Excerpts from latest analyst reports.....

Nomura maintains 'buy' and $1.84 target for BIOSENSORS

Analysts: Jit Soon Lim, CFA, & Wen Jie Chan

1Q results: Headline ahead due to exceptional item

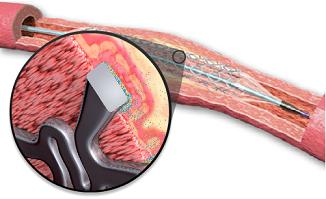

Biosensors reported a 1QFYMar13 net profit of US$33m, underpinned by continued growth of its DES (drug eluting stent) business, with revenues improving 51%.

However, adjusting for the exceptional item of US$4m, the group net profit of US$28m, was slightly below our expectations of US$31m due to a weaker-than-expected contribution from its licensing revenues.

Management continues to await approval for BioFreedom in EU and BioMatrix in China.

We are maintaining our Buy rating and full-year net profit forecast of US$132m for the group.

Recent story: 'Buy BIOSENSORS, ASCOTT REIT, sell CAPITALAND' -- analysts

Deutsche Bank cuts earnings estimates and target price of GENTING

Analyst: Aun-Ling Chia, CFA

Genting Singapore is the second-worst-performing gaming stock YTD under Deutsche Bank coverage.

With earnings risk still to the downside and valuation at a premium to Macau peers (9.2x 2012E EV/EBITDA), we see few near-term catalysts.

An unclear investment strategy in Echo Entertainment and a tightening regulatory environment in Singapore may further cap near-term performance.

We cut our TP by 17.6% to S$1.36/share and maintain Hold.

Nomura turns neutral on RAFFLES MEDICAL

Analysts: Jit Soon Lim, CFA, & Wen Jie Chan

Valuations look fair at current levels. The stock trades close to peers’ average P/E.

Investor demand for healthcare stocks remains strong but on the basis of fundamentals, we struggle to justify further significant multiples expansion that would warrant a Buy rating.

With potential upside of only 11.2% to our new target price, we turn Neutral on the stock.

We adjust our forecasts downwards on the back of rising wage costs resulting from wage hikes to match revised public sector pay scales.

Nonetheless, we remain positive on RFMD as we see it as a defensive company riding on strong structural healthcare demand due to an aging population locally, coupled with company-driven expansion plans.

Catalyst: Listing of IHH. Sentiment seems to have overtaken fundamentals as the key stock price driver for RFMD, which has re-rated by 17% since the announced listing of IHH.

With the IHH IPO 30x over-subscribed, demand for healthcare stocks is strong. The price performance of IHH, upon listing, will arguably impact the stock price for RFMD.