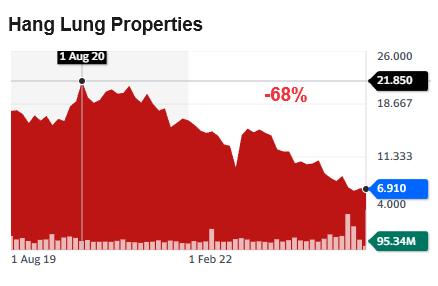

• It's not every day you find a stock that is a big-cap offering a dividend yield of 11+%. We highlighted one such stock recently in : HANG LUNG PROPERTIES: Consistent dividend in past 5 years. The yield is 11+%. Can this continue? • DBS Vickers has a new report on this stock, saying it has "too much value to ignore". It said the "value" lies in it trading at a hefty 79% discount to its appraised current Net Asset Value. (Quite puzzling that the historical steady dividend and high dividend yield are not mentioned by DBS Vickers). • Hang Lung Properties (market cap: HK$30.7 billion), listed in Hong Kong, engages in property investment, development, and management activities. Its wide portfolio spans residential complexes, shopping malls, commercial properties, office spaces, and serviced apartments. • Read more in excerpts of the DBS report below ... |

| Company Update: Negatives priced in |

|

Luxury malls suffering from lower retail sales. In 5M24, tenant sales of Hang Lung Properties’ luxury malls posted a mid-teen decline due to a high comparison base led by revenge consumption following the lifting of pandemic-related restrictions.

Those in Shanghai recorded steeper sales decline, Plaza 66 in particular.

|

Hang Lung Properties |

|

|

Share price: |

Target: |

Leakage of luxury spending led by outbound travel of the affluent and cautious spending among middle-income class also contributed to lower tenant sales.

On the other hand, Dalian Olympia 66 and Wuxi Center 66 fared relatively better.

Despite softening retail sales, retail reversionary growth should remain solid in general. Sub-luxury malls registered positive single-digit growth in tenant sales.

The second phase of the asset enhancement initiative at Jinan Parc 66, which involves the renovation of upper zone (L3-L7), is scheduled to be completed in late 2024.

Plaza 66 extension to enrich retail offering. Hang Lung Properties will commence the construction of Plaza 66 extension, a low-rise standalone retail building in 2024.

Upon scheduled completion in 2026, this will add 13% of retail space to Plaza 66 which currently offers retail area of 0.58msf in GFA terms.

This extension should enable Hang Lung Properties to further enrich the retail offering to cater for demand for shoppers.

Office income is steady. Given the challenging and competitive market landscape, Hang Lung Properties focuses on tenant retention in managing its office portfolio in China.

For Plaza 66 in Shanghai, office reversionary growth has been largely neutral.

Overall, office occupancy is broadly stable, leading to steady office income in Rmb terms.

On the hand, Conrad Hotel in Shenyang delivered stellar performance with RevPAR reaching an all-time high.

Stable rental contributions from Hong Kong. In Hong Kong, retail portfolio occupancy improved slightly from Dec-23’s 95% led by increased occupancy in Causeway Bay and Mongkok.

Hang Lung has been revamping the trade and tenant mix at these two retail hubs.

Retail rents have shown positive growth upon lease renewals. On the other hand, negative rental reversion continues to work its way through the office portfolio.

Despite sluggish leasing demand, the company’s office portfolio occupancy was stable (Dec-23:89%). Leasing progress of newly built office tower in North Point has been slow with commitment rate of <50%.

The Summit in Mid-levels is currently vacated for renovation, thus dragging residential income.

Aided by increased demand from business travelers, Kornhill apartments recorded favourable rental reversion. Taking into account all these, we forecast the Hong Kong investment property portfolio to post steady rental revenue in FY24.

Apartment sales in China was muted. Apartment sales at Wuhan Heartland 66 and Kunming Spring City 66 are proceeding slowly. Heartland Residences in Wuhan has been completed and Grand Park Hyatt Residences in Kunming is slated for completion in 2024.

Elsewhere, construction of Center Residences in Wuxi is in progress with scheduled completion by phases in 2025.

Profit from The Aperture kicking in. In Hong Kong, occupation permit of The Aperture in Kowloon Bay was obtained in Feb-24.

Since its initial launch in late 2021, Hang Lung Properties has sold 125 units for >HKD1bn.

This represents 43% of a total 294 units.

The units sold are gradually being handed over to the buyers with corresponding profits to be booked in FY24.

With the correction in home prices, the remaining units are not expected to contribute any meaningful profit when sold.

Continued sales of Blue Pool Road luxury project. Capitalising on improving market sentiment led by the government’s policy easing, Hang Lung Properties sold one house at 23-39 Blue Pool Road in Happy Valley for HKD250m or HKD54,000psf.

Including another one sold in Jan-24, the company has sold two houses at Blue Pool Road for HKD480m YTD. The corresponding profit should be recognised in FY24.

Meanwhile, eight houses at Blue Pool Road remain unsold.

Reiterate BUY despite lower TP of HKD9.71. YTD, shares of Hang Lung Properties have fallen 38%. Chart: Yahoo!Meanwhile, the stock is trading at a 79% discount to our appraised current NAV, >2SD below its 10-year average discount of 52%. Chart: Yahoo!Meanwhile, the stock is trading at a 79% discount to our appraised current NAV, >2SD below its 10-year average discount of 52%. Even allowing for lingering challenges facing its rental portfolio in China, the current stock valuation is unjustifiably low which provides a good entry point for long-term investors. Based on target discount of 70% to our Jun-25 NAV estimate, we set our TP at HKD9.71. Maintain BUY. |