Bocom: No Big DISCRETIONARY RETAIL Bounce Expected from Break

Bocom said investors shouldn’t expect too much from the upcoming Golden week holiday in terms of boosted Hong Kong-listed discretionary retail shares.

“We reiterate our view of no 2H12E recovery.

"While the upcoming China Golden Week holiday is lengthened due to the Mid-Autumn Festival, we expect the potential benefit to the discretionary retail sector will be limited,” Bocom said.

It added that the continuing unfavorable macro climate is the backdrop, which, in its view, will continue to prompt consumers to spend cautiously.

“That said, we believe select retail stocks may benefit from higher tourist traffic as the longer holiday is likely to encourage more holiday travel, especially internationally, including Hong Kong and Europe.”

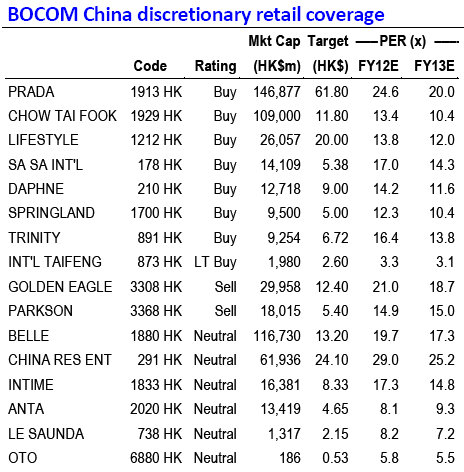

Among its covered names, Bocom believes Sa Sa (178.HK, Buy), Prada (1913.HK, Buy) and Lifestyle (1212.HK, Buy) are the key beneficiaries of tourist growth in Hong Kong and European markets.

“On the contrary, as a trading idea, we believe it is time for the gold and jewelry sector to take a breather after the recent strong share price run-up.

“This is particularly the case given the rally was mainly led by speculation given the gold price surge, rather than fundamental improvement as the sector sales outlook remains sluggish.”

Bocom’s latest key “Buys” are Prada (continuing to be its top sector pick), Sa Sa, Lifestyle, Trinity, Daphne and Springland; and the research house reiterates a “Sell” on Golden Eagle and Parkson, and “Neutral” on Belle, CRE, Intime and Anta.

See also:

BUYER’S MARKET? 12 Consumer Plays Eyeing HK IPOs

SPILLED MILK: China Mengniu In Yet Another Outrageous Scandal

XTEP: Overperforming In Overcrowded, Overstocked PRC Sportswear

TWO LEFT FEET: China Sneaker Play Li Ning Sees Dire Year

Bocom: CHINA DEPARTMENT STORES August Slowdown

Bocom said same store sales (SSS) growth softened in August as expected within Hong Kong-listed Chinese department stores.

The SSS growth in August was lower than that in 1H12, continuing the softening trend seen in July, mainly due to a slowing macro environment.

“We think this should be expected by the market as many companies had lowered their 2H12E SSS growth expectations during analyst briefings last month,” Bocom said.

Springland – SSS growth of the department store segment rebounded to mid-single digits from low-single digits in July. All merchandise categories saw a similar trend.

Commission rate was largely stable YoY. SSS growth of the supermarket segment remained at low-single digits.

Intime – SSS growth was kept at low-single digits in August.

“Business operation of stores in Hangzhou and Ningbo (which contribute 50% of total GSP) was halted for two days due to a typhoon, but we think the impact was limited because the event occurred on weekdays,” Bocom said.

Golden Eagle – Aggregate SSS growth in July and August altogether was slower than in 1H12. All the stores saw the same SSS growth trend.

Maoye – SSS growth was slightly positive in July and August.

“We expect SSS growth to remain weak in September because of sluggish consumer sentiment and the shift of Mid-Autumn Festival holiday. This year, it will be a longer holiday for the Mid-Autumn Festival and National Day Golden Week combined.”

Bocom said it believes consumers would spend less YoY in September this year due to the timing of the Mid-Autumn Festival in October this time around.

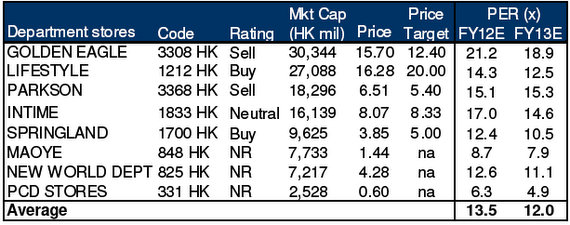

The research house reiterates “Sell” on Golden Eagle due to potential earnings downside and excessive valuation, and Parkson on its deteriorating near-term outlook.

“Lifestyle and Springland remain our preferred stocks in light of their better growth resilience underpinned by strong asset backing.”

See also:

Pearls & Properties: CHOW SANG SANG ‘Buy’

CHOW SANG SANG, LENOVO Both ‘Outperform’

HK & PRC Retail Rundowns; CHOW SANG SANG Looking Golden