Translated by Andrew Vanburen from a Chinese-language piece in First Financial

DURING THE EPIC opening ceremony to the Beijing Summer Olympics in 2008, Mr. Li Ning, founder of China’s top sportswear name Li Ning (HK: 2331), sprinted across the rafters of the iconic Bird’s Nest Stadium.

That may have been the figurative, and literal, highpoint for the Hong Kong-listed athletic footwear and apparel maker after it recently issued a profit warning, saying its first half and full-year bottom lines are likely to see major toe stubs.

For those spending any time in Mainland China, only the most dedicated couch potato without a TV to call their own will not have heard of the heavily advertised and ubiquitously promoted Li Ning Co Ltd.

In addition, the Hong Kong-listed firm has endorsement deals with several high-profile athletes and teams, both at home in China and abroad, that act as paid ambassadors for the brand.

Founded by Mr. Li in 1990 – himself a renowned Olympic gymnast , the company opened its US headquarters and flagship store in Portland, Oregon not long ago, a state which also happens to be the home of rival Nike.

As of 2007, Mr.Li also remains chairman of the company's board of directors.

As for the just-issued profit warning, it couldn’t have come at a worse time for the Beijing-based firm, whose shares are now wallowing at six-and-a-half year lows.

Li Ning Co said it expects full-year 2012 orders to register a “significant decline” on a year-on-year basis, and warned that the bottom lines for both the first half and the full year will see major drop-offs.

The company blamed the dire outlook on slumping sales and higher marketing expenses.

If misery enjoys comfort, then Li Ning Co can take some solace, as the firm is certainly not alone in its current travails.

The entire sector of firms, many listed in Hong Kong as well and with a large chunk based in the eastern Chinese province of Fujian, is suffering through a downtrend accentuated by intense competition, rampant overcapacity and a softening domestic economy.

Li Ning Co is not jumping the starting pistol, so to speak, by warning at this point of full-year troubles.

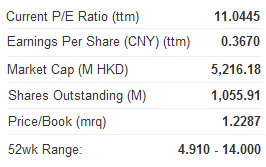

That’s because for a retailing giant as large as Li Ning – with a market cap of 5.2 billion hkd – wraps up its full-year orders in June.

It said orders for the fourth quarter this year saw a “slight decline” for footwear, but a 20% nosedive in apparel sales.

Last year offered little respite for the company as well.

The company announced earlier this year that its 2011 bottom line plummeted 65% year-on-year to 386 million yuan in an overcrowded marketplace.

See also:

CHINA SPORTSWEAR Losing Footrace

LILANG Visit: Steady Earnings And Store Growth... Rising PRC Clothier?

XTEP: Off And Running After Standup 2011

ERATAT LIFESTYLE: RMB13.5m Profit In 1Q After Renovation Subsidy

Sorry that I misunderstood your meaning.

Yes, Li Ning is in for a long winter. Not just Li Ning. Companies like Eratat and Qingmei are going through a very rough time.

Honestly, I don't have the stomach to take the risk whether they will survive this industry consolidation.

Just to update all Singaporean investors in Qingmei. They have built a very pretty office building in Jinjiang but when I was there, the whole place was so quiet... God bless.

I would suggest that you go to China and have a look around the stores at the 步行街.

Li Ning has lost a lot of market share to players like Anta. Only those born in the 70s are buying Li Ning products. Those born after the 90s, have no idea who is Li Ning and are not buying their products.

I personally expect a bigger hit to Li Ning performance in the coming months.

Watch the space