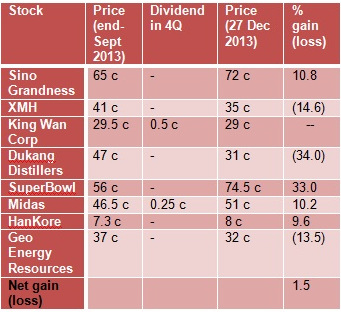

Above: Stock picks for 4Q 2013. Please see links at the bottom of the article for the stock picks in 1Q, 2Q and 3Q.As at end-Friday, Dec 27, three months on, the portfolio has eked out a 1.5% gain (see table), which is about 2 percentage points higher than the benchmark Straits Times Index (which declined 0.57% in that period).

Above: Stock picks for 4Q 2013. Please see links at the bottom of the article for the stock picks in 1Q, 2Q and 3Q.As at end-Friday, Dec 27, three months on, the portfolio has eked out a 1.5% gain (see table), which is about 2 percentage points higher than the benchmark Straits Times Index (which declined 0.57% in that period). The portfolio's most handsome gain of 33% came from SuperBowl, a very undervalued property play which shot up after its sister company, Hiap Hoe Limited, announced a delisting offer for it.

The worst performer (-34%), on the other hand, was Dukang Distillers, which crumbled with a weakening of the baijiu industry in China due to the government's curbs on lavish consumption at official events.

The overall 1.5% gain in 4Q comes over and above the more significant gains that stock picks highlighted on NextInsight made in 1Q, 2Q and 3Q.

Coal mining company Geo Energy Resources recently traded at 32 cents, which is lower than the 35.5 cents that independent director Jim Rogers paid on Aug 22 for 1.7 million shares.

Coal mining company Geo Energy Resources recently traded at 32 cents, which is lower than the 35.5 cents that independent director Jim Rogers paid on Aug 22 for 1.7 million shares.NextInsight file photoThese gains were 25.7%, 16.8% and 7.2%, respectively.

Thus, if we had started with $100,000 in capital, the gain at the end of 1Q resulted in the pile growing to $125,700.

Putting aside the gain of $25,700, we invested the original $100,000 at the start of 2Q and went on to make $16,800 at the end of 2Q.

And so on....

(If the capital gains at the end of each quarter had been reinvested into the next quarter.... the final rewards would certainly have been much higher.)

Taken together, the stocks highlighted at the start of each of the 4 quarters on NextInsight have made a cumulative 51.2% gain. Yes, 51.2%. Wow!

The picks have clearly outperformed the STI which is down 0.55% in the year to date.

We think it's probably got a lot to do with luck mixed with stock insights.

Despite the roaring success of the past year, we will consider the portfolio liquidated and will soon present a different bunch of stocks based on a different set of criteria.

These are: low PE, low price/book and dividend-paying stocks.

They will be selected in cold fashion -- we will use Bloomberg data to sort all SGX-listed stocks according to the three criteria and present a shortlist of 50 stocks. Look out for our article over the next few days.

Previous articles:

8 STOCKS That Inspire Investor Optimism For 3Q

8 STOCKS That Inspire Investor Optimism For 2Q

8 Stocks That Inspire Investor Optimism For 2013

2. Nanjing SR Puzhen Rail Transport Co., Ltd., a non-wholly-owned subsidiary of the Company, has entered into contracts with Nanjing Metro Co., Ltd. and Suzhou Metro Group Co., Ltd., respectively, in relation to the sale of metro cars with an aggregate value of approximately RMB 1.11 billion.

To improve the stock screening process to identify potential winners:

I suggest to incorporate the criteria backtested by Ms Teh and refined by Mr Benny Ong:

sph-vld7.shareinvestor.com/markets/stock...paid-while-you-wait/

1) High Ratio for dividend yield over the price to book ratio plus 2) low leverage level (little borrowings) as interest rate rises, high debt will be a burden

In addition, I will think that a separate list of winners recommended by Nextinsight forum experts should also be shortlisted. For example, Superbowl has low book value as it did not revalue their properties based on current price. This potential winner can only be identified by Nextinsight forum experts and not by the above stock screening process.

Not only the market has changed due to Government intervention,

Also the owner has changed.

Is the latter change for the better?

PGL