LIKE MANY an S-chip, Yamada Green Resources' stock has had a tough year winning the hearts of investors. Its stock price is down at 12.6 cents from as high as 25.5 cents.

This, despite it turning in a RMB139.5 million net profit for FY12 ended June, a 23.7% year-on-year increase.

For a better understanding of its business and prospects, NextInsight met up with CFO Yang Lin and investor relations manager Kim Chew recently.

Here are key takeaways...about a company whose CFO said produces the most shiitake mushrooms (56,000 tonnes in FY12) among listed companies in Singapore and China.

Nature of business:

Photos: Yamada website

1. Yamada rents plots of land from farmers, and pays them for cultivating and harvesting shiitake mushrooms and black fungus. For this, there are contractual agreements between Yamada and the village committees of Zhangping in Fujian province.

Sold fresh to between 25 and 30 wholesalers, these produce accounted for 71% of Yamada's revenue in FY12.

Yamada pays the same farmers for synthetic logs made from sawdust and mycelia which form the base for cultivating these produce.

The mycelia is provided by Fujian Forestry and Agricultural University, with whom Yamada has been in co-operation to develop the mycelia since 2007.

2. Market demand is greater than the supply of these produce.

3. Most reassuringly, for several years already, wholesalers have maintained accounts through which Yamada directly deducts 100% cash payment for every sale.

4. Yamada has bought 51,193mu (1 mu equals approximately 667 sq m) of eucalyptus plantation from the farmers which would be the future source of sawdust for synthetic logs.

In recent months, the company has been negotiating with the local government for permits to log the eucalyptus plantations that have reached maturity at five years of age.

3. Yamada has another business segment -- producing processed foods such as water-boiled

bamboo shoots, konjac products and dried vegetables. This segment contributed 29% to FY12 revenue. The company's high standard of production is reflected in its ability to OEM for Japanese customers for more than 15 years already.

Key near-term developments:

1. A permit to log its eucalyptus plantations and use the sawdust to make synthetic logs will benefit Yamada financially in FY14 at the earliest.

This is because even if it were issued tomorrow, it would not come in time to enable the logging and production of sawdust to make 60 million synthetic logs for FY13's cultivation and harvesting season. This started in Oct 2012 and will end in April 2013.

Depending on the extent of logging permitted, the financial impact on FY14 is expected to be positive.

It could be even more so in subsequent years as a wider swathe of the plantations matures.

Interestingly, the trees that have been cut down can re-generate themselves naturally for about 3 cycles. These biological assets are a 'gold mine" for two reasons:

a. They are conservatively valued in the books based on just 1 cycle.

b. Yamada can better control the cost of its raw materials by harvesting its eucalyptus plantations. In the long term, the plantations will save Yamada significant cashflow as Yamada would not need pay farmers for sawdust to make synthetic logs.

Yamada’s management will update investors on any development in its application for the logging licence.

2. Processed foods is a competitive business but Yamada is set on growing this through branding and through marketing more aggressively to supermarkets and restaurants. For this purpose, it has increased the number of sales staff.

Capex is not significant going forward as Yamada has invested over RMB 20 million in an extended factory and equipment in an office building, and newly acquired industrial land. There is no significant increase in production capacity in the near term as the new factory will replace part of the old factory which will be used for warehousing and R&D space.

3. FY12 revenue for the edible fungi segment (shiitake mushrooms and black fungus) shot up 79% as a result of a doubling of the area under cultivation. Currrently, Yamada has no plans to expand further. The performance of this segment will then largely dependent on the harvested volume and the market price of the mushrooms and fungus -- as well as the extent its synthetic logs are made from eucalyptus trees.

4. The edible fungi segment generates revenues almost exclusively in the 2Q and 3Q -- and key risks to the production volume include bad weather. In FY2, Yamada had its first significant experience of bad weather in 5 years in this business.

Addressing investor concerns

1. Gross margins: These are being squeezed because of rising cost of saw dust and labour. As explained above, things will turn around when the permit for logging is granted.

2. Land and bio assets: In the wake of S-chip scandals and the much-publicised cases of Chaoda and Sino Forest, investor concern has heightened over whether companies really own the land and biological assets they say they have acquired.

Replying, the CFO of Yamada said the company does have all the certificates of land use rights with government stamp to establish its land use rights and ownership of the biological assets, and these have been audited by its external auditor, BDO.

Over the next couple of years, after the government issues logging permits, the harvests will confirm, or otherwise, the actual acreage of Yamada's plantations.

3. Why no logging permit yet? In part, the authorities have tightened up on issuing such permits for environmental reasons.

However, the eucalyptus trees of Yamada are not natural forests and were first cultivated with the blessings of the government.

Thus, rationally, the government is expected to grant a permit sooner or later. In the meantime, the farmers are chopping down trees of other types to make the synthetic logs.

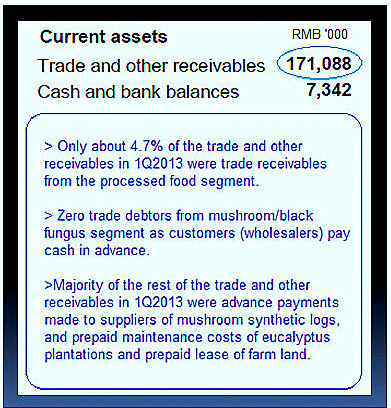

4. Falling cash balance: In part because Yamada has spent RMB131.7 million on acquiring eucalyptus plantations in Dec 2011 and RMB16.9 million as deposit for a piece of industrial land, the cash balance has fallen in the last 2 quarters to RMB7.3 million as at end Sept 2012.

In addition, the company has paid farmers an advance to, among other things, prepare synthetic logs for the current cultivation season, which is classified as 'other receivables'.

The cash balance should recover in the next 2 quarters when the cashflow from the mushroom business spikes up.

Previous stories:

YAMADA Visit: Mushrooming Sales, ‘Unlimited Growth’, 1.6x P/E... What Gives?

YAMADA CEO: Ex-Tour guide who built Fujian’s largest shitake mushroom farm