Translated by Andrew Vanburen from a Chinese-language piece in 21 CN

TO BUY OR NOT TO BUY.

That is the question, and according to Ha Jiming, chief investment strategist in China at Goldman Sachs Asia, he is all for it.

But he’s not talking brick and mortar here.

Mr. Ha said he thinks now is a good time to buy shares or debt in Mainland China’s listed developers because more loosening policies are on the horizon.

However, he is far less bullish on the wisdom of buying homes and apartments these days, given the economic uncertainty for the current half year.

That being said, he does hold out hope for a soft landing to the world’s second biggest economy, and feels fears of a hard landing in China are overblown.

“There have recently been repeated signs from Beijing that a looser fiscal and monetary approach will be taken in the second half.

“Despite macroeconomic figures from the just-finished second half are very likely to be less robust than the first three months, we do expect a slightly higher GDP figure for the July-December period. We’re forecasting a full-year GDP growth of around 8%,” Mr. Ha said.

He added that because a soft landing was expected for the current half, the economic climate will favor purchases of real estate shares and corporate bonds over the outright purchase of fixed assets like homes and apartments, whether on developed land or plots with development potential.

“Therefore, for the time being, I recommend buying property stocks over property.”

In a loose monetary climate with an economic overhang trending toward bearish sentiment, developers have been known to aggressively expand their landbanks, scouring the country for firesale prices.

This makes investing in real estate listcos a good bet at this point, the financial expert said.

Third Quarter Bounce?

He said that if overall economic activity in the current quarter picks up, it will have a lot to do with the vitality of the property sector, and vice versa.

Mr. Ha, who was recently promoted to his current position as chief investment strategist in China, said that his relative bullishness on property shares stems from the fact that a range of policy adjustments have already been made to several regional real estate markets, but business and trading volume has shown strength and resilience throughout.

Even with a series of unit purchase limits in place in various geographical markets, volumes and selling prices have remained robust notwithstanding, which proves that demand still remains strong across the sector.

“Despite the rules limiting buyers to one home in some regions, this seems to be encouraging more and more prospective buyers to make the leap and purchase their first unit. In effect, it’s actually helping spur demand from the non-speculator crowd and opening the marketplace to the true demand still pent up,” Mr. Ha said.

He pointed to Henan – one of China’s most populous provinces – as an example.

“The unit restrictions placed on purchases there not long ago sent a shockwave through the province’s property sector at the time. But not long thereafter, growth returned in kind and other regions have even begun to mimic similar policies to stimulate the real estate industry.”

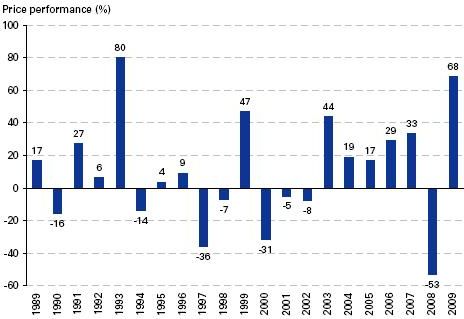

He said that compared to the situation in December of last year, nearly all of the A-share and Hong Kong-listed developers are doing much better in terms of share prices.

He pointed to one counter, Shimao Property (HK: 813) as an example, as the developer’s share price has risen to its current 12 hkd level from just half that price a mere seven months ago.

“There will be a market uplift in the second half, and we’ll be paying close attention to property shares and debt. There will certainly be opportunities,” he said.

See also:

TOP 1H HONG KONG GAINERS: Property King Of The Hill

HONG KONG SHARES: Cars, Planes, H2 Gains

HK Flicks, Footwear & Financiers: Latest Happenings...

HK Market: CONSUMER, INSURANCE, BANKING, PROPERTY Plays