Excerpts from CIMB's excellent 12-page report dated Aug 29 and titled "Catching the privatisation wave".

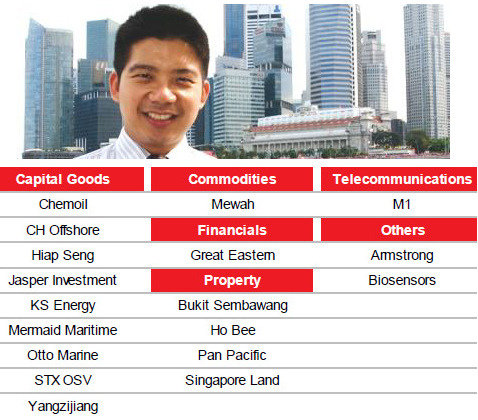

Analyst: Kenneth Ng, CFA

In the Capital Goods sector, Chemoil, CH Offshore, Hiap Seng, KS Energy, Yangzijiang have major shareholders with the capacity to privatise them, we think.

Chemoil, CH Offshore and KS Energy appear to be the most likely candidates.

STX OSV is available for sale. Mermaid Maritime and Otto Marine have not been doing well but with stocks trading at large discounts to NAV at 0.4x-0.6x P/BV, privatisation can be a long shot.

In the Commodities space, although Noble, Olam and Wilmar have consistently popped out in our quantitative screens, we think the size of the companies, their heavy working-capital requirements and the benefits of branding from a listing, reduce the likelihood of any privatisation offers.

Instead, we think a more likely candidate is Mewah, where the family owns 76% and the stock is struggling.

Among Property and Financials, a privatisation offer for Bukit Sembawang is the most likely with the stock trading at a 47% discount to RNAV and the controlling Lee family getting some proceeds from the F&N/APB saga.

Similarly, with OCBC making gains of S$1.15bn, the likelihood of a third privatisation offer for Great Eastern Holdings is high as well.

Pan Pacific is the other stock that could be folded into UOL.

Ho Bee and Singapore Land are the other candidates that could possibly be made offers.

In the other sectors, likely takeover candidates are M1, Armstrong and Biosensors.

M1 could be potentially taken over since its biggest shareholder, Axiata, typically likes to hold subsidiary stakes while the other shareholders do not see M1 as a core holding and could count as willing sellers.

Armstrong, a components manufacturer, has been exploring privatisation options for some time or a complete sell-out.

Biosensor’s parent, Shandong Weigao, could yet absorb the whole Biosensor as one of its various medical-company subsidiaries.

Recent stories:

'Buy BIOSENSORS, ASCOTT REIT, sell CAPITALAND' -- analysts

Nomura has 'buy' on commodity stocks, AmFraser on YANGZIJIANG

OLAM, ANWELL, OTTO MARINE: Latest Happenings...

Buying by MEWAH, YING LI insiders: How will 3Q results turn out?

A big bunch of them even has stock prices which are lower than the net cash in the business! Like China Fibretech. Fujian Zhenyun.

Might as well privatise ! Will it happen soon?