Kevin Scully, executive chairman of NRA Capital. File photo: CompanyWHAT ARE the realised losses from the collapse of these three stocks?

Kevin Scully, executive chairman of NRA Capital. File photo: CompanyWHAT ARE the realised losses from the collapse of these three stocks? Now that the saga of the suspension of Blumont, Asiasons Capital and Lion Gold is over, the stockbroking industry and investors are left licking their wounds.

Nobody knows the exact figure which I am sure will be a closely guarded secret.

The market is rife with rumours about potential losses of broking houses and investors with some suggesting that losses for the stockbroking companies were in the hundreds of million S$s while others are suggesting that the figures range from S$10-50mn per broking house.

Nobody knows but I am sure the MAS and the regulators will be checking on the financial health of these intermediaries to make sure that there is no systemic risks to the stock market.

I lived through the Pan Electric crisis in the mid-1980s when a few broking houses had to shut down because they were insolvent.

I was actually working for one of them (Lyall & Evatt) and am glad that our broking houses today are much stronger financially so that they can weather this hiccup.

Some food for thought

I don't know the answer too but thought I would try and generate some numbers just based on data that is available and making certain assumptions.

These assumptions are not exhaustive and are more illustrative as to what the potential loss might be.

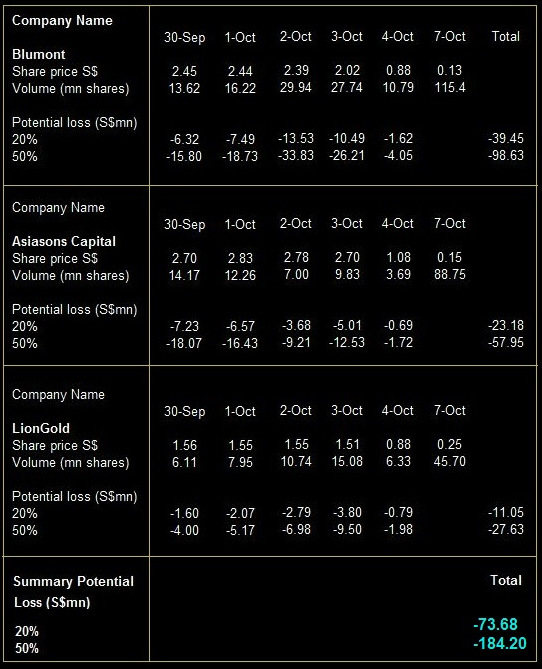

Potential losses by broking houses

Direct losses by broking houses would occur when they take a primary position in the above three stocks throuh their proprietary trading desk or indirectly through their day traders.

These proprietary day traders usually trade intra-day for a fixed clearing fee but must close the position by the end of the trading day.

The SGX does not disclose how much of a day's trading volume is actually an open position, ie a large part of the daily volume in high volume stocks can be contra-trades.

In my analysis, I used two figures for the three to four days before the three stocks were suspended and looked at two scenarios: a) that only 20% of the day's trade was open; and b) that 50% of the day's trade was open.

The Table below summariese my findings.

Based on my Table above, it would appear that the potential loss of the broking houses would range between S$73.7mn to S$184.2mn from their trading desk.

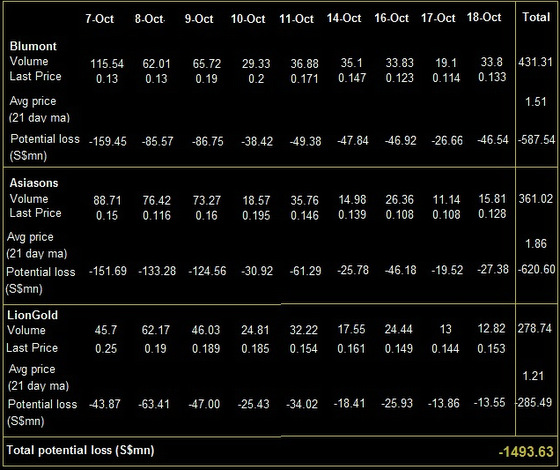

Potential losses by shareholders

The second area of losses is the realised losses of the shareholders of the three companies.

This is different from the paper loss that all shareholders suffered when the share prices collapsed.

I don't know what the average costs of the shares to each investor was so for this theoretical exercise I used the average price on a 21 day moving average.

I then used the volume of shares traded when the shares were designated before the designation was lifted to calculate the potential loss from shareholders.

This is because during this period, when the shares were designated, only investors who owned the shares, ie they were in their CDP accounts, could sell them.

The Table below shows that these numbers are significantly bigger if my estimate of the cost of the shares is correct.

The figures are mind boggling with the total potential loss by shareholders of the three companies in the region of S$1.49bn of which Blumont contributed S$587.5mn, Asiasons Capital S$620.6mn and LionGolf S$285.5mn.

Please bear in mind that these numbers are all theoretical and based on certain assumptions which I have made which are more intuitive.

The most important assumption being the average cost of the shares of the investors who sold their shares during that week.

There is no way to verify the figures and they could be totally wrong but they do provide some illustration as to what may happen when shares prices are that volatile.

The investors are clearly hurt more so if their stakes in the three shares were pledged or margined.

Like the S-Chip saga in the past, I expect that this event will lead to investors being more cautious about trading in penny stocks especially when such stocks see huge rises in their share price which dont seem to be supported by strong fundamentals.

This article was published recently on www.nracapital.com and is reproduced with permission.

Recent story: "What shall I do with my Blumont shares ?....Can I buy at the current level?"

If you choose to play pennies, be prepared for things you don't expect.