FOLLOWING DUKANG DISTILLERS’ announcement of record FY2012 earnings, CEO Zhou Tao provided insights to the Baijiu brewer’s business at an investor teleconference.

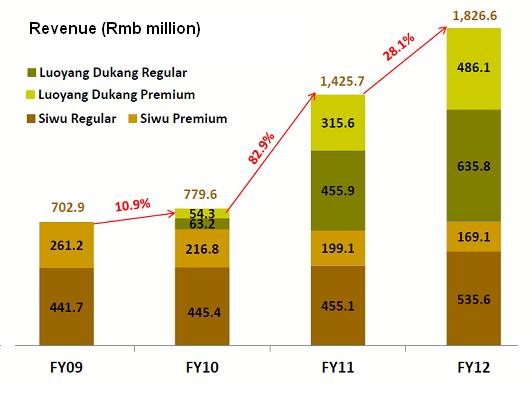

Dukang’s FY2012 sales had grown 28.1% year-on-year to Rmb 1.8 billion, thanks to a higher sales volume and rising average selling price for products under the Dukang brand, acquired in May 2010. Net profit attributable to shareholders increased to Rmb 218.1 million, up 29.8%.

The name “Dukang” is widely recognizable in Chinese literature as it is in fact the name of a semi-legendary inventor of Chinese liquor in ancient China.

When the company acquired Luoyang Dukang, the Dukang Baijiu was already well established in Henan, the largest Chinese province of Baijiu consumption with an estimated market size of Rmb 35 billion.

About three-quarters of Luoyang Dukang sales come from Henan, where it has a market share of less than 5%.

“There is room for gaining market share in Henan as well as in other provinces. We are already in places like Tianjin, Hunan, Shandong, Guangdong, Hebei, Northeastern China and Inner Mongolia,” said the CEO, who dialed in from Dukang's headquarters in Zhengzhou, China.

”It is our strategy to revive Dukang as a national brand”, he added.

In 3QFY2012, it started an aggressive advertising campaign which put its premier product, Jiuzu Dukang, on national TV.

Below is a summary of questions raised at the telecon and the replies provided by Mr Zhou and investor relations manager Ngo Yit Sung.

Q: Why was there a huge increase in inventory from about Rmb 280 million in 3Q2012 to about Rmb 400 million during 4Q2012?

More than 50% of our inventory is grain alcohol, which is stored and becomes aged alcohol. Grain alcohol inventory level is an indication of capacity. We hold very little stock of finished alcohol bottles as we only do bottling upon receiving orders from customers. Such an inventory composition is common among wine breweries.

The increase in grain alcohol reserves was necessary if we want to meet the strong demand that we anticipate. In other words, an increase in grain alcohol inventory is necessary for business growth.

Q: Is it realistic for investors to expect Dukang net margins to increase from the current 12% to reach the national average of 15%?

There is definitely room to grow our net margins.

Nonetheless, we are at the stage of high advertising expenditure to step up brand awareness of Dukang brand of products in the PRC as we are now ready to go nation wide.

We will gradually step up Luoyang Dukang's advertising and promotion (A&P) going forward. We are budgeting an A&P expense ratio of about 10% to 15% for Luoyang Dukang. Group A&P expense is expected to be 10% to 12%.

We think that our net margins will be flat for now, but will gradually increase when advertising expenditure is moderated with strong sales growth.

Q: What is your marketing strategy?

To move sales, 3 factors must be in place.

Firstly, we must have visibility in hotels, restaurants and shops.

Secondly, distributors must be willing to sell it, and this is dependent on product quality, pricing and credit terms.

Thirdly, we must give consumers a good reason to buy our Baijiu. For example, we can encourage corporates to use Dukang Baijiu as an employee award. We also make it conveniently available to consumers by offering both retail and online purchases.

During 2Q (Oct-Dec) and 3Q (Jan-Mar), Baijiu sells especially well because of the cold winter and festivals like Chinese New Year.

Q: Do all distributors get the same price?

Yes, factory price is the same. We do not give discounts for bulk purchases.

Q: Why is your packaging so elaborate?

Chinese are image conscious. Elaborate packaging is the norm for Baijiu and is necessary as Baijiu is often used as gifts and consumed during important dinner events.

Q: Have there been incidences of fake Dukang wine in the market?

Yes, we are working with the large supermarkets and distributors to take the imitation products off their shelves. We also work with local authorities to trace the counterfeit source and shut down the perpetrators.

Related stories:

HI-P INTERNATIONAL, DUKANG DISTILLERS, TAT HONG : What Analysts Now Say..

DUKANG DISTILLERS hosts eye-opening visit for investors