Excerpts from analyst reports

Credit Suisse maintains 'outperform' rating and $1.96 target price for Biosensors

Analyst: Iris Wang & Jinsong Du

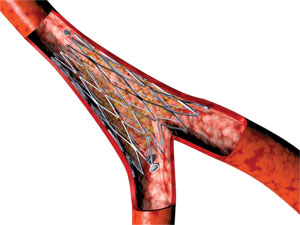

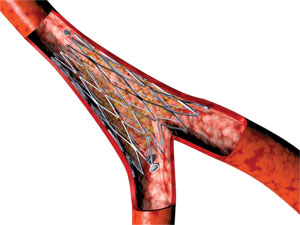

Biosensor's Axxess stent in a blood vessel. Illustration from companyBiosensors on Monday announced that it will acquire substantially all the assets of Spectrum Dynamics. This is in line with our expectation (Early redemption of bonds: A signal of imminent acquisition?—published on 14 December 2012).

Biosensor's Axxess stent in a blood vessel. Illustration from companyBiosensors on Monday announced that it will acquire substantially all the assets of Spectrum Dynamics. This is in line with our expectation (Early redemption of bonds: A signal of imminent acquisition?—published on 14 December 2012).

● According to the agreement, a cash payment of US$51.13 mn will be made upon the closure of the deal, and an additional US$19.0 mn will be paid in 2014 and later if certain performance benchmarks are achieved.

Credit Suisse maintains 'outperform' rating and $1.96 target price for Biosensors

Analyst: Iris Wang & Jinsong Du

Biosensor's Axxess stent in a blood vessel. Illustration from companyBiosensors on Monday announced that it will acquire substantially all the assets of Spectrum Dynamics. This is in line with our expectation (Early redemption of bonds: A signal of imminent acquisition?—published on 14 December 2012).

Biosensor's Axxess stent in a blood vessel. Illustration from companyBiosensors on Monday announced that it will acquire substantially all the assets of Spectrum Dynamics. This is in line with our expectation (Early redemption of bonds: A signal of imminent acquisition?—published on 14 December 2012).● According to the agreement, a cash payment of US$51.13 mn will be made upon the closure of the deal, and an additional US$19.0 mn will be paid in 2014 and later if certain performance benchmarks are achieved.

Biosensors expects the transaction to have minimal impact on FY14 financials with potential to be moderately accretive to its earnings in the following fiscal years.

● Given the ~US$300 mn cash on its balance sheet and S$300 mn raised from medium-term notes in January 2013, we expect Biosensors to have more acquisitions in the near to medium term.

● We believe this deal is a symbolic move of Biosensors for executing its diversification strategy. We maintain our OUTPERFORM rating and S$1.96 target price.

Recent story: BIOSENSORS, SEMBCORP MARINE, EZION: What Analysts Now Say...

Deutsche maintains 'sell" call on Golden Agri and 50-c price target

Analyst: Michelle Foong

Golden Agri (GAR) reported 1Q13 net profit of US$112.8m down 30% YoY. The results accounted for 31% of DBe but only 24% of consensus estimates.

GAR typically generates stronger 1H results as once-off costs such as bonuses etc are recognized in 4Q. The lower YoY earnings were mainly due to a lower CPO price which corrected 25% over the same period.

Maintain Sell; risks remain in the near to mid-term. We expect the CPO price to stay muted in the near to mid-term due to a seasonal increase in production (expected to peak in Oct) and increase in mature acreage while demand is likely to remain lackluster on the back of increasing supply of competing soybean oil from South America.

Currently trading at 15x FY13E PER, valuations are unexciting on expectations of further earnings downgrades by the street and our forecast of an 11% YoY earnings decline.

OSK-DMG downgrades AusGroup to 'sell' and 35-c target

Analyst: Lee Yue Jer

Fabrication facility of AusGroup in Perth, Australia.

Fabrication facility of AusGroup in Perth, Australia.

NextInsight file photoAusGroup reported a disappointing 3QFY13 results with a breakeven performance and a deteriorating order book. As our original turnaround thesis is undermined by the weak order flows and lackluster execution, we downgrade AusGroup to a SELL, TP SGD0.35, based on recent trough valuation of 0.77x FY14F book value.

AUD215m order book is less than two quarters’ work. At current run rates, AusGroup will run out of work within the year. The contract wins and better margins that were supposed to boost 3Q13 and 4Q13 results failed to materialise, and the downward march of the order book presents a dire outlook in the near term.

Slash FY13F/14F estimates by 54%/48%. With this quarter’s breakeven performance in sharp contrast against management guidance, we slash FY13F estimates by 54%.

Core earnings are likely to stay weak through FY14 unless a large quantum of orders is won at once. Successful claims of the variation orders present upside to our FY14F estimates, while provisions on the Karara Mining receivables is the main downside risk.

Likely support near recent P/B trough. Earnings concerns are likely to dominate the relisting revaluation potential. Valuation is supported at the recent P/B trough of 0.77x which also corresponds to one standard deviation below its 5-year mean. We would become bottom-fishers around the 0.6x P/B range.

Currently trading at 15x FY13E PER, valuations are unexciting on expectations of further earnings downgrades by the street and our forecast of an 11% YoY earnings decline.

OSK-DMG downgrades AusGroup to 'sell' and 35-c target

Analyst: Lee Yue Jer

Fabrication facility of AusGroup in Perth, Australia.

Fabrication facility of AusGroup in Perth, Australia.NextInsight file photoAusGroup reported a disappointing 3QFY13 results with a breakeven performance and a deteriorating order book. As our original turnaround thesis is undermined by the weak order flows and lackluster execution, we downgrade AusGroup to a SELL, TP SGD0.35, based on recent trough valuation of 0.77x FY14F book value.

AUD215m order book is less than two quarters’ work. At current run rates, AusGroup will run out of work within the year. The contract wins and better margins that were supposed to boost 3Q13 and 4Q13 results failed to materialise, and the downward march of the order book presents a dire outlook in the near term.

Slash FY13F/14F estimates by 54%/48%. With this quarter’s breakeven performance in sharp contrast against management guidance, we slash FY13F estimates by 54%.

Core earnings are likely to stay weak through FY14 unless a large quantum of orders is won at once. Successful claims of the variation orders present upside to our FY14F estimates, while provisions on the Karara Mining receivables is the main downside risk.

Likely support near recent P/B trough. Earnings concerns are likely to dominate the relisting revaluation potential. Valuation is supported at the recent P/B trough of 0.77x which also corresponds to one standard deviation below its 5-year mean. We would become bottom-fishers around the 0.6x P/B range.