COMTEC SOLAR (HK: 712) recently saw its shares surge nearly 40% in four sessions, over 16% in one day alone, on news that key client SunPower caught the attention of billionaire investor Warren Buffett.

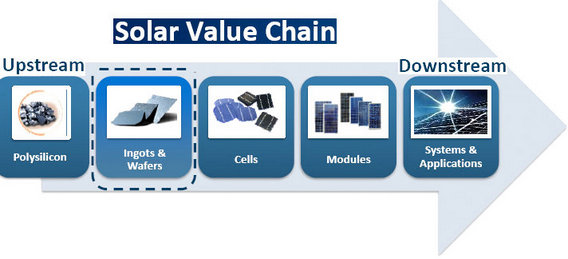

Comtec, a Shanghai-based producer of silicon ingots and wafers, sees sunny prospects for its high-efficiency, healthy-margin Super Mono Wafers, CFO Mr. Keith Chau told investors in Shenzhen.

As a key wafer supplier to SunPower, Comtec and its shareholders were very enthused by the news of Buffett’s purchase of two of SunPower’s solar projects in California for up to 2.5 billion usd.

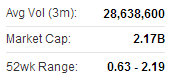

Average daily trading volume for Comtec’s shares over the past three months stands at 28.6 million, but when news broke of “The Oracle of Omaha’s” deal with SunPower, Comtec’s Hong Kong-listed shares saw daily turnover surge to 44.7 million.

Part and parcel of Comtec’s ongoing success on the order book front has been its flagship product – Super Mono Wafers – boasting an industry-leading conversion efficiency ratio of 23%.

This is well above the industry average of around 17.5%.

“We are undergoing a shift to focus on overseas Super Mono Wafer customers while also maintaining our PRC-based listed and reputable customers for our P-type wafers,” said Mr. Chau.

Speaking at last week’s Aries Consulting-sponsored “Braving the Waves: China Investment Strategies 2013” conference in Shenzhen, which featured Singapore, Hong Kong and PRC-listed firms, he said the global solar market is growing and creating more and more demand for Comtec’s high-quality products.

“Comtec’s leadership in product quality and production technologies, our cost-effective and efficient manufacturing model as well as our high utilization rate are driven by strong demand for quality products.”

While 2011 was characterized by painful inventory writeoffs due to plummeting polysilicon prices, last year began to see an industry turnaround with Comtec putting up some of the most impressive balance sheet performances in the sector.

July-September operating revenue rose 21.8% y-o-y to 312 million yuan with net profit nearly tripling to 14.8 million.

Gross profit rose nearly 25% to 31.9 million yuan with margins rising 0.2 percentage points to 10.2%.

“Comtec’s strong sales of Super Mono Wafers were the primary reason for the improved financial performance, and show promise for more robust sales down the road. We enjoy a leading-edge technological advantage with our Super Mono Wafers possessing a very high conversion efficiency ratio,” Mr. Chau said.

Photo: Aries Consulting

The global solar sector is a rapidly developing industry and receives a great deal of government support as a “New Energy” theme.

However, that enthusiasm has lead to overcapacity and overstocking these past two years, though the situation has improved significantly of late for wafer plays like Comtec.

China’s government has authorized subsidies for up to 2.83 GW of production in 2012 – higher than the original foreign estimates of around 2 GW – and there was the likelihood of even more support to come going forward.

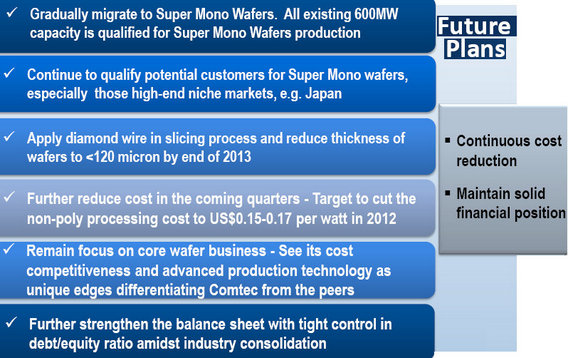

Fortunately for Comtec, whose manufacturing facilities are located in and around Shanghai, its plants are geared toward their flagship product.

“The group’s existing 600 MW capacity is qualified and capable of producing our Super Mono Wafer products,” Mr. Chau said.

He added that Comtec’s main strengths are its tireless commitment to quality production and meticulous cost controls, all while achieving ultra thin wafer production of just 155 microns.

Having a 14-year history in the wafer making industry, Comtec also enjoyed a strong competitive advantage in the sector.

“Major competitors for N-type wafers are from Korea, Philippines, Taiwan and the EU – most of which are mono wafer companies, while a substantial part of excess capacity in the PRC is mainly focused on multi wafers.

“Thus Comtec’s segment enjoys a higher barrier to entry and better product differentiation to improve its operational performance.”

As CFO, Mr. Chau assured investors that Comtec enjoyed a “strong balance sheet, low debt ratio and an experienced management team.”

Indeed, Comtec’s Founder, Chairman and CEO Mr. John Zhang, has been in the semiconductor and solar business for over a decade, with prior working experience in Silicon Valley firms.

On the financial front, Mr. Chau said Comtec lowered the amount of net debt to 90.7 million yuan as at 30 September 2012 from 132.0 million as at 30 June 2012.

The Hong Kong listco also cut its net debt to equity ratio to 6.0% as at 30 September 2012 from 8.9% as at 30 June 2012.

Looking ahead, he said Comtec was going to focus more and more on its bread and butter product, and was open to expanding beyond its Shanghai production base, with operations at a new 100 MW plant in Malaysia set to begin in the second quarter.

“We will gradually be migrating to Super Mono Wafers with our focus to remain on our core wafer business,” Mr. Chau said.

See also:

TECH TALLY: ‘Outperform’ For COMTEC, LENOVO; BYD ‘Neutral’

CHINA SOLAR SECTOR Emerging From Shadows?

ANWELL: Completes US$25 M Solar Power Plant In Thailand

COMTEC SOLAR: Doubles Shipments, But Swings To Loss