Translated by Andrew Vanburen from a Chinese-language piece in Shanghai Securities Journal

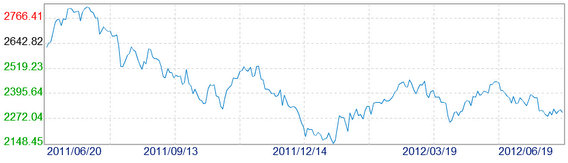

CHINA'S STOCK MARKETS have been a tough sell these days.

That might explain why so few customers are buying.

Meanwhile, the bourse barkers keep beckoning but the public ain't biting.

The fact is that the PRC's capital markets are having quite a hard go these days at lifting spirits and eliciting investor interest.

In other words, since when did investing in Shanghai and Shenzhen listed shares become so listless a prospect?

As of late, a motley assortment of “troubles” within homefront capital markets have been surfacing, and there hasn’t exactly been a raft of upbeat macroeconomic news to greet the bourse and investors in A- and B-shares are still patiently awaiting a semblance of market-moving news from the world at large.

But these are not cataclysmic events, and any capital market should be able to exemplify enough resiliency and dogged perseverance (ie: sticktoitiveness) to endure the buffeting and boisterous bounces.

Specifically, such land and ground-based assaults on the integrity of assumed valuations of both individual counters and the legitimacy of a benchmark's positional authority should be good jumping-in opportunities after a series of losing sessions.

As least in theory.

But in reality, we may be standing witness to the emergence of a new paradigm, in which a falling market doesn’t always automatically translate into a buying opportunity once the dust has settled.

From a purely visceral and non-analytical standpoint, most investors are saying that the recent slumps in Shanghai and Shenzhen, or the current benchmark index downturn, is not only market-justified, but also does not signify any long-term potential for bottom feeders to jump in the fishtank at this particular point in time.

Meanwhile, there is an audible faction that believes the current selloffs have run their course, and there’s little chance of buying much on the bourse these days that hasn’t been more or less virtually deflated.

So the epic ideological impasse continues, or rather the stalemate festers on.

On one side are those saying that the growth in the uber-economy that is Europe is saddled by individual EU member state insolvency as well as stubbornly low employment figures saddled with a softening currency.

That is all worth noting considering that the European Union is the largest trading partner of Mainland China.

From a coldly analytical point of view, investors should be cognizant of two realities regarding near term cyclicality of China shares:

There isn’t a cornucopia of collective cheer on its way to provide upside lift for share prices, and there is an equally conspicuous absence of any drivers that might suddenly put a spark in daily trading turnover.

In short, 1.3 billion potential investors are taking a “wait and see” attitude, and one can't blame them for doing so.

See also:

CHINA ANALYST: ‘Why I’m Back On Diving Board’

IPO DROUGHT: New China Listings Hit 3 Year Low

Greek Vote Comedy Or Tragedy For China Shares?

HK SHARES: Trash Already Tossed To Curb

Historically, there's also been a very strong correlation between the Shanghai Composite and H-chips and S-chips.

When I look at Chinese stocks, I feel like a kid in a candy store. I'm very sure that buying chinese stocks will reap a huge harvest when the bull finally returns to China.