COMTEC SOLAR (HK: 712), a major Chinese solar wafer maker, saw shipments jump 27% last year to 221.1 MW. However, a steep drop in polysilicon prices forced the Hong Kong-listed firm into a one-off inventory write-down which hit the bottom line, management told investors.

“Polysilicon prices are critical to the solar power sector,” said Comtec Chairman and CEO John Zhang.

He said that Shanghai-based Comtec’s supply dynamics did afford it some advantages over competitors.

“We have developed long-term, stable raw material supply contracts with (Germany’s) Wacker Chemie and (South Korea’s) OCI, so I have never been too worried about polysilicon prices, which allows us to get very reasonable prices on a monthly basis.”

Despite the year-on-year shipment spurt last year, Comtec’s top line remained virtually flat, edging 0.5% lower to 1.016 billion yuan in 2011 thanks to falling prices for monocrystalline solar wafers worldwide on rampant industry-wide overproduction.

However, the company’s net profit of nearly 223 million yuan in 2010 swung to a net loss last year of 46.3 million.

Photo: Andrew Vanburen

The chief culprits were the sudden drop in polysilicon prices in the fourth quarter last year which forced Comtec to institute a non-cash one-off write-down of inventory of around 66 million yuan, impairment losses on property, plant and equipment of 89.1 million, impairment losses on advances to suppliers of 7.1 million, provision of onerous contracts of 39.1 million, non-cash accounting charges for the issue of convertible bonds of 23.5 million and the gain change in fair value of warrant liability of 72.1 million.

“Last year was a challenging year for the PV industry as a whole. In view of the supply-demand imbalance throughout the value chain, coupled with uncertainties among European economies, we are facing a tough operating environment,” Mr. Zhang said.

However, he added that by staying committed to offering value-added solar products with premium quality to our customers, the company was able to achieve some positives.

“Despite the market challenges, Comtec still achieved year-on-year shipment growth of our quality wafer products, commenced mass-scale production of our premium ‘Super Mono Wafer’ products and maintained a healthy financial position.”

He said the losses on write-downs and sector-wide overcapacity would have been worse if not for Comtec’s “strong support” from its long-term major customers, but that overcapacity was affecting all industry players.

“The growth in worldwide capacity and channel inventories last year resulted in significantly lower selling prices across the value chain."

In response to the competitive market landscape of the solar industry, Comtec said it “proactively reduced” its debt levels and maintained a healthy net cash balance of approximately 51.1 million yuan (2010: 123.7 million) and cash and bank balances of 746.1 million yuan (2010: 293.7 million).

Photo: Comtec

Mr. Zhang pointed to an encouraging aspect to Comtec’s revenue breakdown in 2011.

“In 2010, sales of our 125x125mm and 156x156mm wafers were almost exclusively traditional ‘P’ type wafers that are often sold in this industry at cost and sometimes even at a loss. However, beginning in June of last year, we began selling our higher margin ‘Super Mono Wafers’ (SMWs) which enjoy much higher margins. This is a critical development for our company.”

He said this was not a phenomenon unique to last year.

“We will continue to try to ship as many SMWs as possible in 2012,” he said, adding that prices for these higher end products will likely make up a “much higher” proportion than the 40% of revenue they contributed in 2011.

He said that the root cause of the polysilicon price plummet last year was a gross overproduction environment.

And while lower raw material prices ostensibly were good for wafer makers like Comtec, solar plays stuck with long-term supply contracts were suffering from chronic inventory write-downs and end-product makers struggled to keep average selling prices above breakeven levels.

“The supply sector needs consolidation. There are simply too many polysilicon suppliers around the world. I think if this number is reduced to around 10 major providers, it will be sufficient to supply the entire world’s demand.”

He also said the end-product sector of which Comtec counted itself a member was also overcrowded, but that it would be more market-led consolidation rather than government-induced restructuring that would determine how the industry would look in Mainland China going forward.

