COMTEC SOLAR Systems Group (HK 712), a global powerhouse in the production of high quality monocrystalline solar wafers, saw its first half shipments nearly double to over 218 MW.

However, due to convertible bonds repurchases and warrant cancellations, the Hong Kong-listed firm swung to a net loss.

Nevertheless, management told investors in Hong Kong it believes industry prospects are “promising in the long run.”

“For the past six months, the PV (photovoltaic) industry continued to face tremendous challenges as competition intensified.

“Continued industry-wide overcapacity, decline of selling prices across the entire solar supply chain and the reduction in feed-in tariffs all in all adversely affected the operating margins and profitability of all solar companies,” said Comtec Solar Chairman and CEO John Zhang.

However, he was not particularly worried about the future growth potential of such a critical sector.

“Looking ahead, though operating conditions remain challenging in the near-term, we firmly believe prospects for the solar industry are promising in the long run,” Mr. Zhang said.

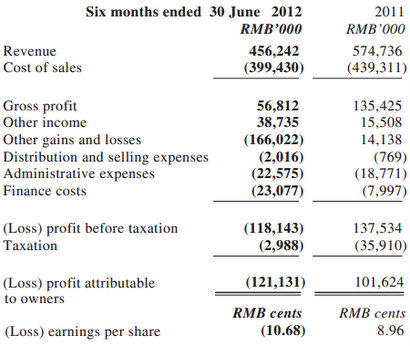

Comtec’s January-June revenue came in at 456.2 million yuan, lower than the 574.7 million seen a year earlier.

Gross profit for the period was 56.8 million yuan (H1 2011: 135.4 million) while the gross profit margin in the first half was approximately 12.5% (H1 2011: 23.6%).

“In the first half, we strategically shifted the focus of production to our premium ‘Super Mono Wafers’ and maintained a remarkable gross profit margin of approximately 12.5%, which generated positive cash flow from operations of around 71.0 million yuan,” Mr. Zhang added.

He said that in the January-June period, customers increasingly realized the benefits of buying highly efficient waters to minimize their overall production costs.

"We successfully differentiated ourselves from other industry peers with our advanced and cost-effective wafer products. Due to the successful shift of focus to premium ‘Super Mono Wafers’ with an average conversion efficiency of approximately 23%, our overall shipments surged by 99.8% year-on-year to nearly 220 MW," he said.

The Chairman added that Comtec plans to “gradually replace” traditional P-type monocrystalline wafers with its “Super Mono Wafers.”

“To further diversity our customer base for ‘Super Mono Wafers’ and to differentiate ourselves in the market through strengthening the entry barrier, we continued to work on the qualification process with potential customers in Japan, where few suppliers can meet their rigorous standards on product quality and reliability.”

Over the years, with the continuous decline in polysilicon prices, remarkable improvements in production efficiency and a substantial drop in solar installation costs, the solar sector continues to achieve strong and remarkable growth in market demand even amid a challenging macro-environment.

“The solar industry will become increasingly independent of traditional feed-in tariffs and solar energy will in turn become increasingly affordable,” Mr. Zhang said.

Mr. Keith Chau, Comtec’s CFO, said the financial position of the firm remained “solid and healthy.”

As of end-June, Comtec’s cash and bank balances amounted to approximately 244 million yuan.

“In response to the competitive market landscape within the solar industry, Comtec proactively reduced its debt levels and tightly controlled the net debt/equity ratio to 8.9% to mitigate any challenges appearing in the industry consolidation process,” Mr. Chau said.

The CFO added that excluding the non-cash accounting treatment on the repurchase of convertible bonds and the cancellation of various warrants of approximately 173.4 million yuan, non-cash effective interest expense on convertible bonds of around 13.3 million yuan, and the net gain on fair value changes of derivative financial instruments of some 7.4 million yuan, Comtec recorded an adjusted net profit in the first six months of around 58.2 million yuan, translating into an adjusted earnings per share of RMB 5.1 cents.

Chairman Zhang concluded the meeting on an upbeat note.

“We believe we are well positioned to manage and mitigate the risks arising from the volatile and challenging industry environment. In order to maximize benefits of industry consolidation, Comtec will continue to evaluate expansion opportunities from decreasing prices for production equipment.”

He said the Hong Kong-listed firm expects to see “continued challenging conditions” in the solar industry in the near term, but firmly believes that lower PV system costs will drive the adoption of solar power and long-term market growth.

“Lower system costs continue to drive market opportunities which are increasingly independent of traditional feed-in-tariffs. In the first half, the cost of generating power of solar energy per Watt was reduced substantially due to the decrease of polysilicon prices, continuous upgrading of production techniques and enhancement of operational effectiveness in the industry.”

He said these developments have accelerated the industry’s progress towards grid-parity and the installation of PV systems is becoming increasingly affordable.

“The PRC and the US, being the largest energy consuming countries in the world, together with Japan, Australia, Africa and the Middle East would be promising solar energy markets with substantial growth prospects.

“We expect that Japan, for example, will be an important market for us as few suppliers can meet Japanese customers’ rigorous standards for product quality and reliability.”

He added that going forward, Comtec expects to benefit from this trend of increasing demand for high-efficiency products.

“We are confident that we have the reputation, the top tier suppliers, customer relationships and the capability to adapt to the new economics and competitive landscape of the solar industry.

“Looking ahead, we will remain focused on our core wafer business where we have demonstrated a solid track record and established competitive advantages. We are confident we can capture enormous opportunities in the upcoming era of clean and economical power of solar energy, to drive continued and healthy growth for Comtec into the future.”

See also:

COMTEC Kept ‘Buy’ By Bocom On Tariff Immunity; 3 Big Banks All 'Buy'

COMTEC ‘Outperform’ On Wafer Niche; FOCUS Helps Out Mercy Relief

COMTEC SOLAR: Economic Cloudcover Not Obscuring Wafer Demand

COMTEC SOLAR: ‘Buy' With 134% Upside, Says Yuanta; But 'Hold' Says UOB