Excerpts from latest analyst reports.....

UOB Kay Hian pegs 64-cent target for SINO GRANDNESS

Analyst: Brandon Ng, CFA

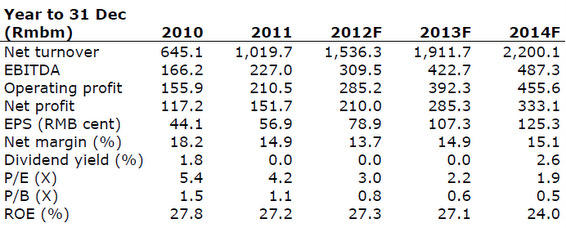

We re-iterate our BUY recommendation on Sino Grandness Food (SGF) with a target price of S$0.64. This translates into 3.0x 2013F PE, pegged to Singapore-listed peers’ average.

Expect strong revenue and net profit in 2013. We forecast SGF to report revenue of Rmb1911.2m (+24.4% yoy growth) and net profit of Rmb285.3m (+35.9% yoy growth) in 2013.

SGF will be able to enjoy the full economic benefits of the increased production capacity for the beverage business and the expansion of canned food business within the domestic market.

Share Price Catalyst.

• We note the potential upside of S$1.12/share if Garden Fresh obtains approval from an exchange to list assuming a holding company discount of 20% to SGF’s Garden stake and a 3.0x 2014F PE valuation to its remaining business.

• SGF is also able to enjoy a re-rating once the company announces the engagement of any financial advisors for this listing.

Last week, we saw an infrastructure-related stock jump more than 20% the day the company announced the intention to demerge and list its assets in an overseas exchange.

CIMB on "the fear factor uprooting CPO...." and a possible rebound in CPO in Dec

Analyst: Ivy Ng, CFA

The 25% price slump for CPO futures over five weeks was fuelled by speculative selling over fears of a build-up of stocks.

Recent export figures and our channel checks on the Sep harvest suggest that stocks could rise to 2.5m-2.6m tonnes by end-Sep, higher than expected.

We believe there is sufficient storage capacity but the concern is that buyers may defer purchases.

We expect CPO price to rebound by year-end due to its attractive pricing relative to soybean oil. Our Trading Buy call on the sector which is premised on a rebound in CPO price in Dec and a potential El Nino is intact, as are our top picks, Sime, IFAR and Astra Agro.

Comments

"Even a week ago, I would have said I'm not that worried, but the 10%-15% move we've seen since then has made me worried there's something I'm not seeing."

He notes the CPO industry lacks some transparency; "no one really knows how much inventory there is in Indonesia." He advises, "take the signals the market is telling us," adding the signals suggest "inventory in Indonesia is high and difficult to work through by the end of the year." He notes, "there might be the financial impact of traders moving the price around, but there is some fundamental concern," adding "we are laboring under a high inventory situation and that's really weighing down on the price." First Resources (EB5.SG) is the worst-performer , down 6.8% at S$1.91; the analyst notes it's down less vs peers over the past week. Golden Agri (E5H.SG) is off 3.1% at S$0.635, Indofood Agri (5JS.SG) is down 3.7% at S$1.295 and Bumitama (P8Z.SG) is off 3.2% at S$1.05. (leslie.shaffer