Sinohydro execs meeting with Venezuela leader Hugo Chavez (left). The state-owned Chinese enterprise is the world's largest hydroelectric firm. Sinohydro earlier this year acknowledged its construction for Malaysia's Bakun Dam was flawed, using a technique involving adding excessive water to cement.

Photo: Sinohydro

Photo: Sinohydro

STABILITY IS the ideal state of any country’s capital markets, bourse regulators would opine.

However, a little bit of volatility is necessary for quick profits, savvy investors would retort.

It seems like the latter will get what they want, as recent measures to bring “order and stability” to Mainland China’s stock markets by market regulators do not rule out the possibility of a surge of end-year IPOs slipping past the scrutinizers.

And with the new listing candidates comes the possibility of over 200 bln yuan in proceeds suddenly being injected into the market.

This will certainly raise the blood pressure of both regulators and investors, but not for the same reasons and with vastly different symptoms.

End-year IPO blitz

Not too long ago, when the China Securities Regulatory Commission (CSRC) was still haranguing over the listing application for industry giant New China Life, Dongwu Securities was promptly waved through and is now on the cusp of going public.

In addition, Shaanxi Coal Mining Company Ltd, CCCC Investment and Engineering Company and other heavyweights are also about to list, and 40 other A-share candidates are seeing their go-public campaigns gaining momentum and may all succeed in listing en masse by the end of this month.

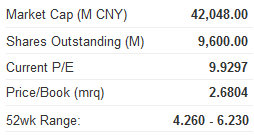

Sinohydro recent price: 4.38 yuan

Not surprisingly, because of their raw bulk, the listing campaigns of Shaanxi Coal Mining and CCCC Investment have attracted the most attention from both media and investors alike.

In late August, Shaanxi Coal announced its intention to raise around 17.2 bln yuan from the planned listing, while CCCC Investment set its sights on some 20 bln yuan in IPO proceeds.

Market watchers say the two IPO candidates are having their listing campaigns held up by the market regulator due to their enthusiastic proceed targets, with the CSRC apparently urging them to adjust their capital raising objectives to bring them more in line with “accommodation capacities of current market conditions.”

However, investors would do well to remember the strong response the market gave Sinohydro Group Ltd (SHA: 601669) in October when its IPO jumped 17% on its debut, netting the firm over two billion usd in proceeds at the time.

Those who missed the boat on Sinohydro’s IPO – one of the chief builders of the massive Three Gorges Dam project –

See also:

BAGGING ASIA: COACH HK Listing Eyes China Luxury Market

Why China Shares Are Poised For Comeback