HEALTHWAY MEDICAL, Q & M Dental and Cordlife Group are market leaders in Singapore’s outpatient medical service sector with revenues tied to population growth and consumer affluence.

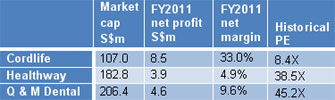

Yet, the first two companies trade at rich PE ratios of around 40 times, while Cordlife is languishing at less than 10.

This is despite Cordlife having net margins in excess of twenty, compared to less than 10 for Healthway and Q & M.

Cordlife generated net margins of 33% for the year ended 30 Jun 2011.

Listing expenses for its March 2012 IPO shaved net margins down to 21.2% for the 9 months ended 31 Mar 2012.

In comparison, Healthway’s net margins were 9.3% for 1Q2012 while Q&M’s was 8.7%.

The market has accorded rich valuation for bread-and-butter businesses - Healthway’s general practice clinic service and Q & M’s dental service are essential services and are covered by employment benefits.

There are similar ‘welfare benefits’ for Cordlife’s services: Singapore has a baby bonus scheme to encourage childbirth as follows:

1) a cash gift of S$4,000 (for the first and second child) and S$6,000 (for the third and fourth child) paid in four equal installments into the children’s Child Development Account (CDA),

2) a dollar-for-dollar government matching contribution up to a certain limit is made available to the CDA before the child turns 6.

The CDA can be used to pay for fees incurred in healthcare institutions licensed under the Private Hospitals and Medical Clinics Act, and this includes Cordlife.

Market leader in Singapore

In Singapore, Healthway has the largest network of clinics for primary healthcare, Q & M has the largest network of dental clinics, and Cordlife is the market leader for private cord blood banks.

Cordlife provides cord blood banking and umbilical cord tissue banking services, including the collection, processing, testing, preservation and storage of umbilical cord blood and umbilical cord tissue at birth.

The company has processing facilities in Singapore and Hong Kong, where it is the No.2 player.

It also has a 10% indirect interest in Guangzhou Tianhe Nuoya Biology Engineering Co., Ltd, the sole cord blood bank operator in Guangdong.

|

About Cordlife Group The SGX-listed entity has stem cell banks with processing facilities in Singapore and Hong Kong. Its CEO is Jeremy Yee, the former CFO of Cordlife Limited. Non-executive chairman, Dr Ho Choon Hou, is a former medical doctor turned venture capitalist. He is now director at private equity firm, Southern Capital. ASX-listed Cordlife Limited has stem cell banks in India, Indonesia and the Philippines. The two companies are affiliated through contractual agreements for the fulfillment of cross-border customer requests. Cordlife Group was demerged from the ASX-listed entity on 30 June 2011 for its Singapore IPO. |

|

||

What's cord blood good for?

Cord blood, also called “placental blood”, is blood that remains in the umbilical cord and placenta following the birth of a baby and after the umbilical cord is cut.

During pregnancy, the umbilical cord functions as a lifeline between mother and child.

After a baby’s delivery, the cord blood present in the umbilical cord could offer hope for the child or members of the family.

Cord blood is a rich source of haematopoietic stem cells, which are primarily responsible for replenishing blood and regenerating the immune system.

Diseases that have been successfully treated with cord blood include: blood cancers, solid tumors, non-malignant blood disorders, immunodeficiency disorders and metabolic disorders.

Expanding range of services

In March last year, Cordlife began offering cord tissue banking services in Hong Kong.

Consumer demand for banking the cord blood of one’s offspring is something that has potential to grow with marketing and public awareness.

With the advancement of stem cell research, the potential for future use of stem cell grows.

Clinical trials are underway for use in cartilage repair, treatment of diabetes, ovarian cancer, among other diseases.

Key risks

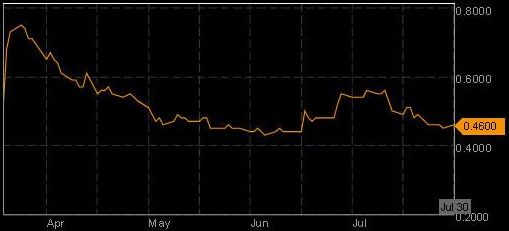

Cordlife's low valuation could be due to the market's lack of familiarity with cord blood banking. It could also be due to the capital investment requirement to keep up with the technology as cord blood banking industry evolves.