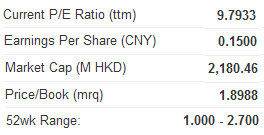

WITH AN UNASSAILABLE 40% output share in China's frozen concentrated orange juice market, China Tianyi Holdings Ltd (HK: 756) once again surprised on the upside, reporting a 2H sales spike of 53% to over 320 mln yuan.

And that product segment represents less than 40% of Hong Kong-listed China Tianyi's top line with plenty more growth potential to be realized, an executive told investors.

Speaking at an event organized by Aries Consulting as part of its Company of the Month series, China Tianyi's Investor Relations Director Ms. Chan Ling said the firm took great pride in the solid position it has earned for itself in Mainland China, where all of the Hong Kong-listed firm's products are sold.

"We have worked very hard to become China's largest FCOJ (frozen concentrated orange juice) producer, accounting for 40% of total domestic output, and we also are proud to be the only such producer listed in Hong Kong. Also, while we realize that the entry barrier to our industry is not particularly daunting, we also appreciate that to succeed in this business you have to be very efficient and smart, and that is what keeps us on top.

"Therefore we will jealously guard and seek to enhance our market share in China," Ms. Chan said.

China Tianyi Holdings, previously known as Tianyi Fruit Holdings before changing its name recently, manufactures and produces frozen concentrated orange juice (FCOJ) in the PRC, sourcing its oranges from its farms across the country's temperate zones -- primarily in Hunan, Chongqing and Fujian.

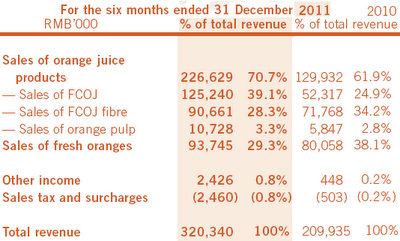

In addition to dominating the Chinese market for FCOJ, a product segment that contributes 39% to the company's top line, China Tianyi also sells fresh fruit, mainly oranges (29% of revenue) and FCOJ fibre (28% of revenue).

But FCOJ has been the star performer of late for China Tianyi.

Its “Summi” brand maintains the leading position in China’s FCOJ industry, through achieving both higher production and sales volumes.

During the July-December 2011 half, the Group saw a surge of sales orders from its customers, with FCOJ revenue up 74.4% year-on-year to 226.6 mln yuan.

China Tianyi Holdings made shareholders very happy last half.

In the July-to-December period, Tianyi’s net profit soared over 61% year-on-year to 143 mln yuan, thanks in large part to the robust growth in frozen orange juice.

Despite an aggressive capacity expansion and equipment upgrade campaign, China Tianyi still manages to keeps its financial house in order, with second half capital expenditure amounting to 28.6 mln yuan compared to 26.6 mln in the year-earlier period.

This is an even more impressive balancing act considering the attention to quality and safety that China Tianyi puts into its cultivating and manufacturing ethos.

“To ensure food safety -- especially in confronting pesticide residues – as well as possessing a reliable supply of fresh fruits for processing, we have been engaged in upstream cultivation operations, currently overseeing 61,000 mu (over 12,000 acres) of orange groves. Another large part of our capex is processing equipment, all of which is imported from the US, Switzerland, Italy and Germany,” Ms. Chan told a roomful of investors.

Photo: Andrew Vanburen

China Tianyi has already set up concentrated orange juice processing facilities in China’s three major citrus plantation areas, thereby completing the establishment of a strategic production network while increasing the firm’s control over raw materials.

In November 2011, Tianyi completed the acquisition of the entire equity interest in Huaihua Oujing Fruits Ltd, whose production facilities were later modified, leading to an increase in Tianyi’s total production capacity of FCOJ from 22,000 tonnes to 30,000 tonnes.

In response to a significant increase in sales orders, China Tianyi increased the production capacity of FCOJ fibre from 30,000 tonnes to 50,000 tonnes in the second half of 2011 through technical modification.

