Slimming tea products play Besunyen nearly swung to the black in H1. CFO Mr. Terence Wong (right) responds to queries in Hong Kong while Chairman and CEO Mr. Zhao Yihong listens on. Photo: Andrew Vanburen

Slimming tea products play Besunyen nearly swung to the black in H1. CFO Mr. Terence Wong (right) responds to queries in Hong Kong while Chairman and CEO Mr. Zhao Yihong listens on. Photo: Andrew Vanburen

BESUNYEN HOLDINGS Co Ltd (HK: 926), a leading therapeutic tea products play addressing weight loss and digestive health issues and a popular drink among traditional tea lovers, nearly swung to the black in the first half.

Revenue was down 22.6% year-on-year at 251.8 million yuan, but increased 67.8% sequentially.

Meanwhile, the January-June gross profit margin edged up to 86.1% from 86.0% a year earlier.

Due to a variety of encouraging factors, the first half net loss shrunk substantially to 4.6 million yuan versus a net loss of 167.6 million in the year-earlier period, which almost pushed Besunyen into the black for the first half.

“The improved results were within our expectations,” said Besunyen Chairman and CEO Mr. Zhao Yihong.

Besunyen's Detox Tea and Slimming Tea have market shares of 20.8% and 32.5%, respectively, in their categories in China. Photo: Aries ConsultingThe firm had more good news on the market front for its therapeutic tea products.

Besunyen's Detox Tea and Slimming Tea have market shares of 20.8% and 32.5%, respectively, in their categories in China. Photo: Aries ConsultingThe firm had more good news on the market front for its therapeutic tea products.

According to a recent survey by the China Southern Medicine Economic Research Institute, Besunyen is the No.1 provider of therapeutic tea products in the PRC, enjoying a market share of 20.8% and 32.5%, respectively, for laxative products and slimming products.

Just a few short years ago, China became a majority urban population for the first time in its five-thousand year history, and this has been very good news for Besunyen.

“We believe that long-term trends of rapid urbanization and increasing disposable income in China will escalate consumer demand for health and healthy lifestyle products, in turn offering better long-term market potential for detox and slimming as well as our other new products,” Mr. Zhao said.

He added that cost-cutting measures and increased efficiency were major contributing factors helping Besunyen nearly swing back to profitability in the first half of the year.

Total January-June operating expenses (including selling and marketing expenses, administrative expenses and R&D costs) plummeted 45.7% year-on-year to 225.8 million yuan.

Losses on the disposal of a subsidiary stood at nil in the first half versus 6.7 million yuan a year earlier. From left: Aries Consulting Executive Director Mr. Mark Lee, Besunyen Chairman and CEO Mr. Zhao Yihong, NextInsight's Andrew Vanburen and Besunyen CFO Mr. Terence Wong.

From left: Aries Consulting Executive Director Mr. Mark Lee, Besunyen Chairman and CEO Mr. Zhao Yihong, NextInsight's Andrew Vanburen and Besunyen CFO Mr. Terence Wong.

Photo: Aries ConsultingIn addition, there was no impairment loss recognized in the first half of 2013 (for the same period of 2012: 20.3 million yuan) with respect to property, plant and equipment.

“We will continue our efforts in selling, manufacturing and developing products that combine the modern methods of tea brewing in teabags with the self-cure functionality of traditional Chinese herbs.

“Our vision is to turn the Besunyen brand into a Chinese household name, promote its function in curing ailments of our customers and instill the enjoyment of a green lifestyle among them.” Mr. Zhao said.

He added that a large part of Besunyen’s ability to gain No.1 market share in China is the firm’s development of a sales network with full coverage in all provinces, autonomous regions and centrally administered municipalities.

In the first half, Besunyen took initiatives to restructure its sales organization across China, raising its work efficiency through a more streamlined sales management team. “Our vision is to turn the Besunyen brand into a Chinese household name, promote its function in curing ailments of our customers and instill the enjoyment of a green lifestyle among them.” said Besunyen Chairman and CEO Mr. Zhao. Photo: BesunyenThe firm selected distributors with well-developed sales networks and good distribution capacity, and also removed under-performing distributors from its list.

