Credit Suisse: CHINA RETAIL Kept at ‘Overweight’

Credit Suisse said it is maintaining its “Overweight” recommendation on China’s retailing sector.

“Fast-growing online shopping is set to destock industry inventory, but also squeeze channel shares of traditional retailers,” Credit Suisse said.

The research house said that on November 11 (“Single’s Day” in China), online shopping portal Taobao recorded historical high sales of Rmb19.1 bn (up 260% YoY).

This compares with US$1.3 bn (or Rmb7.8 bn, up 22% YoY) on 2011 “Cyber Monday” (the first Monday after “Black Friday”) in the US.

It also represents 19.1% of an average one-day holiday sales in China; compared with that, Cyber Monday sales represented 11.4% of total Black Friday sales in 2011 in the US.

“The fast-growing online shopping effectively helps to destock industry inventory. However, it also gains the channel shares from traditional retailers.

“In our view, the most-affected sectors include home appliances, supermarkets and home products, followed by apparel/department stores, footwear, luxury brands, and fresh food.”

Credit Suisse said it expects strong online sales to push up the overall retail sales growth in November, given some discounting continuation post-Single’s Day.

“However, it would likely drag down department stores’ SSSG in November and overall retail sales in December, in our view.

“We believe the department stores targeting mid/high end consumers and operating own online stores are relatively safer.”

Credit Suisse said it is of the opinion that China’s fast-growing online shopping is driven by: (1) consumers’ robust consumption demand; (2) fluent product supply (excess export capacity now severing domestic markets); (3) newly-built infrastructure and rising penetration of broadband; and (4) competitive logistic expense.

“On top of that, e-stores offer 5-50% lower retail price. For an average brand, rental, sales force and advertising accounts for 20%, 15% and 5-10% of retailing price, respectively.

“This is the major cost that online stores could save, though they require higher logistic investment and operation skills.”

See also:

CHINA RETAIL, DEPT STORES: Who’s In A Shopping Mood?

BUYER’S MARKET? 12 Consumer Plays Eyeing HK IPOs

SPILLED MILK: China Mengniu In Yet Another Outrageous Scandal

Bocom: BOSIDENG Initiated with ‘LT-Buy’ Call

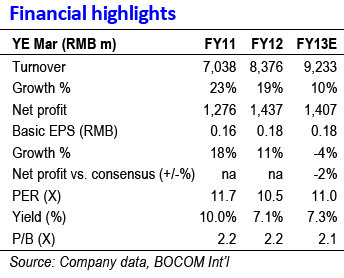

Bocom International said it is initiating coverage on down apparel play Bosideng (HK: 3998) with a target price of 2.70 hkd (recently 2.39).

“Bosideng is a market leader in China’s down apparel sector.

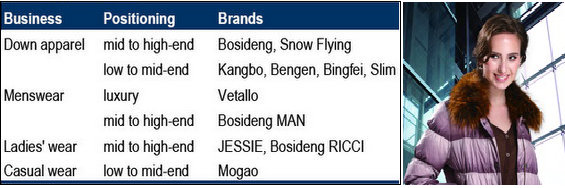

“By transforming itself into a multi-apparel brand operator that covers demand for different apparel products and customers from different age groups and purchasing power, Bosideng has increased the revenue contribution of non-down apparel business, led by acquisitions, from 0% in FY09 to 16% in FY12,” Bocom said.

Management has a target to grow the non-down apparel business to 30% of net profit by FY14E (profit contribution of down apparel business and non-down apparel business were estimated at 70%+ and 20%+ of net profit, respectively, in FY12).

“Backed by RMB3.7 bln net cash, Bosideng looks to acquire non-down apparel brands to accelerate earnings growth and lessen sales seasonality via diversification of its apparel brand portfolio, which should trigger a re-rating of the stock, in our view,” Bocom added.

The research house said its target price is based on 11X FY14E P/E, at a 30% premium to apparel retailers’ average (8.4X FY13E P/E).

“As a cross check, our target P/E multiple is in line with the average forward P/E since listing.

“In our view, Bosideng deserves to trade at a premium valuation over the apparel retailers’ average because of its sustainable dominant market leadership, larger economies of scale (3x of peers’ average revenue and profit), less downside risk of earnings/dividend than peers, and above-average dividend yield (7.3% vs. 6.2% in FY13E).”

See also:

XTEP: Overperforming In Overcrowded, Overstocked PRC Sportswear

TWO LEFT FEET: China Sneaker Play Li Ning Sees Dire Year