Roxy-Pacific's stock has soared 200% since the start of 2012. Its market cap is now $722 million. Chart: Bloomberg.ROXY-PACIFIC HOLDINGS, its stock near a record high, has just reported a near doubling in net profit after tax to S$16.1 million for 3Q ended Sept.

Roxy-Pacific's stock has soared 200% since the start of 2012. Its market cap is now $722 million. Chart: Bloomberg.ROXY-PACIFIC HOLDINGS, its stock near a record high, has just reported a near doubling in net profit after tax to S$16.1 million for 3Q ended Sept.Going forward, its strong property development sales, which continues with its recent launches, will ensure that its financial results stay resilient.

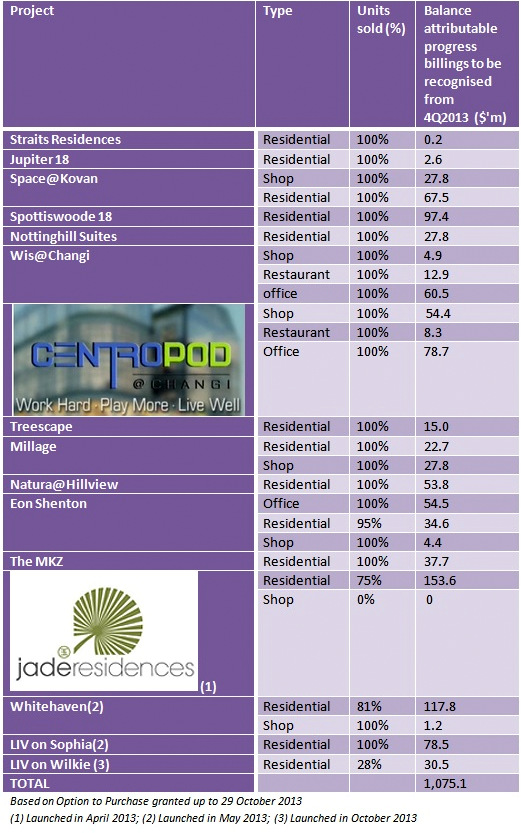

Roxy has a massive S$1.1 billion in sales which it will recognise from 4Q2013 to year 2017.

This amount of sales is equivalent to more than 16 times the $64.1 million of property development revenue it recognised in 3Q2013.

The best is yet to come: In 4Q, when commercial project Wis@Changi is expected to achieve TOP, Roxy will recognise $78.3 million in revenue from that project alone.

Another successful commercial project is Centropod@Changi whose TOP is expected to happen in 2014.

The attributable revenue of $141 m will be recognised at one go, too.

In the meantime, a big residential project, Jade Residences, has S$154 million of revenue yet to be recognised. This will happen progessively according to construction milestones.

Teo Hong Lim, executive chairman of Roxy-Pacific. NextInsight file photo.While property development contributed 84% of the Group’s turnover in 3Q2013, hotel ownership accounted for 16% or S$12.2 million (which is 7% lower y-o-y).

Teo Hong Lim, executive chairman of Roxy-Pacific. NextInsight file photo.While property development contributed 84% of the Group’s turnover in 3Q2013, hotel ownership accounted for 16% or S$12.2 million (which is 7% lower y-o-y).The third business segment, property investment, contributed 1% of the Group’s turnover, or S$0.39 million.

The gross profit margins for these segments were 27%, 66% and 62%, respectively.

Given the size of Roxy's progress billings, and its cash and cash equivalents on hand amounting to S$346.8 million as of Sept 30, and net debt to Adjusted NAV of 0.66 times, "the Group continues to be well positioned on seizing opportunities, whether in Singapore or overseas markets,” said Mr Teo Hong Lim, the executive chairman and CEO of Roxy-Pacific.

Roxy has three parcels of land for development:

Koh Seng Geok, CFO and executive director. NextInsight file photo.

Koh Seng Geok, CFO and executive director. NextInsight file photo.

1). Currently, the site of Sunnyvale at 134B Lorong K Telok Kurau Singapore with an attributable gross floor areas of 32,423 sq ft.

2). Currently, the site of Yi Mei Garden at 111, Tampines Road with an attributable gross floor area of 139,283 sq ft.3). Lot 3370, Section 41, Jalan Dewan Sultan Sulaiman, Kuala Lumpur (328,397 sq ft).

In total, the attributable gross floor area of its landbank for development stands now at 500,103 sq ft.

For more information, see Roxy's Powerpoint materials on the SGX website.

Recent stories:

Jim Rogers buys GEO ENERGY shares; Bonus news pushes ROXY-PACIFIC shares up

YANGZIJIANG target $1.00, ROXY-PACIFIC 79.5 cents