She added that being the biggest FCOJ producer in China has in no way gone to Tianyi’s head, and they are by no means resting on their laurels.

Last year, the PRC’s total FCOJ consumption stood at around 70,000 tonnes, with three-quarters of this met via imports (mainly from Brazil).

That left domestic suppliers like China Tianyi only providing a quarter of the total, with the Hong Kong-listed firm producing 40% of domestic output and enjoying a 10% market share in Mainland China for FCOJ.

But Tianyi expects the PRC government to continue implementing pro-domestic policies to reduce reliance on imports, which is music to the ears of Ms. Chan as Beijing hopes to cut imports to around 50% of local supply by 2015.

“Our strategy is to continue to expand production capacity in order to satisfy the FCOJ demand of the domestic beverage manufacturing industry,” she said.

Tianyi was not exaggerating the scale of the opportunity as the PRC’s fruit juice market scale continues to grow at an annual rate of between 20% to 30%.

China Tianyi also enjoyed "benefits" from income tax exemption and preferential policies from Beijing, with the government expressly stating as one of its primary goals to help alleviate the income gap between the relatively well-off maritime provinces and the agricultural hinterlands where Tianyi happens to have most of its cultivation bases.

“We also enjoy favorable contracts with some key clients in which they agree to use us as their exclusive supplier for a set timeframe, as long as a decade, with prices re-negotiated annually, usually in October as with Coca-Cola’s case,” she said.

Indeed, Coca-Cola is China Tianyi’s highest profile client, with the Atlanta-based giant buying FCOJ products from Tianyi for use in its highly popular Minute Maid bottled orange juice, a brand which is virtually ubiquitous in Mainland China.

“Our partnership with Coca-Cola greatly boosts our own quality image. Coca-Cola is extremely demanding on issues of quality and safety and we benefit greatly by being associated with them,” Ms. Chan said.

She added that this pays tremendous dividends in terms of customer acceptance and brand loyalty, especially as Chinese consumers are becoming increasingly aware of food safety and quality issues as well as Beijing’s ongoing campaign to clean up the image of the country’s sometimes lax quality assurance regime.

“To ensure quality and safety all along the production chain, we also constantly educate the farmers cultivating our oranges in China on how to most efficiently, effectively, and most importantly – how to most safely – go about growing and picking the fruit,” she said.

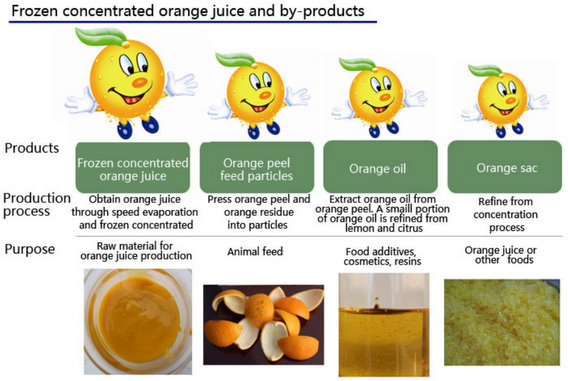

China Tianyi Holdings engages in processing and selling frozen concentrated orange juice (FCOJ) and related products primarily in the PRC. The company manufactures and distributes FCOJ for the production of fruit juice and blended fruit juice. It also cultivates and sells premier fresh and fresh oranges to third party customers; manufactures and distributes FCOJ fiber, which is a mixture of FCOJ with lower concentration rate and orange pulp sac, for use in the production of pulpy fruit juice and blended fruit juice; and orange pulp, a by-product from the production process of FCOJ, for the production of blended fruit juice.

See also:

DUKANG: 2Q2012 Net Profit Up A Whopping 55% At Rmb 94.4m

VITASOY: Stronger Revenue/Profit Growth Expected From 1Q12 Onwards

FOOD FOR THOUGHT: WANT WANT, TINGYI Noodle Blue-Chip Bound