Dukang Distillers undervalued, says OSK

At 38 cents a share, Singapore-listed Dukang Distillers deserves better valuation, according to OSK Securities Hong Kong analyst, Dr Jason Siu.

After his recent visit to Dukang Distillers’ production plant in Ruyang, China, he published a report (on 16 Jan) saying that the producer and seller of Chinese heavy liquor was trading at a huge discount to its Hong Kong and China peers in spite of being equally profitable, if not more so.

Dukang has a return on invested capital of 20% versus its China and HK-listed peers’ 16.5%. However, it trades at 7.1x 12-month trailing PER and 8.3x FY11 earnings vs. adjusted Asian peers’ average of 10.0x PER of FY10/11.

Including all China A-share peers (such as market leader Kweichow Moutai, 600519.CH), the sector trades as high as 31.3x over the same period.

What impressed the analyst: sales growth of the Dukang brand was up 120% year-on-year in 4QFY12, its brand presence and distribution network.

1) Branding

The company has two major brands of Chinese heavy liquor, or Bai Jiu. The Dukang is a traditional alcoholic formulation lauded by famous Chinese kings, most notably Cao Cao. The other brand, Siwu, has won various recognitions in Henan Province.

2) Expanding distribution network

The company has about 239 distributors over the country (incl. 69 for Siwu brand), and has expanded to new markets, such as Tianjin City, and provinces of Guangdong, Guangxi, Heilongjiang and Gansu.

Risk: Sales volume of its Siwu brand fell 44% year-on-year in 1QFY12 due to restructuring of its distributors.

Recent story: DUKANG Visit: Strong Spirits, Weak Valuation... Bargain Baijiu?

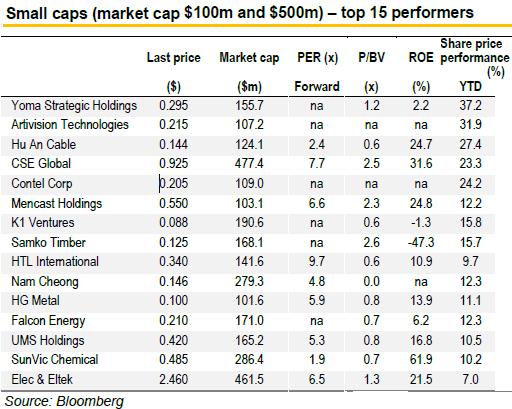

Small-caps that gain over 10% in first two weeks of 2012

Some small caps have been defying the lack-luster stock market outlook by climbing 10% to as much as 40% in the past two weeks. With blue chip stocks taking a beating from macroeconomic issues, Kim Eng Research is touting small-cap stocks as an alternative for punters. Small-cap stocks that have delivered impressive returns due to situational issues include the following:

Hu An Cable gains 27.4% YTD

Hu An Cable’s stock price has gained 27.4% year-to-date. Hu An Cable had been plagued by concerns over the cost of its raw material, copper, but with commodity markets softening, the market is recognizing its competitive advantage as one of the 10 largest wire and cable manufacturers in China.

Other than the risk of raw material costs, Hu An Cable’s revenue base is actually very well diversified, as its customers range from power generation, transmission and distribution, petrochemical, transportation, alternative energy to other industries.

Last month, it announced contracts worth Rmb 154.9 million from China’s largest power transmission and distribution company, State Grid Corporation of China, awarded through its subsidiary Jiangsu Electric Power Co.

Jiangsu Electric Power Company has also given Hu An Cable a framework agreement to place an additional Rmb 314.6 million worth of orders by July this year.

Related story: HU AN CABLE: 9M2011 revenue up 40.8% but margins squeezed by higher costs

***

Samko Timber returns to black

Samko Timber has caught the attention of Kim Eng analysts after its stock price climbed 15.7% year-to-date.

The leading plywood manufacturer for tropical hardwood managed three consecutive quarters of profit after reporting losses since it listed in 2008, suggesting that the company may finally be making a turnaround.

Samko had a net profit of Rp30 billion in 1H2011 versus loss of Rp104 billion in 1H2010.

Related story: Insider buying at SAMKO TIMBER, OXLEY HOLDINGS

***

Mencast on target to being MRO player

A month after its transfer to the Main Board, Mencast’s stock price has gained 14.6%. (It closed at 48 cents before its transfer on 14 Dec.)

In its report dated 13 Jan, UOB Kayhian analyst Tan Junda gave Mencast a ‘Buy’ recommendation, with a target price of 71 cents. The valuation is pegged to 8.6x 2012 PE, at a 6.2% premium to peers’ average of 8.1x.

The sterngear equipment services provider is on target to becoming a maintenance, repair and overhaul (MRO) player for the offshore and marine vessels via M&A.

Its latest proposed acquisition is the fabrication plant and machinery of Team Precision Engineering and Team International Development for S$4.5m.

Also, the completion of Mencast’s waterfront facility at Tanjong Penjuru Road will allow the group to move up the value chain to serve larger, more complex vessels. Its facility will be expanded to 40,000 sqm, more than four times the size of its previous workshop.

Related story: MENCAST: Side-steps shipping downturn with oil & gas foray

Comments

The less popular brands compete on price.

Unfortunately, it seems that Siwu is not selling well. A friend who was in China recently asked for it in a restaurant and the waitress said this brand is doing badly.