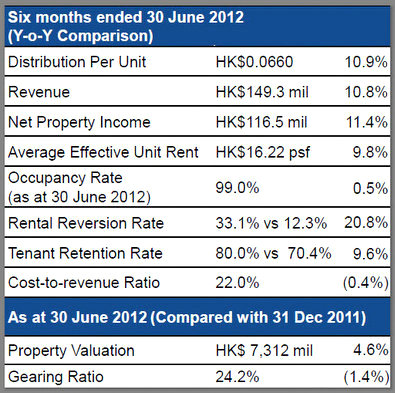

PROSPERITY REIT, whose shares have outperformed Hong Kong's benchmark Hang Seng Index by nearly 13% in the first seven months of the year, grew its first-half revenue nearly 11% year-on-year to 149.3 million hkd thanks in large part to crimped commercial property supply and a nearly 100% occupancy rate.

Management broke down Prosperity REIT's performance for investors in Hong Kong as part of Aries Consulting's Company of the Month series.

The firm's net property income was rose to 116.5 million hkd versus 104.6 million in the year-earlier period.

However, despite a healthy first half in which the top line registered strong double-digit growth, Prosperity REIT's bottom line came in lower at 376 million hkd versus 756 million a year earlier due to slower asset value appreciation over the period.

This didn't hamper the Hong Kong-listed real estate investment trust firm's share price from outperforming the Hang Seng REIT Index by 6.2% between January 1 and June 29 of this year.

It also enjoyed a unit price increase during the first half of 18% compared to year-earlier levels, which is second best in the industry behind only key rival Fortune REIT.

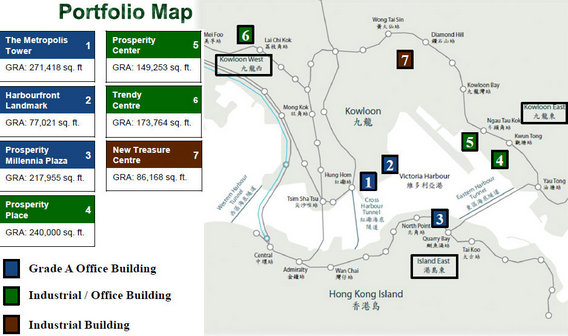

Prosperity REIT specializes in developing and then enhancing commercial property assets in seven strategic locations straddling both the north and south side of the iconic Victoria Harbour.

"We've already applied for asset enhancements and have begun such work on properties.

"Our aim is to convert assets into more high-quality properties," said Acting CEO Mavis Wong.

Its Prosperity Millennia Plaza -- with a floorspace of nearly 218,000 square feet and housing clients including JDB Holdings and Lamex -- is the REIT's Hong Kong-island based commercial property asset and is one of its three Grade A office buildings.

Completed in 1999, it contributed a hefty 21.3% to net property income in the first half and is strategically located near the entrance to the Eastern Harbour Tunnel.

However, Prosperity REIT's flagship property is its star earner -- the 11-year old Metropolis Tower -- which is responsible for hauling in a full third of the firm's sales revenue.

Metropolis Tower, located in prime real estate astride the busy Hong Hom metro station and beside the even busier Cross Harbour Tunnel entrance, houses major Japanese electronics behemoths including Canon, NEC and Nintendo.

"We do enjoy higher-than-industry-average occupancy rates, with three of our seven holdings at 100% and the remaining four flirting with full occupancy as well.

"Part of this is due to the relative undersupply in Kowloon with much of the supply already sold off," said Ms. Wong.

She added that Prosperity REIT was on the "right" side of the supply-demand calculus.

"The still tight supply for new commercial property space and the continued strong demand is doing us a favor, and we expect stable rental rises over the next six to 12 months."

Ms. Wong added that there will likely be "further room" for rental increases down the road.

"At the very least, we don't anticipate any rental decreases over the near term."

Prosperity REIT didn't always enjoy such a strong position in the push-and-pull relationship informing supply and demand.

"Just a few years ago, the vacancy rate in East Kowloon (where Prosperity operates two key industrial/office dual use sites) had vacancy rates of around 30%. But now it's around 5% so we are certainly beneficiaries of this phenomenon," Ms. Wong added.

She also said Prosperity REIT's enviably high occupancy rates are a function of have several big-name commercial clients who expand their floorspace within a single complex as their business grows rather than scattering their commercial and industrial property presence piecemeal across Hong Kong.

"We've found that our occupancy rates still remain high even in times of economic downturn. For example, our occupancy rates averaged over 95% even during the toughest of financial times during the 2008-09 global crisis."

Samuel Cheung, the firm's finance manager, said not only did its tenants enjoy reasonable rentals given the carefully selected locations, but shareholders were well taken care of as well.

"All Hong Kong-listed REITs are required to distribute at least 90% of their distributable income. But we've gone a step further and have consistently had a 100% payout ratio since our IPO in 2005," Mr. Cheung said.

Having raised some two billion hkd at the time, the firm was founded in the same year with the goal of enhancing seven commercial property assets and some 407 carpark spaces in "decentralized" areas of Hong Kong.

"We have over seven billion hkd in property assets but only some two billion in bank loans. Part of the reason for our gearing ratio falling to 24.2% is our strong share price performance of late."

Indeed, Prosperity has been living up to its namesake, with its Hong Kong-listed shares now selling at around 2.10 hkd, up a stunning 63% since early October of last year.

And with experienced industry players serving as shareholders -- Cheung Kong Hldgs and Hutchison Whampoa Ltd hold a combined 20% in Prosperity REIT, along with big name Japanese, Taiwanese and Western commercial clients -- the sky's the limit for Prosperity REIT's commercial sky-rise aspirations.

Prosperity Real Estate Investment Trust was the first private sector REIT to list on Hong Kong's Main Board with exposure to the Hong Kong office and industrial/office sectors in decentralized business districts. Cheung Kong (Holdings) Ltd together with Hutchison Whampoa Ltd make up the single largest unitholder of Prosperity REIT. Prosperity REIT owns and invests in a diverse, income producing portfolio of commercial properties which enjoys high growth potential. Through Prosperity REIT, investors can have direct exposure to one of the most vibrant real estate markets in Asia today.

The portfolio currently features seven high-quality properties with a total of 1,215,579 square feet. The properties are strategically located with direct access to the mass transportation network of Hong Kong. The properties include The Metropolis Tower, Prosperity Millennia Plaza, Harbourfront Landmark (portion), Prosperity Place, Trendy Centre, Prosperity Center (portion) and New Treasure Centre (portion). Prosperity REIT is managed by ARA Asset Management (Prosperity) Ltd, a highly experienced and visionary management team.

See also:

CHINA NEW TOWN Inks Landmark Beijing Fund Deal

SING HOLDINGS: Stock Price Is No Reason For Shareholders To Sing

HOUSE MONEY: Top 500 PRC Developers Assets Up 50% To 5 Trillion Yuan

PROPERTIES, PREMIUMS, PIERS: Three China Sectors Scrutinized