OSK-DMG raises target for XMH to 40 c after Koh Boon Hwee's entry

Analyst: Lee Yue Jer

Koh Boon Hwee is one of the founders of Credence Partners which manages Credence Capital Fund II. Photo: Internet XMH announced that Credence Capital Fund II has become its first institutional investor, subscribing to 36m new shares at SGD0.2774 per share. Interestingly, Credence also took up 3-month call options on another 47.6m vendor shares at a strike price of SGD0.315. The pricing of the placement and the short expiry of the options lead us to believe that XMH is about to make an acquisition.

Koh Boon Hwee is one of the founders of Credence Partners which manages Credence Capital Fund II. Photo: Internet XMH announced that Credence Capital Fund II has become its first institutional investor, subscribing to 36m new shares at SGD0.2774 per share. Interestingly, Credence also took up 3-month call options on another 47.6m vendor shares at a strike price of SGD0.315. The pricing of the placement and the short expiry of the options lead us to believe that XMH is about to make an acquisition. Credence will own 8.6% of the enlarged XMH share capital, and the call options will allow it to increase its stake to 19.9% within three months of the placement.

Being XMH’s first institutional investor, we believe that Credence would have had the bargaining power to get a 10% discount on the placement, equal to about SGD0.261 per share. The strike price of SGD0.315 represents a 20.7% premium over what they could have paid, and their willingness to pay the option premium (implicit in the 6.3% higher price) indicates a strong expectation of a large short-term gain.

We believe that XMH has no need for extra cash today. Our model indicates that its new facilities can be funded by cash on hand and operating cash flows without bank debt. The cash inflow today means that any potential acquisition can be made with a higher proportion of cash vs. shares, leading to a stronger EPS accretion. As its war-chest is not yet depleted, we believe that XMH remains on track for more acquisitions in the future.

Maintain BUY with a higher TP of SGD0.40. We have flagged XMH as a potential acquirer since our initiation report in Nov 2012, and the factors mentioned above all point towards an acquisition within three months from the placement. We are maintaining our BUY call with a higher TP of SGD0.40 (from SGD0.35), which assumes a SGD15m acquisition at 7x P/E, pegged at 11x FY14F EPS.

Recent story: XMH HOLDINGS: On track for record revenue, profit in FY13

Click on video above of a visit to XMH

OSK-DMG maintains 'buy' and 84-c target for FOOD EMPIRE

Analyst: Melissa Yeap

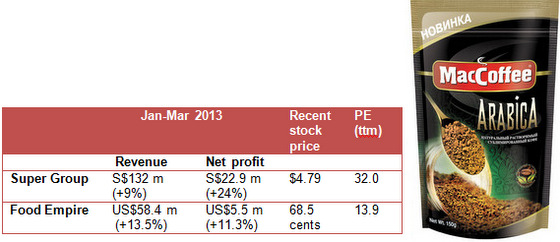

Food Empire reported an 11% growth in 1Q13 earnings of USD5.6m. Results are in-line with expectations, accounting for 25% of our full year estimates.

Sales in Russia grew at a stronger pace of 18% y-o-y vs our forecast of 15% due to a change in business model.

Previously the Group would buy ingredients, book sales upon selling them to its main distributor who has an agreement with Food Empire's Russian plant.

This agreement was previously set up to alleviate inventory risk. Now it will cut off that layer and only book sales upon finished goods to the distributor.

Sales for the quarter were also boosted by a raising of average selling prices (ASPs) for products last year. We also note an expansion in gross margins by 5ppt for the quarter.

We maintain our estimates and BUY call with TP of SGD0.84, pegged to 16x FY13F P/E.

Food Empire trades at a sharply lower valuation than Super Group. (In the picture: MacCoffee is a top brand of Food Empire).

Food Empire trades at a sharply lower valuation than Super Group. (In the picture: MacCoffee is a top brand of Food Empire).Recent stories:

@ FOOD EMPIRE's AGM: Shareholders interested in new markets, new capex

FOOD EMPIRE: Focusing growth efforts in Asia, Middle East, Africa