And with so many smaller solar plays struggling to stay afloat, larger operators would be on the lookout for attractive pickups to boost their capacity non-organically.

But that didn’t mean leading solar wafer manufacturers like Comtec would ever succumb to short-sighted targets emphasizing capacity expansion at any cost.

“In today’s market, if you keep expanding with your existing equipment, then you will be obsolete very quickly. That’s why we are aggressively using smaller and smaller diamond wire-cutting technology to cut our wafers.

Photo: Andrew Vanburen

“We are always striving to make thinner wafers as well as boost their electricity conversion efficiency,” Mr. Zhang said.

This was key to staying atop the heap, as industry consolidation was upon us.

“There are around 400 players in China engaged in our sector. I believe this number will be shrinking dramatically over the next several years.”

Looking ahead, Comtec believes the long term prospects of the industry are “still promising.”

“Last year, the cost of generating power via solar energy per watt was reduced substantially due to the decrease of polysilicon prices, continuous upgrading of production techniques, as well as enhancement of operational effectiveness in the industry. This has accelerated the industry’s progress towards grid-parity with the installation of PV systems becoming increasingly affordable,” the chairman and CEO said.

He added that the cost of solar power is now below user-paid rates for an increasing number of markets and user categories.

“Regardless of the reduction of FiTs (Feed-in Tariffs) by various governments, the continuous cost reductions will fuel robust growth of demand for solar products. We believe this will sustain the strong prospects of the cost leaders among the value chain and benefit the overall solar industry.”

And given the company’s strong focus on both quality controls, technological upgrades and financial discipline, they were more than adequately prepared to face 2012 and beyond head on.

“We believe we are well-positioned with our strong financial position, competitive cost structure and advanced technical capabilities, and feel these are crucial to maintain our leading position in the industry and to maximize our benefits from the industry consolidation ahead in 2012,” Mr Zhang said.

Comtec CFO Keith Chau echoed the Chairman’s sentiments on the market conditions facing Comtec last year.

“Indeed, 2011 was a really challenging operating environment,” Mr. Chau said.

He said that due to “overly aggressive” downstream solar sector capacity expansion in 2011, wafer prices have since fallen by around 25%.

“This naturally affected P&L performance and margins and will take time to return to more healthy, stable levels.”

But he said that despite the hardships facing the entire industry from top to bottom, Comtec’s ability to keep its books in a healthy state was providing a great deal of stability.

“We maintain one of the most conservative and stable financial positions in the sector,” Mr. Chau said, adding that the inventory write-off last year would “probably be digested” early this year thanks to the firm’s financial discipline.

“We prefer not to rely on debts to fund expansion.”

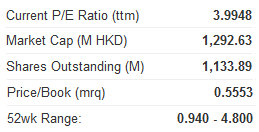

Founded in 1999 and tapped into the solar wafer industry in 2004, Comtec Solar is a leading monocrystalline solar ingot and wafer manufacturer in the PRC and one of the pioneer manufacturers in the PRC able to massively produce Super Mono Wafers which achieve average conversion rates of approximately 23%. With production bases in Shanghai and Jiangsu, Comtec focuses on the design, development, manufacture and marketing of high-quality solar wafers and has accumulated strong industry experience in the manufacture of semiconductor ingots and wafers. Currently, Comtec supplies most of its solar products to the leading solar cell/module manufacturers. Listed on the Main Board of the HKSE on 30 October 2009, Comtec is committed to enhancing product quality as well as developing new and innovative solar wafers. As it is well positioned to benefit from the growth of the solar PV industry, Comtec aims to broaden its customer base internationally. Comtec began selling TDRs in Taipei last year, while also attracting a 1.2 billion hkd strategic investment from private equity firm TPG Capital in 2011.

See also:

COMTEC ‘Outperform’ On Wafer Niche

COMTEC SOLAR: Economic Cloudcover Not Obscuring Wafer Demand

COMTEC SOLAR: ‘Buy' With 134% Upside, Says Yuanta; But 'Hold' Says UOB