Excerpts from analyst reports

UOB KH says KSH Holdings has "good earnings growth and visibility for the next 5 years"

Analyst: Loke Chunying

UOB KH says KSH Holdings has "good earnings growth and visibility for the next 5 years"

Analyst: Loke Chunying

KSH executive chairman Choo Chee Onn.

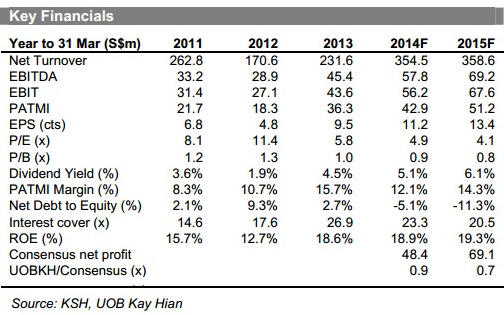

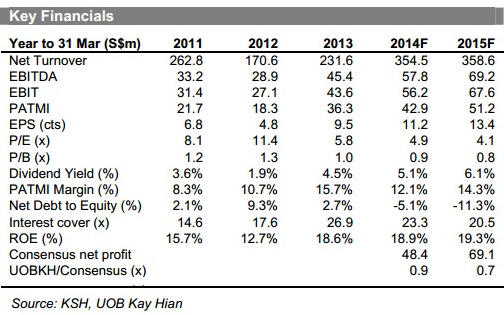

KSH executive chairman Choo Chee Onn. Photo: annual report We initiate coverage with a BUY with a target price of S$0.71, representing a 29.1% upside. With locked-in sales from its successful property launches, KSH is likely to enjoy good earnings visibility over the next five years.

As an established contractor, KSH continues to replenish its orderbook with consistent contract wins with a comparative favourable margin compared to peers.

Strong earnings and free cash flow (FCF) support KSH as a dividend play with a current dividend yield of 4.5%.

Strong earnings visibility. Through its JVs, KSH has interest in 13 local property development projects.

Based on KSH’s existing (eight launched) projects and current sales, we conservatively estimate KSH to recognise profit of about S$124.6m (S$0.32/share) over the next five years.

In addition, KSH’s 45% interest in its Beijing property development project, Liang Jing Ming Ju (LJMJ) Phase 4, is expected to contribute very positively to earnings for FY16.

We estimate profit of S$32m (S$0.08/share) for a fully sold LJMJ, which is expected to be launched by 3Q13.

Recent story: SUMER: "My latest take on my 10 property stocks"

Based on KSH’s existing (eight launched) projects and current sales, we conservatively estimate KSH to recognise profit of about S$124.6m (S$0.32/share) over the next five years.

In addition, KSH’s 45% interest in its Beijing property development project, Liang Jing Ming Ju (LJMJ) Phase 4, is expected to contribute very positively to earnings for FY16.

We estimate profit of S$32m (S$0.08/share) for a fully sold LJMJ, which is expected to be launched by 3Q13.

Recent story: SUMER: "My latest take on my 10 property stocks"

Credit Suisse lowers Golden Agri's target price from 80 cents to 67 cents

Analyst: Tan Ting Min

Weaker palm oil prices should result in a much weaker profit contribution YoY for Golden Agri. We have cut GGR’s FY13E and FY14E earnings forecasts by 22% and 15%, respectively. Its target price has been lowered to S$0.67 from SG$0.80.

Weaker palm oil prices should result in a much weaker profit contribution YoY for Golden Agri. We have cut GGR’s FY13E and FY14E earnings forecasts by 22% and 15%, respectively. Its target price has been lowered to S$0.67 from SG$0.80.

Analyst: Tan Ting Min

Weaker palm oil prices should result in a much weaker profit contribution YoY for Golden Agri. We have cut GGR’s FY13E and FY14E earnings forecasts by 22% and 15%, respectively. Its target price has been lowered to S$0.67 from SG$0.80.

Weaker palm oil prices should result in a much weaker profit contribution YoY for Golden Agri. We have cut GGR’s FY13E and FY14E earnings forecasts by 22% and 15%, respectively. Its target price has been lowered to S$0.67 from SG$0.80.● GGR remains one of the most leveraged plantation companies to palm oil prices—for every RM100/t decrease in palm oil prices, its earnings would fall by 8%. Therefore, it works both ways—when palm oil prices eventually improve, GGR's share price should be quick to react positively.

● In 2013, GGR profits are expected to be hit on all fronts:

(1) Weaker palm oil prices should result in a much weaker profit contribution YoY;

(2) Refining margins in Indonesia should be further eroded, as numerous new refining capacities in Indonesia kick in; and

(3) Crush margins in China remain depressed and the operating environment remains difficult due to overcapacity.

(1) Weaker palm oil prices should result in a much weaker profit contribution YoY;

(2) Refining margins in Indonesia should be further eroded, as numerous new refining capacities in Indonesia kick in; and

(3) Crush margins in China remain depressed and the operating environment remains difficult due to overcapacity.

● GGR’s share price has fallen 16% YTD. There are no short-term positive catalysts, but we retain our OUTPERFORM rating, as GGR trades at a 2014E P/E of 12x.

Its P/E appears attractively priced among the large-cap plantation stocks.

Its P/E appears attractively priced among the large-cap plantation stocks.