“Our vision is to turn the Besunyen brand into a Chinese household name, promote its function in curing ailments of our customers and instill the enjoyment of a green lifestyle among them.” said Besunyen Chairman and CEO Mr. Zhao. Photo: BesunyenThe firm selected distributors with well-developed sales networks and good distribution capacity, and also removed under-performing distributors from its list.

Management added that Besunyen also paid close attention to retailing excellence through strong execution, and chose higher quality retailers.

As a result, the total number of distributors dropped from 384 as at 31 December 2012 to 309 as at 30 June 2013.

“This displays how we always emphasize quality over quantity,” said Besunyen CFO Mr. Terence Wong.

The number of retail outlets covered by the group’s distributors decreased moderately to approximately 126,000 as at 30 June 2013 (including around 118,000 retail pharmacies and some 8,000 supermarkets, hypermarkets and chain stores), compared with approximately 131,000 retail outlets as at 31 December 2012.

Besides enhancing the sales network of physical stores, Besunyen also developed its e-commerce business as a new sales and distribution channel.

The company has established its B2C and B2B platforms on its self-owned website 7cha.com and other websites like Tmall.com (天貓), 360buy.com (京東商城), Dangdang.com (噹噹網), Amazon.cn (亞馬遜), yihaodian.com (一號店) and Lefeng.com (樂蜂網), etc.

This has produced fruitful results as first half sales revenue generated from Tmall.com alone increased by over 25% year-on-year.

For long-term brand building, the group continued to adopt multi-channel marketing and communication programs.

To appeal to varying demographics, Besunyen carried out its “Three Screens” program utilizing advertising platforms on TV, the Internet and public transportation. Besunyen recently 0.36 hkdBesunyen in the first six months has proportionally increased spending on Internet advertising and marketing to reach out to the younger generation, especially in cities with high TV advertisings costs.

Besunyen recently 0.36 hkdBesunyen in the first six months has proportionally increased spending on Internet advertising and marketing to reach out to the younger generation, especially in cities with high TV advertisings costs.

“Our products often have a stronger market appeal among certain demographics than non-therapeutic teamakers like Master Kong.

“For example, our slimming tea products are very popular among weight-conscious female consumers,” said Mr. Zhao.

Leveraging on its leading brand position in the therapeutic tea market and its innovative capabilities, the company launched two new teabag products in June 2012 – the Chinese herbal tea series and the floral tea series.

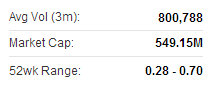

By June 2013, two new teabag products have further extended their footprint on major online sales platforms and into thousands of retail stores across East China. Besunyen's recent share price performance. Source: Yahoo Finance

Besunyen's recent share price performance. Source: Yahoo Finance

Besunyen plans to launch new products including Maishuping, an OTC medicinal teabag which helps stabilize blood pressure.

In February 2013, the group acquired a GMP certificate from the China Food and Drug Administration (CFDA) for Maishuping’s teabag production, and Besunyen has been refining the production process for Maishuping in order to realign with the higher standards set by the CFDA.

Besunyen Holdings is a leading provider of therapeutic tea products in China, and engaged in the development, production, sales and marketing of therapeutic teas and other health food products. The Group’s products use exclusive formulas and are manufactured with high quality traditional Chinese medicine and tea leaves, providing effective, safe, affordability and convenience for those with mild chronic or recurring health problems as well as those seeking to maintain a healthy body and lifestyle. The majority of the Group’s sales turnover comes from the Group’s two best-selling products, namely Besunyen Detox Tea and Besunyen Slimming Tea.

Based on a survey conducted by the China Southern Medicine Economic Research Institute in February 2013, these two products were both the leading products in the detox and slimming categories distributed through retail pharmacies in China. In terms of sales turnover, these two products accounted for a market share of 20.8% and 32.5%, respectively, in retail pharmacies in China in 2012. The Group’s distribution network covered over 384 distributors in 31 provinces, autonomous regions and centrally-administrated municipalities in China as of 31 December 2012.

See also:

Survey: SINO GRANDNESS Unrivaled In Shenzhen

SINO GRANDNESS: Way Paved For HK Listing, But Will There Be A Special Dividend?