Bocom: Expect PROPERTY Slowdown After ‘Amazing’ June

Bocom International said it expects China’s listed property developers to see a slowdown going forward after an “amazing” June.

“Eight mainland developers have announced July contracted sales data so far. Contracted sales revenue plummeted 22% MoM on average in July, though it still rose 18% YoY. We think the slowdown should be well-anticipated, given the incredible sales performance in June,” Bocom said.

The research house added that most of the developers recorded better-than-expected sales revenue in 1H12, and were ahead of their full-year sales schedules.

“On the other hand, July is traditionally a low season for the mainland property market, ahead of the peak season of ‘Golden September' and 'Silver October’. We believe some developers may have strategically held back their sales progress during the period.”

Contracted ASP yet to recover

Contracted average selling prices (ASP) dropped again in July, down 2% MoM, or 19% YoY, during the period with six out of eight developers recording MoM declines in ASP.

“It concurred with our view that property prices have yet to achieve a turnaround despite the robust sales in June, especially given the return of policy headwinds. YoY growth and lock-in ratio of year-to-date sales revenue were in line with expectations,” Bocom said.

January-July contracted sales revenue rose 13.9% YoY on average, slightly better than the 13% achieved in 6M12.

Also, the Jan-July lock-in ratio of full-year sales target was 56%, in line with 57% achieved in 7M11.

“We expect 15-20% MoM decline for market leaders. Evergrande (HK: 3333) may be able to meet its minimum target.

“We expect most of the market leaders, such as COLI (HK: 688), CR Land (HK: 1109) and Agile (HK: 3383), to record 15-20% MoM decrease in contracted sales revenue in July. Evergrande may be able to maintain a monthly sales revenue of RMB8bn, the minimum monthly sales revenue it needs to meet its full-year target, as it still lags somewhat behind in sales progress.”

The sector is overshadowed by policy headwinds, and the prospect of sluggish August sales.

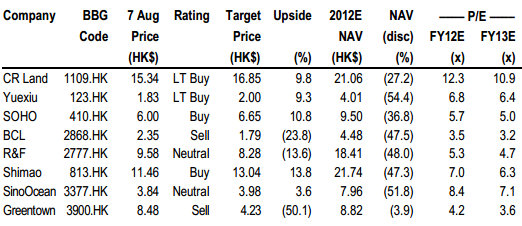

“The sector is trading at a 48.4% discount to 2012E NAV, at the middle of the discount range of 40-63% during 2010-11. We expect the upcoming interim results would not contain much surprise, except for the improvement in net gearing ratio.”

Bocom maintains its view that policy risks will remain an overhang on the sector, at least in the short term.

“Such risks will only fade out slowly when there are no more adverse policies. Also, we expect contracted sales to remain sluggish in August. Thus, we maintain our ‘Market Perform’ sector rating.”

See also:

Five China Sectors About To Get Hot

BUCKING TREND: China Shares Ready For Rebound?

Bocom: Weak External Demand Pounding CONTAINER SHIPPING

Bocom International said that continued weak demand from overseas markets in Europe and North America is continuing to take its toll on China’s listed container shipping plays.

Industry watcher Container Trade Statistics reported a 9% YoY decline in containerized cargo import in Europe from Asia in June, after a 3.2% YoY decline in May, suggesting weakening demand from Europe.

Thanks to a 12.8% WoW increase in Transpacific freight rate (to US West Coast destinations), the SCFI rose 3.2% WoW. Freight rate on the Asia-Europe tradelane was down 1.0% WoW, giving back part of the hike in the week before.

Freight rate on the Asia-Australia/New Zealand tradelane was up 2.4% WoW, and was up 13.3% YoY.

“However, freight rate on the Far East-Middle East tradelane was still down, declining 5.5% WoW and was 16.0% YoY lower,” Bocom said.

Positive sentiment to lift shares

The market reacted positively in the first two trading days of the week as a result of the good employment data from the US, the research house said.

“While we think upcoming interim results will unlikely deliver excitement, the positive sentiment may mitigate the impact to some extent.

“Nevertheless, we maintain our ‘Underperform’ recommendation as we believe the industry oversupply will continue to dampen the chance of further significant rate hikes in the near term.”

See also:

CHU KONG: Initiated ‘Buy’, CONTAINER SHIPPING To ‘Underperform’

TOUGH TALK: Dissecting China Market Fall, Fate

Bocom: INSURANCE Recovering From ‘Weak’ July

Bocom International said China’s listed insurers underperformed the benchmark Hang Seng Index by 2.0% in July, mainly attributable to concerns about lower-than-expected 1H new business value (NBV) growth, as well as floods caused by inclement weather in northern China.

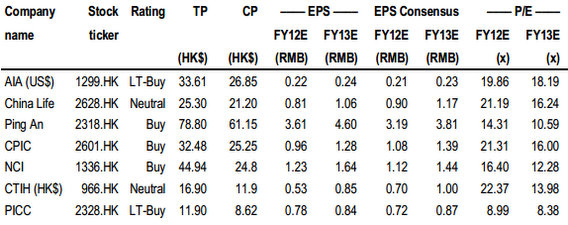

“China Life and AIA outperformed HSI by 5.64% and 1.00%, respectively, while CTIH and NCI lagged behind HSI by 14.75% and 19.43%, respectively, owing to concerns about reassurance business risk and lower-than-expected 1H NBV growth.

“We expect new premium growth to be weak in July. For the individual channel, we expect Ping An to report about 20% YOY growth in single-month new individual premium, mainly attributable to the low base last year,” Bocom said.

The research house added that it expects China Life to see flat growth, CPIC to see a single-digit decrease, and NCI and Taiping Life to see nearly 10% decline.

“We expect the decline in banc assurance premium to widen in July, which might be attributable to the lower- than-expected return of participating insurance in 1H, as shown on the notices of return sent to clients in late June.”

Bocom said it is maintaining its “Outperform” rating on the sector, with NCI its top pick.

“We expect the catastrophes in Beijing, Liaoning, Shanghai and Zhejiang to increase the industry’s claims by about Rmb2-2.8bn in 2012. We estimate this to increase the industry’s combined ratio by about 0.47%-0.62%.”

See also:

MOVING TARGETS: Setting Stable Sights On China Shares

What’s Depressing P/Es In China?