MORGAN STANLEY said it is maintaining its “Overweight” recommendation on Chow Sang Sang Holdings Intl (HK: 116), calling its 2012 results “In-line.”

“The worst period is in the rearview mirror,” said Morgan Stanley.

The price target is kept at 24.6 hkd (recent share price 21.4).

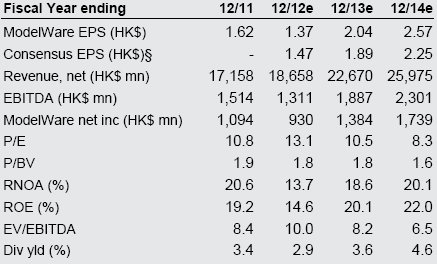

Source: Morgan Stanley

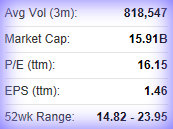

Source: Morgan Stanley

Chow Sang Sang reported 2012 net income of 985 million hkd, down 10% year-on-year.

Pretax profit of 1.222 billion hkd matched the research house’s estimate, while net profit beat it by 6% on lower tax expenses.

The US research house said it expects steady SSSG improvement to drive the jeweler’s P/E re-rating.

Morgan Stanley is staying 'Overweight' on Chow Sang Sang

Morgan Stanley is staying 'Overweight' on Chow Sang Sang

Photo: CSSPositive outlook

SSSG YTD has reached >20%/highteens in Hong Kong/China, from lows of 2%/2% in 2H12.

“We believe recovery is now firmly under way. Despite a YTD decline in gold prices, the recovery is led by gold jewelry (all volume-driven), while gemset jewelry is also growing healthily,” Morgan Stanley said.

Operating expense growth, after reaching a high in 2H12, should be tamer in 2013, as rental is likely to grow < 20% YoY vs. 32% in 2012.

Second half 2012 gross margin (20.0%) was stronger than expected, up from 17.6% in 1H12 and 19.5% in 2H11, despite weaker gold price (2H12: flat, 2H11: +30%).

“We find this all the more impressive in light of the intensified discounting environment in China.

“Despite challenging industry conditions, net gearing fell by 5%pt HoH, to 18%, as the company reduced borrowings by 164 million hkd.”

Credit Suisse: CHOW SANG SANG Still 'Outperform'

Credit Suisse said it is maintaining its “Outperform” recommendation on jewelry retailer Chow Sang Sang (HK: 116) with a 23.50 hkd target price (recent share price: hkd).

Chow Sang Sang shares are trading near 52-week highs

Chow Sang Sang shares are trading near 52-week highs

Chow Sang Sang’s reported FY12 net profit declined 10% year-on-year to 985 million hkd and came largely in line with the research house’s projection which is at the high-end of street estimates, but 4% above consensus.

“Upside surprise mainly came from the better-than-expected cost control and more favorable business mix. For the first two and a half months in 2013, both Hong Kong and Mainland China registered mid- to high-teens SSSG, driven mainly by gold products, and sales momentum held up well post-CNY,” Credit Suisse said.

The Swiss research house added that it expects rental costs to moderate in 2013 and the continuous focus on jewelry sales is likely to enhance the gross margin going forward.

“However, such margin enhancement is likely to be offset by the recent weak gold price trend and sales momentum being driven more by gold products yielding lower gross margin.”

Guoco: ‘Buy’ on CHOW SANG SANG

Guoco: ‘Buy’ on CHOW SANG SANG

Guoco Research said it has a “Buy” call on jewelry retailer Chow Sang Sang (HK: 116) with a target price of 25.7 hkd (recent share price: 21.4 hkd).

“After rising a maximum of 23% during first two weeks of January, the counter traded within the range of 20.2-22.4 hkd. Last Friday, it surged 7.5% with exceptional turnover, rising above the top of three-month trading range,” Guoco said.

The research house’s cut loss on Chow Sang Sang is 19.9 with the consensus 2013 P/E ratio at 12.7 times.

See also:

CHOW SANG SANG 'Buy'