WE Holdings will take a 20% stake in Dragon Cement of Myanmar, which employs about 600 personnel at its plant. Photo: Dragon Cement

WE Holdings will take a 20% stake in Dragon Cement of Myanmar, which employs about 600 personnel at its plant. Photo: Dragon CementTO ESTABLISH a foothold in Myanmar, WE Holdings has entered into agreements with 12 private investors for the issue of 204.05 million new at 4.3021 cents apiece for a total of S$8.8 million.

The net proceeds will be used to fund the acquisition of a 20% stake in Dragon Cement, which is principally engaged in the business of cement manufacturing, and is majority-owned by Nay Win Tun, a prominent Myanmar businessman and the Chairman of the Ruby Dragon Group of companies.

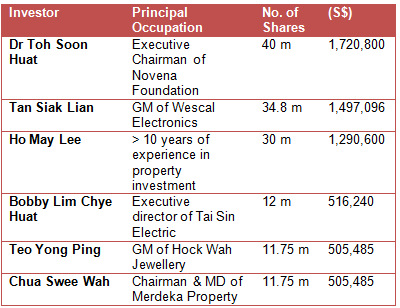

Dr Toh Soon Huat, an existing shareholder of WE, is paying $1.7208 million for the placement shares. He is Executive Chairman of Novena Foundation, an investment holding company. NextInsight photoThe 12 investors -- including well-known investors Dr Toh Soon Huat and Bobby Lim Chye Huat -- in the share placement announced this morning are also granted the option to subscribe for an aggregate of 204.05 million additional shares.

Dr Toh Soon Huat, an existing shareholder of WE, is paying $1.7208 million for the placement shares. He is Executive Chairman of Novena Foundation, an investment holding company. NextInsight photoThe 12 investors -- including well-known investors Dr Toh Soon Huat and Bobby Lim Chye Huat -- in the share placement announced this morning are also granted the option to subscribe for an aggregate of 204.05 million additional shares.The subscription price is 10% greater at 4.73222 cents apiece for an aggregate of S$9.7 million.

This option may be exercised within three months from the date of the placement agreements, provided that the investor has completed the subscription of his/her own portion of the placement shares.

The proposed placement and option (if exercised in full) will increase the issued and paid-up share capital of WE by approximately $17.7 million to $95.4 million.

After adjusting for the issue of the placement shares and option shares, the loss per share and net asset value per share of WE for the financial year ended 31 March 2013 will be 0.91 cents and 1.99 cents respectively. The figures were 0.86 cents and 0.95 cents, respectively, before the adjustment.

Top investors. For the full list, please see announcement on SGX.Profitable Myanmar business

Top investors. For the full list, please see announcement on SGX.Profitable Myanmar businessWE (market cap: $73 million based on 5.3 cents stock price) had also, in March, announced plans to venture into petroleum, oil and gas and related resources in Myanmar through a partnership with Mr Nay.

WE said it is focused on efforts to diversify its income stream and to achieve sustainable long term growth for the company.

"Following our extensive groundwork on the dynamics of Dragon Cement, we found the acquisition to be an operational, financial and environmental sound venture. Furthermore, we are investing into an already operational and profitable business. This complements our strategy to diversify into sectors with good prospect for long term growth, whilst broadening our income stream.

"The net proceeds raised with the support of the accredited placees empower the company to undertake this important stride towards growth and expansion.”

"The net proceeds raised with the support of the accredited placees empower the company to undertake this important stride towards growth and expansion.”

In the last five months, the Company had undertaken the following fund raising exercises to strengthen its balance sheet and fund its business expansion:

- Rights-cum-warrants issue which raised net proceeds of S$10.68 (as first announced on 2 April 2013) to strengthen its balance sheet and fund expansion into resources businesses in Myanmar; and

- Placement of 80 million new shares to 14 private investors which raised net proceeds of S$7.5 million (as first announced on 30 May 2013). The net proceeds have been used to repay US$5.9 million of the company’s borrowings.

For the full announcement, click here.

For the full announcement, click here.