Translated by Andrew Vanburen from a Chinese-language piece in Sinafinance

IT MIGHT BE a good time to take a shopping trip to China.

That's because China’s top two electronics and home appliance retailers, Suning and Gome, are in a vicious price war.

So who wins and who doesn’t?

In fact, the sight of the two industry heavyweights scrapping away in the ring has become quite farcical, but consumers are likely laughing all the way to the bank.

The same can't necessarily be said for investors.

It was an online retailer – Beijing Jingdong Century Trading -- parent of China’s No.2 retail site 360.com, that fired the first shot in the new price war beginning on Tuesday.

But China’s top two brick-and-mortar electronics and home appliance brands – Suning Appliance (SZA: 002024) and Gome Electrical (HK: 493) – quickly jumped into the fray in a hectic race to the bottom.

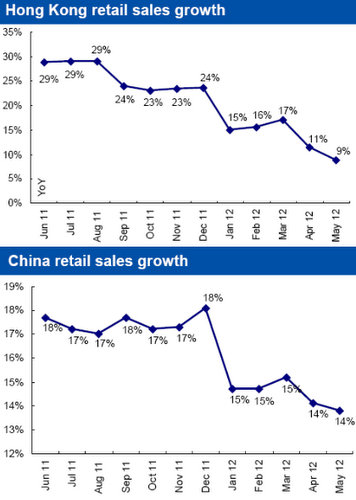

The move was precipitated by Beijing Jingdong to combat sluggish domestic sales at home as China’s economic growth continues to surprise on the low end of late.

Nanjing-based Suning runs a nationwide network of over 1,300 electronics and home appliance retail stores in 231 Mainland Chinese cities

Founded in 1990, Suning listed in Shenzhen in 2004.

Gome Electrical was founded in 1987 by Huang Guangyu, who just three years ago was China’s richest individual.

However, Mr. Huang’s luck has taken a decided turn for the worse, as he's spent the past three years in prison for a stock manipulaiton charge.

The Beijing-based retailer was listed in Hong Kong in 2004 and has over 1,000 stores scattered across Mainland China.

It remains to be seen whether the moves by Suning and Gome, along with similar price cutting strategies by online retailers Beijing Jingdong and Dangdang Inc, will pan out as management planned.

They are surely acting out of the fear of being ignored by heavy foot traffic in popular retail zones if they are saddled with a perception of not jumping onboard the price-cutting train alongside their industry rivals.

The first salvo in the current flurry of price cuts was fired by Jingdong CEO Liu Qiangdong, who on Tuesday announced a full scale price war against its top two competitors – Gome and Suning.

“I can pledge to you that prices for large home appliances available on Jingdong will be at least 10% cheaper than identical items in Suning and Gome shops,” said Mr. Liu in an online announcement.

He added in the shocking announcement that Jingdong would assign 5,000 undercover shoppers to collect pricing data from its rivals, saying he’s willing to break even over the next three years if necessary.

Not to be outdone by its online competitor, A-share listed Suning pledged that its entire inventory is already offered at prices below those on Jingdong’s 360buy.com site.

Meanwhile, Hong Kong-listed Gome also quickly bought into the campaign for fear of being left behind, saying its entire line of products offered online would now be sold at prices 5% below identical items available through Jingdong.

Other peers jumping into the scuffle include Dangdang and Tencent’s online shopping site: 51buy.com.

Investor response has been mixed.

Suning’s A-shares jumped their daily 10% limit on Wednesday while Gome’s Hong Kong-listed shares fell 7% the same day.

Meanwhile, Dangdang’s US-listed shares dropped over 3% in New York following the move.

The electronics and appliances retailers are in a classic damned if you do, damned if you don't pickle.

If they ignore the price war, they will surely be overlooked because the products offered by all combatants are the exact same brands and models in most cases.

However, if they jump headfirst into the fray, they will do serious damage to already tight profit margins in an overcrowded and hypercompetitive sector struggling to gain customer loyalty in a climate of nervous anticipation for shoppers.

The more tenacious and patient among them who stick it out the longest will be rewarded with higher volume sales and elevated market shares.

But at what cost?

Plainly, some players – such as Jingdong’s CEO – are not too concerned with costs at this point.

Therefore, there will be only two winners to emerge from this conflict.

Firstly, there are the investors who benefit from strategic purchases of pump-and-dump shares like those who may have bought Suning shares early on Wednesday only to see the share price add 10% by end-day.

Secondly, of course, are the consumers, who are getting a lot more value for their yuan in this vicious price war.

See also:

Rocky Going For Hong Kong’s Cornerstone Investors

BUCK STOPS HERE: 15% Of China H1 IPOs Denied

HEAT STROKE: China’s Erratic Summer IPOs

OLD MAN, NEW MONEY: Meet China’s Nearly Century-Old Investor